ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

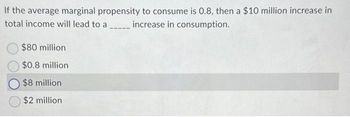

Transcribed Image Text:If the average marginal propensity to consume is 0.8, then a $10 million increase in

total income will lead to a

increase in consumption.

$80 million

$0.8 million

$8 million

$2 million

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- The marginal propensity to consume out of permanent income equals 0.9 and the marginal propensity to consume out of transitory income equals 0.1. Suppose that there is an emergency increase in government spending of $200 billion to repair infrastructure. The spending takes place within a year. The spending increase is financed by a one-time increase in taxes. Prior to the increase in government spending, permanent income equals $9,600 billion and transitory income equals zero. (a) Compute the amounts of consumption expenditures and private saving prior to the tax increase. (b) Compute the amount of changes in consumption expenditures and private saving, given that the tax increase lasts for only one year. (c) Compute the initial change in aggregate demand that results from this combination of increases in government spending and taxes.arrow_forwardIf Pat's incöme increased from $250,000 to $500,000 and his consumption increased from $200,000 to $300,000, what was his marginal propensity to consume? 0 04 0.6 0.8 0.9arrow_forwardThe marginal propensity to consume is a)the average amount of income that is consumed or spent b)the ratio of consumption to income c)the ratio of the change in consumption to a change in income d)the ratio of income to consumptionarrow_forward

- In an economy the marginal propensity to consume is 0.9 and increase in investment is of 100 million dollars. Find out the increase in national income.arrow_forwardSuppose the government reduces taxes by 50,000,000, that there is no crowding out, and that marginal propensity to consume is 0.9. What is the total amount of additional economic activity that results from this tax cut?arrow_forwardConsider an economy in which the marginal propensity to consume is 0.75, prices are constant, G is initially 1,500, taxes are autonomous (not related to income) and are initially 2,000, transfer payments are initially 500, and GDP is initially 8,200. The economy is currently experiencing an inflationary gap. The government wishes to eliminate the gap and intends to reduce GDP to 7,000, and is considering changing government purchases, or taxes, or transfer payments. What new levels of these fiscal policy tools would be needed? In each case, what would the new government surplus or deficit be?arrow_forward

- What is the effect on savings of a tax cut of $15 billion? Is this inflationary or deflationary? Assume that the MPC is 0.9.arrow_forwardAssume a model where marginal propensity to save is 0.2, the marginal propensity to import is 0.1 and the marginal income tax rate is 0.2. What is the size of the expenditure multiplier?arrow_forwardAssume that the Marginal Propensity to Consume (MPC) is 0.8. If the multiplier effect is taken into account, the reduction in government expenditure by $ 200 million will shift the overall demand process to the correct order below. A) right, $1,000 million B) left, $ 200 million C) left, $160 million D) left, $1,000 million E) right, $ 160 millionarrow_forward

- If the marginal propensity to consume is 0.50, how much would government spending have to rise to increase output by $1,000 billion? AG = $500 billion. (Enter your response as an integer.) How much will taxes need to decrease to increase output by $1,000 billion? AT $ billion. (Enter your response as an integer.)arrow_forwardIf the Marginal Propensity to Consume is 0.8, this means that For each $1 increase in income, residents will increase their consumption by 20 cents. For each $1 increase in government purchase, spending in the economy will increase by $4.00. For each $1 increase in taxes, spending in the economy will decrease by $5.00. For each $1 increase in taxes, spending in the economy will increase by $4.00. For each $1 increase in taxes, spending in the economy will decrease by $4.00.arrow_forwardIf the marginal propensity to consume (MPC) is .90 estimate the total (multiplied) effect of governement purchases/spending of $100B in the economy of its aggregate expenditurearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education