ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

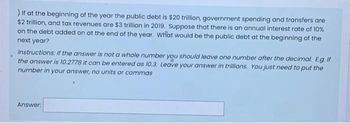

Transcribed Image Text:) If at the beginning of the year the public debt is $20 trillion, government spending and transfers are

$2 trillion, and tax revenues are $3 trillion in 2019. Suppose that there is an annual interest rate of 10%

on the debt added on at the end of the year. What would be the public debt at the beginning of the

next year?

Instructions: If the answer is not a whole number you should leave one number after the decimal. E.g. If

the answer is 10.2778 it can be entered as 10.3. Leave your answer in trillions. You just need to put the

number in your answer, no units or commas

Answer:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Government spending $515 Tax revenues Year 1 $400 Year 2 459 442 Year 3 529 482 Refer to the above data. If year 1 is the first year of this nation's existence and year 3 is the present year, how much is this nation's public debt?arrow_forwardYear Government Purchases Government Taxes Real GDP 1 340 268 5,926 2 419 226 5,792 Suppose there is no public debt before Year 1 and that net transfers are equal to zero. What is the public debt as a percentage of GDP in Year 2? Answer this as a percentage and round your answer to two digits after the decimal without the percentage sign. ex. If you found the rate to be 5.125%, answer 5.13.arrow_forward7.arrow_forward

- The following table contains approximate figures for gross domestic product (GDP) and the national debt in the United States for June 2007 and June 2020. The national debt represents the total amount of money owed by the federal government to holders of U.S. securities. All numbers are in trillions of dollars. June 2007 June 2020 GDP (Trillions of (Trillions of Dollars) Dollars) 13.7 Total National Debt 20.89 8.9 20.9 Source: "U.S. Treasury, Bureau of Economic Analysis." Debt Held by Federal Government and Federal Reserve (Trillions of Dollars) 4.7 9 Debt Held Outside Fed. Govt. and Fed. Reserve Foreign Ownership (External U.S. Ownership (External National Debt) National Debt) (Trillions of Dollars) (Trillions of Dollars) 2.2 6.3 2.0 5.6arrow_forwardDirections: click on the graph in the window on the right and select Time Series to graph the U.S. public (federal) net outstanding debt as a percentage of GDP for the years 1940-2005. For Y Axis1 select Net Federal Debt, percentage of GDP. Use the figure to help determine which of the following statements are true. O A. The U.S. net federal debt to GDP ratio has been, for the most part, decreasing since the end of World War II, despite the fact that the U.S. economy was expanding and could afford a larger debt to GDP ratio. OB. As a result of the exceptionally large increases in U.S. government military expenditures in the first half of the 1940's, that were needed to win World War II, the net U.S. public debt to GDP ratio increased substantially, surpassing 100%. Since the late 1950's however, U.S. net federal debt to GDP ratio has fluctuated within a relatively small bend around the 40% line. OC. The net U.S. federal debt to GDP ratio follows a pattern that cannot have a meaningful…arrow_forwardConsider an economy in which people spend 90 percent of each additional dollar of income they earn. If the government does easy (expansionary) fiscal policy via changing taxes by $2000, what will be the total effect on Y? Carefully follow all numeric instructions. Use a positive number (no sign) to show an increase in Y and a negative number (with negative sign) to show a decrease.arrow_forward

- The question is based on the following information: Item R million 510 540 490 534 Total government revenue Total government expenditure Current government revenue Current government expenditure Non-interest expenditure Cyclically adjusted revenue Cyclically adjusted expenditure The current budget balance is R million. If the balance is negative indicate it using the minus sign in your answer for instance-32 Answer: 500 480 500arrow_forwardSuppose that in 2011, Mexico's total government outlays were 657 billion pesos and total government revenue was 550 billion pesos. Calculate Mexico's budget surplus or deficit. Be sure to include a negative sign if appropriate. billion pesos Select the answer that best describes the impact that the surplus or deficit you calculated will have on Mexico's debt. Mexico's debt will rise by an amount equal to the size of the deficit O Mexico's debt will not change. OMexico's debt will fall by an amount equal to the size of the surplusarrow_forwardc) How worrying is the increases in government deficits and debt? Answer these questions in detail and While answering these questions please write academic references in havard referencing style and site them in text please.arrow_forward

- Government Spending Tax Revenues GDP Year 1 $450 $425 $2,000 Year 2 500 450 3,000 Year 3 600 500 4,000 Year 4 640 620 5,000 Year 5 680 580 4,800 Year 6 600 620 5,000 The accompanying table gives budget information for a hypothetical economy. Assume that all budget surpluses are used to pay down the public debt. The public debt declined in yeararrow_forwardYear Government Purchases Government Taxes Real GDP 1 400 247 5,812 2 434 203 5,898 Suppose there is no public debt before Year 1 and that net transfers are equal to zero. What is the public debt as a percentage of GDP in Year 2? Answer this as a percentage and round your answer to two digits after the decimal without the percentage sign. ex. If you found the rate to be 5.125%, answer 5.13.arrow_forward12. The national debt in the current year is equal to the national debt at the beginning of the year minus the annual budget deficit. a. b. equal to the national debt at the end of the year plus the annual budget deficit. equal to the national debt at the beginning of the year plus the annual budget deficit. C. d. none of the above. H. Iarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education