Principles of Cost Accounting

17th Edition

ISBN: 9781305087408

Author: Edward J. Vanderbeck, Maria R. Mitchell

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Compute the cost to be allocated

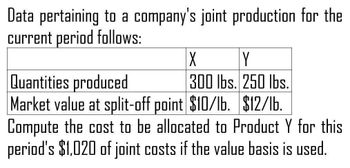

Transcribed Image Text:Data pertaining to a company's joint production for the

current period follows:

Quantities produced

Y

300 lbs. 250 lbs.

Market value at split-off point $10/lb. $12/lb.

Compute the cost to be allocated to Product Y for this

period's $1,020 of joint costs if the value basis is used.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- X Corp produces 200 units of A and 100 units of B products. Final sales amount of A is 9,000. Joint cost is 6,600. Cost beyond the split off point is 3,000 each for both A and B. Using NRV or adjusted sale value method, the computed unit cost of A is 22 per unit. What is the Final sales amount of product B?arrow_forwardA company manufactures two joint products at a joint cost of 1,000. These products can be sold at split-off, or when further processed at an additional cost, sold as higher quality items. The decision to sell at split-off or further process should be based on the: A. allocation of the 1,000 joint cost using the quantitative unit measure B. assumption that the 1,000 joint cost is irrelevant C. allocation of the $1,000 joint cost using the relative sales value approach D. assumption that the 1,000 joint cost must be allocated using a physical-measure approach E. allocation of the 1,000 joint cost using any equitable and rational allocation basisarrow_forwardThe joint costs allocated to product Y werearrow_forward

- Bulldog Canyon Manufacturing produces three products from a joint process. The following information is available for the period just ended: Units produced Joint cost allocation. Sales value at split-off Multiple Choice O $53,280. $48,000. BDC-4 BDC-5 10,800 25,200 $33,120 $57,600. ? Assume that Bulldog Canyon allocates joint costs using the relative-sales-value method. What is the amount of joint cost allocation to BDC-4? $17,280. $187,200 ? BDC-6 54,000 Not enough information is provided to determine how to allocate the joint cost. Total 90,000 $144,000 ? 2 $468,000arrow_forwardPT Agile Box produces products 1,2 and 3 from one combined product process. Information relating to the allocation of combined production costs is as follows Production Product Points / Market / unit Volume Units price 1.200 unit 3 200.000 600 unit 250.000 3 500 unit 4 350.000 Total 2.300 unit Based on this data, you allocate a joint production cost of IDR 345,000,000 to each product and calculate the cost / unit of each product if PT DZAKI uses the following alternatives: a. Average unit method b. Weighted average method (based on points /units) 2. 1, 2.arrow_forwardExample with Byproduct and Separable Costs: Lond Co. produces joint products Jana and Reta, together with byproduct Bynd. Jana is sold at split-off, whereas Reta and Bynd undergo additional processing. Production data pertaining to these products for the year ended December 31, 20x1 were as follows: Jana Reta Bynd Total Joint costs Variable $88,000 Fixed 148,000 Separable costs Variable $120,00 $3,000 123,000 Fixed 90,000 2,000 92,000 Production in Pounds 50,000 40,000 10,000 100,000 Sales price per pound $4.00 $7.50 $1.10 There were no beginning or ending inventories. No materials are spoiled in production. Variable costs change in direct proportion to production volume. The net realizable value of the byproduct (Bynd) is deducted from joint costs. Joint costs are allocated to joint products to achieve the same gross margin percentage for each joint product. Required: Allocate joint costs using: 1. Unit of measure method. 2. Net realizable value method. 3. Constant gross margin…arrow_forward

- LeMoyne Manufacturing Inc.’s joint cost of producing 2,000 units of Product X, 1,000 units of Product Y, and 1,000 units of Product Z is $50,000. The unit sales values of the three products at the split-off point are Product X–$30, Product Y–$100, and Product Z–$90. Ending inventories include 200 units of Product X, 300 units of Product Y, and 100 units of Product Z. Compute the amount of joint cost that would be included in the ending inventory valuation of the three products on the basis of their sales values at split-off. Assume that Product Z can be sold for $120 a unit if it is processed after split-off at a cost of $10 a unit. Compute the amount of joint cost that would be included in the ending inventory valuation of the three products on the basis of their net realizable values.arrow_forwardClarion Industries produces two joint products, Y and Z. Prior to the split-off point, the company incurred costs of $36,000. Product Y weighs 25 pounds and product Z weighs 75 pounds. Product Y sells for $150 per pound and product Z sells for $125 per pound. Based on a physical measure of output, allocate joint costs to products Y and Z.arrow_forwardLaramie Industries produces two joint products, H and C. Prior to the split-off point, the company incurred costs of $66,000. Product H weighs 44 pounds and product C weighs 66 pounds. Product H sells for $250 per pound and product C sells for $295 per pound. Based on a physical measure of output, allocate joint costs to products H and C.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning