ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

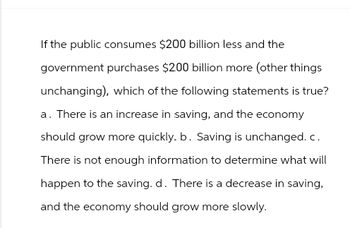

Transcribed Image Text:If the public consumes $200 billion less and the

government purchases $200 billion more (other things

unchanging), which of the following statements is true?

a. There is an increase in saving, and the economy

should grow more quickly. b. Saving is unchanged.c.

There is not enough information to determine what will

happen to the saving. d. There is a decrease in saving,

and the economy should grow more slowly.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- ..arrow_forwardThe figure shows the flows of income and expenditure in an economy. In 2008, Q was $1,100 billion, U was $250 billion, W was $550 billion, R was $100 billion, and Z was $80 billion. Calculate investment and saving. Investment is $220 billion. Saving is $ billion. ...arrow_forward不 An economy is based on three sectors, agriculture, manufacturing, and energy. Production of a dollar's worth of agriculture requires inputs of $0.30 from agriculture, $0.30 from manufacturing, and $0.30 from energy. Production of a dollar's worth of manufacturing requires inputs of $0.30 from agriculture, $0.30 from manufacturing, and $0.30 from energy. Production of a dollar's worth of energy requires inputs of $0.30 from agriculture, $0.40 from manufacturing, and $0.30 from energy Find the output for each sector that is needed to satisfy a final demand of $16 billion for agriculture, $47 billion for manufacturing, and $24 billion for energy. The output of the agricultural sector is billion dollars. (Round the final answer to three decimal places as needed. Round all intermediate values to six decimal places as needed.)arrow_forward

- The classification of government spending as an investment or having an investment-effect depends on: a. How the spending affects current consumption. b. How the spending affects future productivity. c. How the spending affects current stock prices. d. How the spending affects future stock prices.arrow_forwardWhich of the following correctly describes how a decrease in the price level affects consumption spending? Select one: a. A decrease in the price level raises real wealth, which causes consumption to increase. b. A decrease in the price level decreases the amount of money a household needs to buy goods and so raises the interest rate, which causes consumption to increase. c. A decrease in the price level increases the amount of money a household needs to buy goods and so raises the interest rate, which causes consumption to increase. d. A decrease in the price level lowers real wealth, which causes consumption to decrease.arrow_forwardPlease explain how a rise in the household saving rate can cause a fall in GDP?arrow_forward

- true/false explain When savings equals investment, reducing savings and increasing consumption is especially effective in stimulating output.arrow_forward1. Suppose your annual income is $82,000 this year and it is expected to increase 25% next year. The market interest rate is 3%. a. Please illustrate all possible consumption patterns with a figure. Do not forget to label your axes. b. You believe that your consumption this year and your consumption next year should be the same. If you follow your plan and consume equally in those two years, how much should you save or borrow this year?arrow_forward3. Many parts of the economy are related to one another. In particular, a decrease in spending in one area may have an impact somewhere else. Provide an example of this scenario. Economic theory tells us that "one person's spending is another person's income." What is meant by this phrase? Explain in your own words.arrow_forward

- Suppose that in a closed economy, GDP is $15 trillion, Consumption is $6 trillion, Government Purchases are $5 trillion, and there is a $500 billion budget deficit. 6. What are taxes? 7. What is public saving? 8. What is private saving? 9. What is national saving? 10. What is investment? If then taxes are raised by $500 billion dollars, and the public pays for those taxes entirely by reducing their consumption (no change to their savings), after this tax increase, 11. What is consumption? 12. What are taxes? 13. What is public saving? 14. What is private saving? 15. What is national saving? 16. What is investment?arrow_forwardCurrently, the US has a total consumption of $12 trillion, saving of $6 trillion, tax revenues of $5 trillion, and government spending of $7 trillion. Relative to a balanced budget, the government’s actions in this economy will cause: a. Higher interest rates today and reduced economic growth for future generations. b. Lower interest rates today and reduced economic growth for future generations. c. Higher interest rates today and enhanced economic growth for future generations. d. Lower interest rates today and enhanced economic growth for future generations.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education