ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

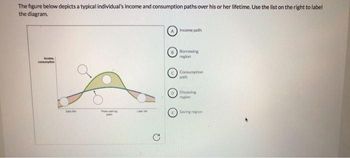

Transcribed Image Text:The figure below depicts a typical individual's income and consumption paths over his or her lifetime. Use the list on the right to label

the diagram.

me

consumption

www

Later

Income path

8 Borrowing

region

c) Consumption

path

D) Dissaving

region

Saving region

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- It has been said that a society withhigh savings rate is a society with ahigh standard of living. Discuss thelink (if any) between saving andstandard of living and also explainthe overall economic function ofprofits.arrow_forwardOne of the benefits financial capital markets offer savers is the opportunity to earn income. a. Savers earn income in the form of purchasing b. Savers earn income in the form of through partial ownership of a corporations that they acquire by by lending money to corporations when they purchasearrow_forward3. The meaning of saving and investment Classify each of the following based on the macroeconomic definitions of saving and investment. Saving Investment Caroline purchases new ovens for her cupcake-baking business. Antonio buys a government bond. Dmitri takes out a loan and uses it to build a new cabin in Montana. Frances purchases stock in Pherk, a pharmaceutical company.arrow_forward

- not understanding how to show thisarrow_forwardView History Bookmarks Tools Window Help Coy, Jonnifer - Outlo X C Martin County School District X S MyPath - Home Content https://ezto.mheducation.com/ ext/map/index.html?_con%3Dcon&external_browser%3D0&launchUrl=https%25 Saved Level of Output and Income (GDP= DI) Consumption Saving APC APS MPC MPS S480. $-16 520 560 16 60 32 640 48 680 64 720 80 760 96 800 112 Des Instructions: Enter your answer as a whole number. b. What is the break-even level of income in the table? What is the term that economists use for the saving situation shown at the $480 level of income? (Click to select) Y c. For each of the following items, indicate whether the value in the table is either constant or variable as income chanc The MPS: (Click to select) The APC: (Click to select) The MPC: (Click to select) The APS: (Click to select) aw Prev 1 of 1 JAN 11 %24arrow_forwardThe following table contains data on the relationship between saving and income. a. Rearrange the income and saving data into an ascending order of income and graph them on the accompanying grid. Income per Year $ Saving per Year 15,000 $ 0 10,000 5,000 20,000 1,000 -500 500 0 1,500 Rearranged Rearranged Income per Year Saving per Yeararrow_forward

- #18. What would happen in the market for loanable funds if the government were to increase the tax on interest income? a The supply of loanable funds would shift right. b The demand for loanable funds would shift right. c The supply of loanable funds would shift left. d The demand for loanable funds would shift left.arrow_forwardDescribe the investment decisions made in the private sector?arrow_forwardHow is capital transferredbetween savers and borrowers?arrow_forward

- C wrongarrow_forwardThe following graph shows the market for loanable funds in a closed economy. The upward-sloping orange line represents the supply of loanable funds, and the downward-sloping blue line represents the demand for loanable funds. 10 Supply 8 Demand 100 200 300 400 500 600 700 800 900 1000 LOANABLE FUNDS (Billions of dollars) is the source of the supply of loanable funds. As the interest rate falls, the quantity of loanable funds supplied increases v Suppose the interest rate is 4.5%. Based on the previous graph, the quantity of loanable funds supplied is v than the quantity of loans demanded, resulting in a v of loanable funds. This would encourage lenders to v the interest rates they charge, thereby v the quantity of loanable funds supplied and v the quantity of loanable funds demanded, moving the market toward the equilibrium interest rate of 5% . INTEREST RATE (Percent)arrow_forwardPLEASE ANSWER ALL QUESTIONS NOT JUST SOME PLEASE WRITE THE EXACT NUMBERS FOR THE GRAPH. PLEASE READ CAREFULLY, THIS MAY BE A SIMILAR QUESTION, BUT ALL QUESTIONS ARE DIFFERENTarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education