ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

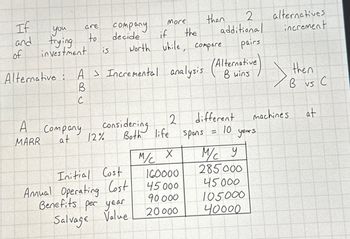

Transcribed Image Text:If

More

than

2

alternatives

you

are

Company

and

to

decide

of

is

trying

investment

A > Incremental analysis (Alternativ

Alternative: A > Incremental analysis

B

C

if

the

additional

increment

Worth while, compare.

pairs

wins

then

B vs C

A

Company

Considering

2

different

machines

at

MARR

at

12%

Both life

spans

=

10

years

M/C X

M/CY

Initial Cost

160000

285000

Annual Operating Cost

45000

45000

Benefits per year

Salvage Value

90000

105000

20000

40000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Give correct explanation and answerarrow_forwardProblem 1 is the first picture and answer Asap the problem in the 2nd picture pleasearrow_forwardThe city council of Morristown is considering the purchase of one new fire truck. The options are Truck X and Truck Y. The purchase is to be financed by money borowed at 10% per year. Which fire truck should be purchased? The appropriate financial data are as follows: Truck X Truck Y Capital Investment $53000 S69000 Maintenance cost per year $5000 $5500 Useful life 5 years 5 years Reduction in fire damage per $19000 $20000 year Your answer: O Truck X O Neither Truck X nor Truck Y O Truck Yarrow_forward

- Nonearrow_forwardYou have two machines under consideration for an improved automated wrapping process for Snickers Fun Size candy bars as detailed below. Compare them on the basis of annual worths at i= 14.00%. Machine First Cost Annual Cost per Year Salvage Value Life с $-30000 $-12000 $12000 D $-55000 $-17000 $18000 3 years 6 yearsarrow_forwardCompare the alternatives C and D on the basis of a present worth analysis using an interest rate of 14% per year and a study period of 10 years. Alternative First Cost AOC, per Year Annual Increase in Operating Cost, per Year Salvage Value Life, Years с $-48,000 $-9,000 $-1,400 $8,000 10 The present worth of alternative C is $ -117974.14 Alternative D offers the lower present worth. D $-34,000 $-9,000 $-1,500 $1,400 5 and that of alternative D is $ -73129.34 xarrow_forward

- M2arrow_forwardQUESTION 3 For the below ME alternatives, which machine should be selected based on the AW analysis. MARR=10% Machine A Machine B Machine C First cost, $ 15,828 30000 10000 Annual cost, $/year Salvage value, s Life, years 8,753 6,000 4,000 4,000 5,000 1,000 Answer the below questions: A- AW for machine A= QUESTION 4 For the below ME alternatives, which machine should be selected based on the AW analysis. MARR=10% Machine A Machine B Machine C First cost, $ 15000 21,344 10000 Annual cost, $/year 8,314 6,000 4,000 Salvage value, $ Life, years 4,000 5,000 1,000 Answer the below questions: B- AW for machine B=arrow_forwardWhat Term goes with what Conceptarrow_forward

- There are 5 national projects with infinite life time listed below. Select the best two projects if MARR is 8% per year using rate of return analysis? Project First Cost A 2000 B 1000 C 1500 D 7000 E 5000 ORDER: Annual income 200 130 150 600 260 Calculate i* for each alternativearrow_forwardhelp please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forwardFor the project with cash flow given below find the most sensitive factor among annual benefit, annual cost and salvage value if the changes by ±20%. Initial investment Annual revenue Annual Cost Salvage Value MARR Life in years Project Rs.2,00,000 Rs.1,00,000 Rs. 40,000 Rs. 50,000 10% 5arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education