Shadee Corporation expects to sell 600 sun shades in May and 800 in June. Each shade sells for $180. Shadee’s beginning and ending finished goods inventories for May are 75 and 50 shades, respectively. Ending finished goods inventory for June will be 60 shades.

Each shade requires a total of $40 in direct materials that includes 4 adjustable poles that cost $5.00 each. Shadee expects to have 120 poles in direct materials inventory on May 1, 80 poles in inventory on May 31, and 100 poles in inventory on June 30.

Suppose that each shade takes three direct labor hour to produce and Shadee pays its workers $9 per hour. Additionally, Shadee’s fixed manufacturing

Additional information:

- Selling costs are expected to be 6 percent of sales.

- Fixed administrative expenses per month total $12,000.

Required:

Prepare Shadee’s

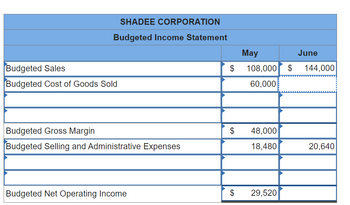

Everyhting else is right except for the June value for budgeted cost of goods sold.

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

- ! Required information [The following information applies to the questions displayed below.] Shadee Corporation expects to sell 560 sun shades in May and 330 in June. Each shade sells for $151. Shadee's beginning and ending finished goods inventories for May are 80 and 50 shades, respectively. Ending finished goods inventory for June will be 70 shades. Each shade requires a total of $55.00 in direct materials that includes 4 adjustable poles that cost $10.00 each. Shadee expects to have 130 in direct materials inventory on May 1, 100 poles in inventory on May 31, and 110 poles in inventory on June 30. Suppose that each shade takes three direct labor hour to produce and Shadee pays its workers $14 per hour. Additionally, Shadee's fixed manufacturing overhead is $12,000 per month, and variable manufacturing overhead is $14 per unit produced. Additional information: Selling costs are expected to be 7 percent of sales. • Fixed administrative expenses per month total $1,700. Required:…arrow_forwardIguana, Inc., manufactures bamboo picture frames that sell for $25 each. Each frame requires 4 linear feet of bamboo, which costs $2.00 per foot. Each frame takes approximately 30 minutes to build, and the labor rate averages $12.00 per hour. Iguana has the following inventory policies: Ending finished goods inventory should be 40 percent of next month’s sales. Ending direct materials inventory should be 30 percent of next month’s production. Expected unit sales (frames) for the upcoming months follow: March 275 April 250 May 300 June 400 July 375 August 425 Variable manufacturing overhead is incurred at a rate of $0.30 per unit produced. Annual fixed manufacturing overhead is estimated to be $7,200 ($600 per month) for expected production of 4,000 units for the year. Selling and administrative expenses are estimated at $650 per month plus $0.60 per unit sold.Iguana, Inc., had $10,800 cash on hand on April 1. Of its sales, 80 percent is in cash. Of the…arrow_forward1) Gertrude Products expects the following sales of its single product: Units July 6,000 August 6,500 September 7,200 October 7,800 November 8,800 Gertrude desires an ending finished goods inventory to be equal to 20% of the next month's sales needs. July 1 inventory is projected to be 1,000 units. Each unit requires 5 pounds of Chemical A and 14 pounds of Chemical B. July 1 materials inventory includes 10,600 pounds of Chemical A and 76,000 pounds of Chemical B. Gertrude desires to maintain a Chemical A inventory equal to 30% of next month's production needs and a Chemical B inventory equal to 100% of next month's production needs. a Prepare a production budget for Gertrude for July, August and September. a. Production July August September Qtr. Total Sales +Ending Inv. -Beginning Inv. Production b. Prepare a direct materials…arrow_forward

- ! Required information [The following information applies to the questions displayed below.) Shadee Corporation expects to sell 610 sun shades in May and 350 in June. Each shade sells for $144. Shadee's beginning and ending finished goods inventories for May are 70 and 60 shades, respectively. Ending finished goods inventory for June will be 55 shades. Each shade requires a total of $45.00 in direct materials that includes 4 adjustable poles that cost $5.00 each. Shadee expects to have 130 in direct materials inventory on May 1, 90 poles in inventory on May 31, and 110 poles in inventory on June 30. Suppose that each shade takes three direct labor hour to produce and Shadee pays its workers $15 per hour. Additionally, Shadee's fixed manufacturing overhead is $9,000 per month, and variable manufacturing overhead is $13 per unit produced. Use the information and solutions presented to complete the requirements. Required: 1. Determine Shadee's budgeted manufacturing cost per shade. (Note:…arrow_forwardAbrams Bottling Company sells fruit-flavored colas. Estimated sales in cartons for May, June, and July are 1,000, 3,000, and 5,000, respectively. The price is forecast at $5 per carton. Abrams requires that finished goods ending inventory be 20 percent of the next month's sales. Inventory was 500 units on May 1. Each carton requires 12 oz. of fruit syrup and 130 oz. of carbonated water. Materials ending inventory is 10 percent of the next month's production needs. May 1 inventory met that requirement. A. The budgeted revenue for May is B. The budgeted revenue for July is C. Production in May is D. Production in June is E. Purchases of syrup in May is F. Purchases of carbonated water in May is $ cartons cartons ounces ouncesarrow_forwardManjiarrow_forward

- [The following information applies to the questions displayedbelow.]Shadee Corp. expects to sell 630 sun visors in May and 410 inJune. Each visor sells for $24. Shadee’s beginning and endingfinished goods inventories for May are 75 and 45 units,respectively. Ending finished goods inventory for June will be 60units.!Each visor requires a total of $4.00 in direct materials that includes an adjustableclosure that the company purchases from a supplier at a cost of $1.50 each. Shadeewants to have 31 closures on hand on May 1, 23 closures on May 31, and 20 closureson June 30 and variable manufacturing overhead is $1.75 per unit produced.Suppose that each visor takes 0.80 direct labor hours to produce and Shadee paysits workers $8 per hour.Additional information:Selling costs are expected to be 8 percent of sales.Fixed administrative expenses per month total $1,300.Required:Complete Shadee's budgeted income statement for the months of May and June.(Note: Assume that fixed overhead per unit is…arrow_forwardOlympia Productions Incorporated makes award medallions that are attached to ribbons. Each medallion requires 18 inches of ribbon. The sales forecast for March is 2,000 medallions. Estimated beginning inventories and desired ending inventories for March are as follows: (Assume 18 inches = 0.5 yards) Estimated Beginning Medallions Ribbon (yards) Inventory 1,100 70 Desired Ending Inventory 750 23 Required: a. Calculate the number of medallions to be produced in March. b. Calculate the number of yards of ribbon to be purchased in March. a. Number of medallions produced b. Number of yards of ribbon purchasedarrow_forwardIguana, Inc., manufactures bamboo picture frames that sell for $30 each. Each frame requires 4 linear feet of bamboo, which costs $2.50 per foot. Each frame takes approximately 30 minutes to build, and the labor rate averages $12 per hour. Iguana has the following inventory policies: Ending finished goods inventory should be 40 percent of next month’s sales. Ending direct materials inventory should be 30 percent of next month’s production. Expected unit sales (frames) for the upcoming months follow: March 280 April 260 May 310 June 410 July 385 August 435 Variable manufacturing overhead is incurred at a rate of $0.40 per unit produced. Annual fixed manufacturing overhead is estimated to be $7,800 ($650 per month) for expected production of 3,000 units for the year. Selling and administrative expenses are estimated at $700 per month plus $0.50 per unit sold. Iguana, Inc., had $10,900 cash on hand on April 1. Of its sales, 80 percent is in cash. Of the credit…arrow_forward

- Please help me with show calculation thankuarrow_forwardIguana, Inc., manufactures bamboo picture frames that sell for $25 each. Each frame requires 4 linear feet of bamboo, which costs $2.50 per foot. Each frame takes approximately 30 minutes to build, and the labor rate averages $14 per hour. Iguana has the following inventory policies: • Ending finished goods inventory should be 40 percent of next month's sales. Ending direct materials inventory should be 30 percent of next month's production. Expected unit sales (frames) for the upcoming months follow: March April May June July August 315 330 380 480 455 505 Variable manufacturing overhead is incurred at a rate of $0.60 per unit produced. Annual fixed manufacturing overhead is estimated to be $7,200 ($600 per month) for expected production of 3,000 units for the year. Selling and administrative expenses are estimated at $650 per month plus $0.50 per unit sold. Iguana, Inc., had $11,000 cash on hand on April 1. Of its sales, 80 percent is in cash. Of the credit sales, 50 percent is…arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education