Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

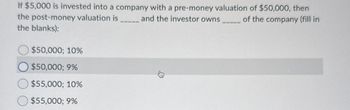

Transcribed Image Text:If $5,000 is invested into a company with a pre-money valuation of $50,000, then

the post-money valuation is _____ and the investor owns_____ of the company (fill in

the blanks):

$50,000; 10%

$50,000; 9%

$55,000; 10%

$55,000; 9%

33

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Given an asset with a net book value (NBV) of $35,000. a. What are the after-tax proceeds for a firm in the 33% tax bracket if this asset is sold for $47,000 cash? After-tax proceeds $ 43,040 b. What are the after-tax proceeds for this same firm if the asset is sold for $21,000 cash? After-tax proceedsarrow_forwardAssume that you sell $100,000 of a 10 percent shareholding with a payment of the future one year from now is $1.5 million. A. Explain what is meant by implied return for the owner of 10 percent?arrow_forwardYou are given the following information concerning a firm:Assets required for operation: $5,100,000Revenues: $8,400,000Operating expenses: $7,850,000Income tax rate: 40%. Management faces three possible combinations of financing: 100% equity financing 30% debt financing with a 8% interest rate 60% debt financing with a 8% interest rate What is the net income for each combination of debt and equity financing? Round your answers to the nearest dollar. 1 2 3 Net income $ $ $ What is the return on equity for each combination of debt and equity financing? Round your answers to one decimal place. 1 2 3 Return on equity % % % If the interest rate had been 16 percent instead of 8 percent, what would be the return on equity for each combination of debt and equity financing? Round your answers to one decimal place. 1 2 3 Return on equity % % % What is the implication of the use of financial leverage…arrow_forward

- A5 6e DEF Company is comparing three different capital structures. Plan A is an all-equity plan and would result in 1000 shares of stock. Plan B would result in 700 shares of stock and $13,500 in debt. Plan C would result in 800 shares of stock and $9000 in debt. The firm’s EBIT will be $10,000 per year until infinity. The interest rate on the debt is 12%. e. Ignoring taxes, what is the break-even EBIT that will cause the EPS on Plan B to be equal to the EPS on Plan C?arrow_forwardHewlard Pocket's market value balance sheet is given. Assets Liabilities and Shareholders' Equity A. Original balance sheet Cash Debt 150,000 950,000 Equity $1,100,000 Other assets 1,100,000 Value of firm Value of firm $1,100,000 Shares outstanding = 100,000 Price per share = $1,100,000 / 100,000 = $1 Pocket needs to hold on to $52,000 of cash for a future investment. Nevertheless, it decides to pay a cash dividend of $2.10 per share and to replace cash as needed with a new issue of shares. After the dividend is paid and the new stock is issued: a. What will be the price per share? (Do not round intermediate calculations. Round your answer to 2 decimal places.) b. What will be the total value of the company? (Enter your answers in whole dollars, not in millions.) c. What will be the total value of the stock held by new investors? (Enter your answers in whole dollars, not in millions. Do not round intermediate calculations. Round your answer to the nearest whole dollar amount.) d. What…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education