Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

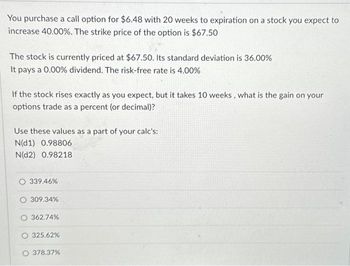

Transcribed Image Text:You purchase a call option for $6.48 with 20 weeks to expiration on a stock you expect to

increase 40.00%. The strike price of the option is $67.50

The stock is currently priced at $67.50. Its standard deviation is 36.00%

It pays a 0.00% dividend. The risk-free rate is 4.00%

If the stock rises exactly as you expect, but it takes 10 weeks, what is the gain on your

options trade as a percent (or decimal)?

Use these values as a part of your calc's:

N(d1) 0.98806

N(D2) 0.98218

O 339.46%

O 309.34%

362.74%

325.62%

O 378.37%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Assume that you have shorted a call option on Intuit stock with a strike price of $40. The option will expire in exactly three months' time. a. If the stock is trading at $55 in three months, what will you owe? b. If the stock is trading at $35 in three months, what will you owe? c. Draw a payoff diagram showing the amount you owe at expiration as a function of the stock price at expiration. a. If the stock is trading at $55 in three months, what will you owe? If the stock is trading at $55 in three months, you will owe $ (Round to the nearest dollar.)arrow_forwardA stock is currently selling for $45. Over the next two periods, the stock will move up by a factor of 1.23 or down by a factor of .61 each period. A call option with a strike price of $54 is available. If the risk-free rate of interest is 3.2 percent per period, what is the value of the call option? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Value of the call optionarrow_forwardA call option is currently selling for $5.00. It has a strike price of $85 and ten months to maturity. A put option with the same strike price sells for $8.10. The risk-free rate is 4.6 percent and the stock will pay a dividend of $2.60 in three months. What is the current stock price? (Do not round intermediate calculations. Round your answer to 2 decimal places.)arrow_forward

- A call option currently sells for $9.25. It has a strike price of $45 and six months to maturity. A put with the same strike and expiration date sells for $7.50. If the risk-free interest rate is 6.3 percent, what is the current stock price? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Current stock pricearrow_forwardA call option currently sells for $7.00. It has a strike price of $40 and five months to maturity. A put with the same strike and expiration date sells for $5.00. If the risk-free interest rate is 5 percent, what is the current stock price? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Current stock pricearrow_forwardSuppose a stock drops in value by 50% one week, then increases in value the next week by 75%. Is the value higher or lower than where it started? 1. The value of the stock is (lower or higher) than where it started. 2. If the value of the stock started at $100, then what is it worth now?arrow_forward

- Consider a put option whose underlying asset is a stock index with 6 months to expiration and a strike price of $1000. Suppose the risk-free interest rate for the six months is 2% and that the option’s premium is $74.20. (a) Find the future premium value in six months. (b) What is the buyer’s profit is the index spot price is $1100? (c) What is the buyer’s profit is the index spot price is $900 Only typed answerarrow_forwardUse the Black-Scholes formula to find the value of the put option using the next data: Stock price: $5.03 Time to expiration: 176 days (365 days in a year) The volatility of a stock return: 65% per year Strike price: $5 Risk-free interest rate: 1% per yeararrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education