Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

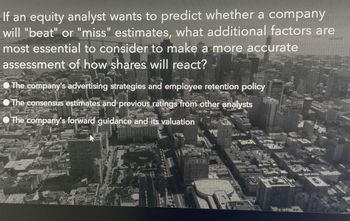

Transcribed Image Text:If an equity analyst wants to predict whether a company

will "beat" or "miss" estimates, what additional factors are

most essential to consider to make a more accurate

assessment of how shares will react?

The company's advertising strategies and employee retention policy

The consensus estimates and previous ratings from other analysts

The company's forward guidance and its valuation

C

2

FREAK

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Statement 1: Fundamental analysis believe that the historical performance of the stocks and markets areindications of future performanceStatement 2: Fundamental analysis works best in determining market sentiment and factor in the creation ofinvestment or trading decisionsStatement 3: Fundamental analysis will succeed if the analyst finds overlooked data in identifying undervaluedsecuritiesStatement 4: Fundamental analysis works best if all investors are logical and could separate emotions frominvestment decision.Statement 5: Fundamental analysis use charts and patterns that can suggest future activity and to measure asecurity’s intrinsic value.a. Only statements 1 and 3 are correct b. Only statements 2 and 4 are correct c. Only statements 1 and 2 are correct d. Only statements 3 and 4 are correctarrow_forwardFor publicly traded firms, which of these ratios measure what investors think of the company's future performance and risk? Multiple Choice liquidity ratios market value ratios price value ratios profitability ratiosarrow_forwardHow do companies evaluate their performance using financial ratios, and what are the key ratios used to assess liquidity, profitability, and solvency?arrow_forward

- Consider the role of financial statement analysis in an efficient capital market, and review empirical evidence on the association between changes in earnings and changes in stock pricesarrow_forwardWhen assessing a company’s Credit Risk, analysts use financial ratios to determine liquidity and solvency IS IT TRUE?arrow_forwarddiscuss the critical issues invlove in implementing the dividend growth model approach and the security market line approach in computing the cost of equity of a firmarrow_forward

- Which financial ratios will you study and why before investing in a company's debentures? * Confirm upvote/helpful answer.arrow_forwardHow do you calculate investment growth based off the stock price record for a company?arrow_forwardThe following comment appeared in the financial press: “Inadequate financial disclosure, particularly with respect to how management views the future and its role in the marketplace, has always been a stone in the shoe. After all, if you don't know how a company views the future, how can you judge the worth of its corporate strategy?” What are some arguments for reporting earnings forecasts?arrow_forward

- How would one assess below parameters using financial statements: a) Market assessment of the firm and its market capitalizations. B) the firm as a “going concern” and sustainability.arrow_forwardTo what extent would market timing be an effective strategy for a financial manager regarding high-income investors? Retirees? Please explain and ensure to add references and citations.arrow_forwardWhy do technical analysts look at the moving average of a company’s stock price, and why do they look at trend lines? (Did you know that technical analysis is used for bond investing too?)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education