FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

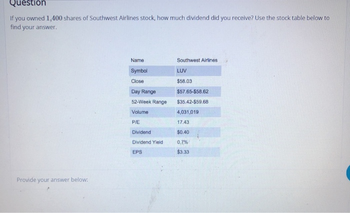

Transcribed Image Text:Question

If you owned 1,400 shares of Southwest Airlines stock, how much dividend did you receive? Use the stock table below to

find your answer.

Provide your answer below:

Name

Symbol

Close

Day Range

52-Week Range

Volume

P/E

Dividend

Dividend Yield

EPS

Southwest Airlines

LUV

$58.03

$57.65-$58.62

$35.42-$59.68

4,031,019

17.43

$0.40

0.7%

$3.33

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please do not give solution in image format thankuarrow_forwardThe following financial information is available on the Haverty Company:Current per share market price $48.00Most recent per share dividend $3.50Expected long-term growth rate 5.0% Haverty can issue new common stock to net the company $44 per share. Determine the cost of equity raised through selling new stock using the dividend growth model approach. (Compute answer to the nearest .1%).arrow_forwardI need the answer as soon as possiblearrow_forward

- If C CORP. had 3,198,000 shares of common stock outstanding when it paid dividends last year, how much did it pay in dividends? Portion of Stock Exchange Listing Name Symbol Open High Low Close Net Chg %Chg Volume 52 Wk High 52 Wk Low Div Yield P/E Ytd % Chg A CORP. A 30.6 31.24 30.5 31.12 0.58 1.9 994,770 32.9 19.4 ... ... 24 6.6 B LTD. B 28.14 28.57 27.67 28.42 0.28 1 270,400 28.87 16.11 0.48 1.7 14 25.1 C CORP. C 48.6 49.07 48.52 28.42 0.29 0.6 1,598,100 50.33 25.43 1.48 3 ... 52.1 D LTD. D 14.35 14.58 13.92 14.51 0.16 1.11 54,900 16.55 12.6 ... ... ... −6.1 E CORP. E 23.76 24.3 23.62 24.03 0.23 0.97 570,711 27.45 17.95 ... ... 172 −9.2arrow_forwardChico Pop Co. stock price and dividend history are as follows: Year Beginning of year price 2014 $100 $110 $90 $95 2015 2016 2017 1.37% An investor buys three shares of Chico Pop at the beginning of 2014, buys another two shares at the beginning of 2015, sells one share at the beginning of 2016, and sells all four remaining shares at the beginning of 2017. What is the dollar-weighted average return for this investor? O 2.18% -1.07% Dividend paid at year end $2 O -2% $3 $4 $5arrow_forwardWhat is the market price of a share of stock for a firm with 100,000 shares outstanding, a book value of equity of P3,000,000, and a market/book ratio of 1.0? a. P8.57 b. P30.00 c. P85.70 d. P105.00arrow_forward

- Calculate the total cost, proceeds, and gain (or loss) (in $) for the stock market transaction. Company an oil company Number of Shares 100 Purchase Price $48.20 Selling Price $57.06 Commissions Buy Sell Odd Lot 3% 3% LA Total Cost ta Proceeds LA Gain (or Loss)arrow_forward1.arrow_forwardIf C CORP. had 3,518,000 shares of common stock outstanding when it paid dividends last year, how much did it pay in dividends? Click the icon to view the portion of Stock Exchange Listing. Data table TERE AL shares of common stock Quistenalleg when it bald dividends last year now much did it pay in dividend Portion of Stock Exchange Listing Name A CORP BLID C CORP DLTD. E CORP. Symbol Open High 30.6 31.24 28.14 28.57 48.6 49.07 14.35 14.58 23.76 24.3 A B C D E CIDO 994,770 32.9. 270,400 28.87 19.4 16.11 Low Close Net Chg %Chg Volume 52 Wk High 52 Wk Low Div 30.5 31.12 0.58 1.9 1 0.6 1.11. 0.97 1,598,100 50.33 25.3 27.67 28.42 0.28 48.52 28.42 0.29 13.92 14.51 0.16 23.62 24.03 0.23 54,900 16.55 12.6 570,711 27.45 17.95 Print Done Yield P/E Ytd % Chg 24 6.6 14 25.1 52.1 -6.1 172-9.2 yove THE 0.48 1.7 1.48 3arrow_forward

- Nonearrow_forwardWhat is the annual rate of return on the stock (percentage) before tax? 37.67% 29.19% 23.55%arrow_forwardStockholder Profitability Ratios The following information pertains to Montague Corporation: Net income $60,000 Average common equity $1,500,000 Preferred dividends $7,500 Average common shares outstanding 100,000 Required: Calculate the return on common equity and the earnings per share. Round your answers to two decimal places. Return on common equity fill in the blank 1 % Earnings per share $fill in the blank 2 per sharearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education