FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

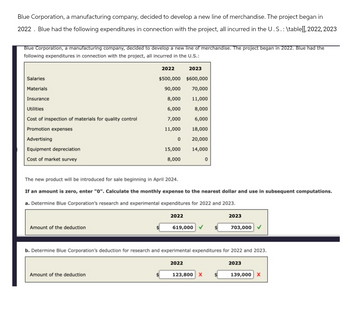

Transcribed Image Text:Blue Corporation, a manufacturing company, decided to develop a new line of merchandise. The project began in

2022. Blue had the following expenditures in connection with the project, all incurred in the U.S.: \table[[, 2022, 2023

Blue Corporation, a manufacturing company, decided to develop a new line of merchandise. The project began in 2022. Blue had the

following expenditures in connection with the project, all incurred in the U.S.:

2022

2023

Salaries

$500,000 $600,000

Materials

90,000 70,000

Insurance

8,000

11,000

Utilities

6,000

8,000

Cost of inspection of materials for quality control

7,000

6,000

Promotion expenses

11,000

18,000

Advertising

0

20,000

Equipment depreciation

15,000

14,000

Cost of market survey

8,000

0

The new product will be introduced for sale beginning in April 2024.

If an amount is zero, enter "0". Calculate the monthly expense to the nearest dollar and use in subsequent computations.

a. Determine Blue Corporation's research and experimental expenditures for 2022 and 2023.

Amount of the deduction

2022

619,000

2023

703,000✓

b. Determine Blue Corporation's deduction for research and experimental expenditures for 2022 and 2023.

Amount of the deduction

2022

2023

123,800 X

139,000 X

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A-5arrow_forward3. Early in 2025, Dobbs Corporation engaged Kiner, Inc. to design and construct a complete modernization of Dobbs's manufacturing facility. Construction began on June 1, 2025 and was completed on December 31, 2025. Dobbs made the following payments to Kiner, Inc. during 2025: Date June 1, 2025 August 31, 2025 December 31, 2025 Payment $2,000,000 3,000,000 2,500,000 To help finance the construction, Dobbs issued the following during 2025: 1. $1,700,000 of 10-year, 9% bonds payable, issued at par on May 31, 2025, with interest payable annually on May 31. 2. 300,000 shares of no-par common stock, issued at $10 per share on October 1, 2025. In addition to the 9% bonds payable, the only debt outstanding during 2025 was a $425,000, 12% note payable dated January 1, 2024 and due January 1, 2025, with interest payable annually on January 1. Instructions Compute the amounts of each of the following (show computations): 1. Weighted-average accumulated expenditures qualifying for capitalization…arrow_forwardA machine that produces cellphone components is purchased on January 1, 2024, for $112,000. It is expected to have a useful life of four years and a residual value of $10,000. The machine is expected to produce a total of 200,000 components during its life. distributed as follows: 40,000 in 2024, 50,000 in 2025, 60,000 in 2026, and 50,000 in 2027. The company has a December 31 year end. (a) Calculate the amount of depreciation to be charged each year, using each of the following methods: i. Straight-line method Straight-line method depreciation $ per year ii. Units-of-production method (Round depreciation per unit to 3 decimal places, e.g. 15.257 and depreciation expense to 0 decimal places, e.g. 125.) Units-of-production method depreciation S per unitarrow_forward

- JRE2 Incorporated entered into a contract to install a pipeline for a fixed price of $2,365,000. JRE2 recognizes revenue upon contract completion. Estimated Cost to Complete. $ 1,660,000 621,000 0 Cost incurred. 2023 2024 2025 $ 272,000 1,710,000 560,000 In 2025, JRE2 would report gross profit (loss) of: . Multiple Choice $(177,000) $84,000, $61,000 $20.222arrow_forwardThrasher Construction Co. was contracted to construct a building for $1,045,000. The building is owned by the customer throughout the contract period. The contract provides for progress payments. Thrasher's accounting year ends 31 December. Work began under the contract on 1 July 20X5, and was completed on 30 September 20X7. Construction activities are summarized below by year: 20X5 Construction costs incurred during the year, $192,600; estimated costs to complete, $674,100; progress billings during the year, $163,500; and collections, $149,800. 20x6 Construction costs incurred during the year, $481,500; estimated costs to complete, $203,300; progress billing during the year, $409,100; and collections, $406,600. 20X7 Construction costs incurred during the year, $209,000. Because the contract was completed, the remaining balance was billed and later collected in full per the contract. Required: 1. Prepare Thrasher's journal entries to record these events. Assume that percentage of…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education