FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

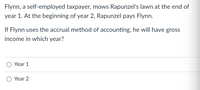

Transcribed Image Text:Flynn, a self-employed taxpayer, mows Rapunzel's lawn at the end of

year 1. At the beginning of year 2, Rapunzel pays Flynn.

If Flynn uses the accrual method of accounting, he will have gross

income in which year?

Year 1

Year 2

Expert Solution

arrow_forward

Step 1

Accrual method of accounting is a method of accounting for expenses and revenues at the date of occurrence rather than the date of payment or receipt

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- An individual taxpayer can adopt either the calendar or fiscal year period forpurposes of filing his income tax return. TRUE OR FALSE?arrow_forwardHow did you come up the number for Income before income tax, why did you subtract the quipment cost.arrow_forwardHow do you determine net income applying the accrual accounting model?arrow_forward

- What is referred by unearned income? How is it adjusted in the final accounts?arrow_forwardWhich of the following is business income for NOL purposes? Interest earned on savings account. Unemployment compensation. Alimony received. IRA distribution.arrow_forwardhow to calculate someones adjusted basis in taxarrow_forward

- How do you report self-employment income?arrow_forwardWhat is a key requirement for filing individual income tax returns? a) Providing proof of employment history b) Reporting all sources of income c) Submitting bank statements d) Listing personal expensesarrow_forwardwhat is the net income? or how do I find it?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education