FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

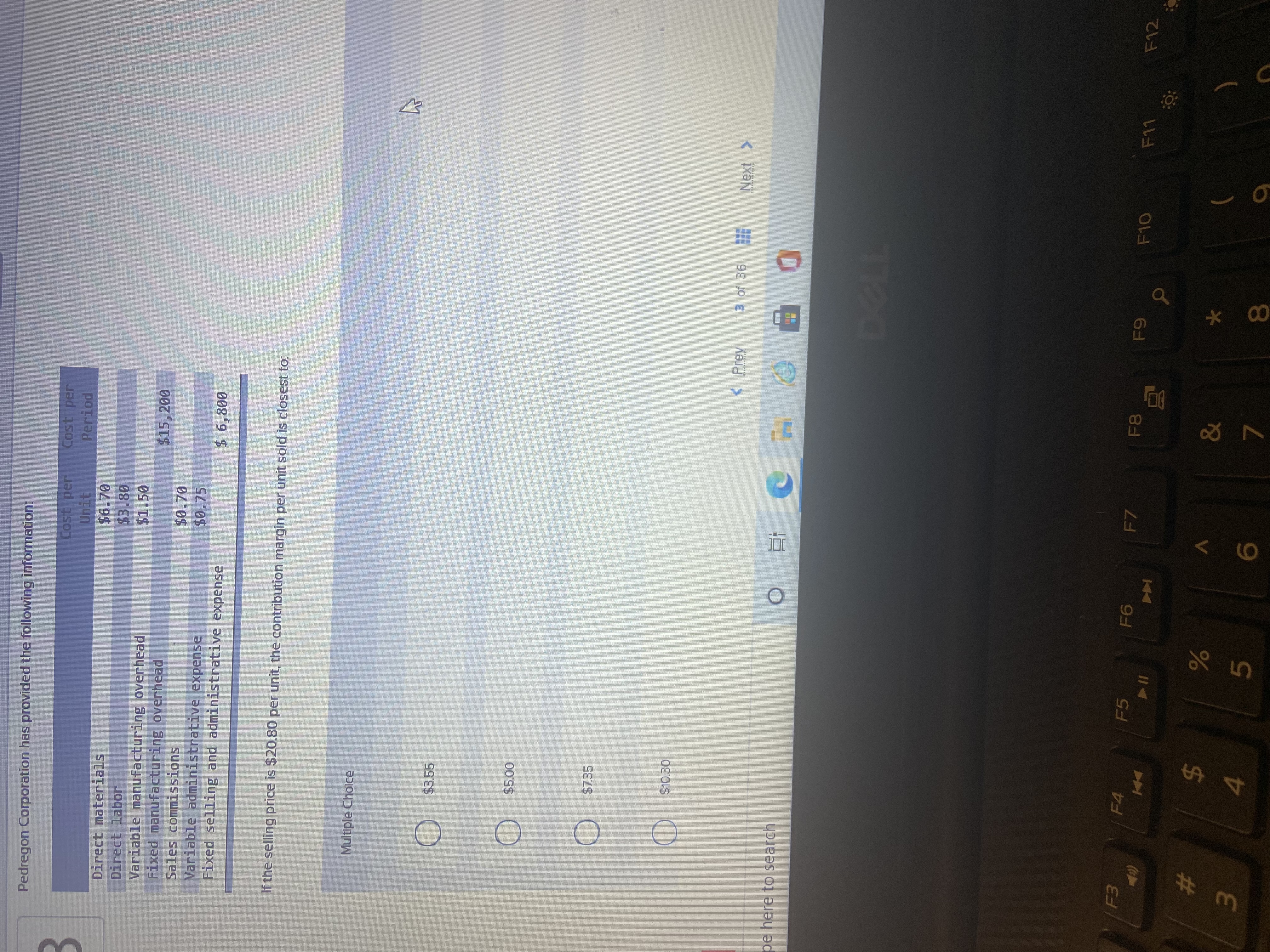

Transcribed Image Text:### Pedregon Corporation Cost Analysis

Pedregon Corporation has provided the following cost information:

| **Cost Item** | **Cost per Unit** | **Cost per Period** |

|----------------------------------------|-------------------|---------------------|

| Direct materials | $6.70 | |

| Direct labor | $3.80 | |

| Variable manufacturing overhead | $1.50 | |

| Fixed manufacturing overhead | | $15,200 |

| Sales commissions | $0.70 | |

| Variable administrative expense | $0.75 | |

| Fixed selling and administrative expense| | $6,800 |

**Note:** If the selling price is $20.80 per unit, the contribution margin per unit sold is closest to one of the options in the multiple-choice question below.

### Multiple Choice Question

**Determine the contribution margin per unit:**

- $3.55

- $5.00

- $7.35

- $10.30

**Instructions:** Select the option that represents the correct contribution margin per unit.

Contribution margin per unit is calculated as the selling price per unit minus the variable costs per unit. Use the provided cost information to determine the appropriate figure.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Is this correct?arrow_forwardFind out BEP in units and value with the following data:Fixed cost - $30000Variable cost - $20 per unitSelling Price - $50 per unit.arrow_forwardPlease explain this statement thoroughly. "To estimate what the profit will be at various levels of activity, multiply the number of units to be sold above or below the break-even point by the unit contribution margin."arrow_forward

- The contribution margin equals sales minus all O period O variable O fixed O product expenses.arrow_forward1. Assume a company sells three different products. The contribution margin ratio of the first product is 20 percent. The contribution margin ratio of the second product is 50 percent. The contribution margin ratio of the third product is 80 percent. What is the range of the company's overall contribution margin ratio?arrow_forwardWhat are the answers for the following? Construct a cost-volume-profit chart on your own paper. What is the break-even sales? What is the expected margin of safety in dollars and as a percentage of sales? Determine the operating leverage. Round to one decimal place.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education