ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

q3b

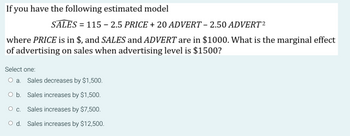

Transcribed Image Text:If you have the following estimated model

SALES = 115 - 2.5 PRICE + 20 ADVERT – 2.50 ADVERT ²

where PRICE is in $, and SALES and ADVERT are in $1000. What is the marginal effect

of advertising on sales when advertising level is $1500?

Select one:

Sales decreases by $1,500.

Sales increases by $1,500.

O C. Sales increases by $7,500.

O d. Sales increases by $12,500.

a.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- "A financial investor has $31,000 to invest. The choices have been narrowed down to the following two options.-OPTION 1:Invest in a foreign bond that will mature in one year. This will entail an immediate brokerage fee of $100. For simplicity, assume that the bond will provide interest of $2,470, $2,130, or $1,527 over the one-year period and that the probabilities of these occurrences are assessed to be 0.29, 0.43, and 0.28, respectively.-OPTION 2:Invest in a $31,000 certificate with a savings-and-loan association. Assume that this certificate has an effective annual rate of 5.6%.Which form of the investment should the investor choose in order to maximize her expected financial gains? Enter the expected net gain (total return - initial investment - fee) of the preferred option."arrow_forwardSt. John's Brewery (SJB) is getting ready for a busy tourist season. SJB wants to either increase production or produce the same amount as last year, depending on the demand level for the coming season. SJB estimates the probabilities for high, medium and low demands as 0.32, 0.31, and 0.37 respectively, on the basis of the number of tourists forecasted by the local recreational bureau. If SJB increases production, the expected profits corresponding to high, medium and low demands are $800,000, $400,000 and $100,000 respectively. If SJB does not increase production, the expected profits are $550,000, $325,000 and $200,000 respectively. (NOTE: Text answers are case sensitive and the value of different parts of this question is indicated in square brackets [*/*]) Construct a decision tree for SJB. On the basis of the EV, what should SJB do? What is the expected value of increasing production? What is the expected value of not increasing production? Should SJB increase production (enter…arrow_forwardA 28- year- old man pays $158 for one year life insurance policy with coverage of $110,000. If the probability he will live through the year is 0.9994, what is the expected value for the insurance policy?arrow_forward

- A manufacturer sells a particular product in both Brazil and the U.S. In Brazil, the manufacturer has been selling 4,900 units per year of the product at a price of $200 and a contribution margin of 25 percent. For sales of this product in Brazil, calculate the breakeven sales level for a $20 price increase. Show your work. In the U.S., the manufacturer’s price for this product is $400 and the contribution margin is 50 percent. The manufacturer knows that, because of gray market commerce, every one-unit change of sales of this product in Brazil leads to a 0.15-unit sales change in the opposite direction in the U.S. Given this information, recalculate the breakeven sales level in Brazil described in Part a. Show your work. Using the course material, describe the concept of a price corridor. Then explain how the difference between the breakeven you calculated in Part (b) and the one you calculated in Part (a) is helpful for applying the price-corridor concept in this situation.arrow_forwardThe owner of a ski resort is considering installing a new ski lift that will cost $850,000. Expenses for operating and maintaining the lift are estimated to be $2,000 per day when operating. The U.S.Weather Service estimates that there is a 55% probability of 90 days of skiing weather per year, a 30% probability of 100 days per year, and a 15% probability of 120 days per year. The operators of the resort estimate that during the first 90 days of adequate snow in a season, an average of 550 people will use the lift each day, at a fee of $10 each. If 10 additional days are available, the lift will be used by only 450 people per day during the extra period; and if 20 more days of skiing are available, only 250 people per day will use the lift during those days. The study period is eight years; the ski lift will be depreciated by using the MACRS Alternative Depreciation System (ADS); the ADS recovery period is seven years; MARR = 10% per year (after-tax); and the effective income tax rate…arrow_forwardurgentarrow_forward

- St. John's Brewery (SJB) is getting ready for a busy tourist season. SJB wants to either increase production or produce the same amount as last year, depending on the demand level for the coming season. SJB estimates the probabilities for high, medium and low demands as 0.2, 0.3, and 0.5 respectively, on the basis of the number of tourists forecasted by the local recreational bureau. If SJB increases production, the expected profits corresponding to high, medium and low demands are $750,000, $325,000 and $100,000 respectively. If SJB does not increase production, the expected profits are $450,000, $325,000 and $150,000 respectively. (NOTE: Text answers are case sensitive and the value of different parts of this question is indicated in square brackets [*/*]) Construct a decision tree for SJB. On the basis of the EV, what should SJB do? What is the expected value of increasing production? What is the expected value of not increasing production? Should SJB increase production (enter…arrow_forwardFethe's Funny Hats is considering selling trademarked, orange-haired curly wigs for University of Tennessee football games. The purchase cost for a 2-year franchise to sell the wigs is $20,000. If demand is good (40% probability), then the net cash flows will be $27,000 per year for 2 years. If demand is bad (60% probability), then the net cash flows will be $9,000 per year for 2 years. Fethe's cost of capital is 14%. A. What is the expected NPV of the project? B. Use decision-tree analysis to calculate the expected NPV of this project, including the option to continue for an additional 2 years. B. Use decision-tree analysis to calculate the expected NPV of this project, including the option to continue for an additional 2 years.arrow_forwardYou decide to invest in a portfolio consisting of 21 percent Stock X, 48 percent Stock Y, and the remainder in Stock Z. Based on the following information, what is the standard deviation of your portfolio? State of Economy Normal Boom Probability of State of Economy .84 .16 Return if Stat Stock X Stock Y 10.20% 3.60% 17.50% 25.50%arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education