FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

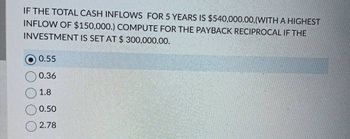

Transcribed Image Text:IF THE TOTAL CASH INFLOWS FOR 5 YEARS IS $540,000.00, (WITH A HIGHEST

INFLOW OF $150,000.) COMPUTE FOR THE PAYBACK RECIPROCAL IF THE

INVESTMENT IS SET AT $ 300,000.00.

0.55

0.36

1.8

0.50

2.78

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Compute the payback statistic for Project A if the appropriate cost of capital is 7 percent and the maximum allowable payback period is four years. (Round your answer to 2 decimal places.) Project A Time: 0 1 2 3 4 5 Cash flow: −$2,300 $870 $870 $780 $560 $360arrow_forwardAnnual cash inflows that will arise from two competing investment projects are given below: Investment A $ 3,000 4,000 5,000 6,000 $ 18,000 Year 1 2 3 4 The discount rate is 10% Click here to view Exhibit 148 1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using tables Required: Compute the present value of the cash inflows for each investment Year 1234 S S Investment B $6,000 5,000 4,000 3,000 $18,000 Present Value of Cash Flows Investment A 300 300 $ Investment Barrow_forwardAn investment project costs $15,600 and has annual cash flows of $3,900 for six years. a. What is the discounted payback period if the discount rate is zero percent? Discounted payback period b. What is the discounted payback period if the discount rate is 6 percent? Discounted payback periodarrow_forward

- the project's net cash flow is listed as follows. Please calculate its simple payback period and discounted payback period (i=10%). End of 2 3 4 1 5 Year $12 $11 $10 $10 $9, ,00 ,00 ,00 Net -$4 Cash 2,00 ,00 00 Flowarrow_forwardAn investment project costs $13,200 and has annual cash flows of $3,600 for six years. a. What is the discounted payback period if the discount rate is zero percent? Discounted payback period 3.67 b. What is the discounted payback period if the discount rate is 5 percent? Discounted payback period 4.15arrow_forwardMendez Company has identified an investment project with the following cash flows. Year Cash Flow 1 2 3 $780 1,050 1,310 1,425 a. If the discount rate is 8 percent, what is the present value of these cash flows? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. What is the present value at 17 percent? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) c. What is the present value at 25 percent? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) a. Present value at 8% b. Present value at 17% c. Present value at 25%arrow_forward

- Nikularrow_forwardGiven the following end of year cash flows what is the IRR of this project? Also assume that following year four the cash flows will grow by 3% in perpetuity. Enter your answer as a percent without the “%”; round your final answer to two decimals. Timeline: 0 1 2 3 4CF: -4,000 200 350 400 500arrow_forwardPlease help me with show all calculation thankuarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education