FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Compute the total carrying amount of Metlock's patents on its December 31, 2025 balance sheet . (2024 carrying amount is $56,994.)

Please don't give image format

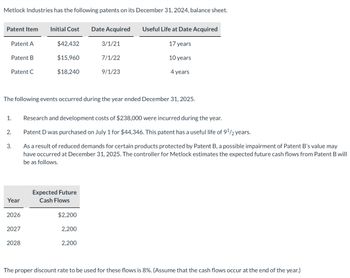

Transcribed Image Text:Metlock Industries has the following patents on its December 31, 2024, balance sheet.

Patent Item

Patent A

Patent B

Patent C

2.

3.

Year

2026

Initial Cost Date Acquired

The following events occurred during the year ended December 31, 2025.

2027

$42,432

$15,960

$18,240

1. Research and development costs of $238,000 were incurred during the year.

Patent D was purchased on July 1 for $44,346. This patent has a useful life of 9¹/2 years.

As a result of reduced demands for certain products protected by Patent B, a possible impairment of Patent B's value may

have occurred at December 31, 2025. The controller for Metlock estimates the expected future cash flows from Patent B will

be as follows.

2028

Expected Future

Cash Flows

$2,200

3/1/21

2,200

7/1/22

2,200

9/1/23

Useful Life at Date Acquired

17 years

10 years

4 years

The proper discount rate to be used for these flows is 8%. (Assume that the cash flows occur at the end of the year.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- a) Compute the total carrying amount of Metlock's patents on its december 31, 2024 balance sheet. b) Compute the total carrying amount of Metlock's patents on its December 31, 2025 balance sheet Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardMeyer & Smith is a full-service technology company. They provide equipment, installation services as well as training. Customers can purchase any product or service separately or as a bundled package. Sunland Corporation purchased computer equipment, installation and training for a total cost of $ 135405 on March 15, 2021. Estimated standalone fair values of the equipment, installation and training are $ 88500, $ 44400 and $ 26400 respectively. The journal entry to record the transaction on March 15, 2021 will include a O credit to Sales Revenue for $ 135405. O credit to Unearned Service Revenue of $ 22440. O debit to Unearned Service Revenue of $ 26400. O credit to Service Revenue of $ 44400.arrow_forwardSwifty Company incurred $551000 of research and development cost in its laboratory to develop a patent granted on January 1, 2027. On July 31, 2027, Swifty paid $83600 for legal fees in a successful defense of the patent. The total amount debited to Patents through July 31, 2027, isarrow_forward

- Ivanhoe Construction Company uses the percentage-of-completion method of accounting. In 2025, Ivanhoe began work under contract #E2-D2, which provided for a contract price of $2,237,000. Other details follow: Costs incurred during the year Estimated costs to complete, as of December 31 Billings during the year Collections during the year (a) Your answer is correct. Revenue recognized in 2025 Revenue recognized in 2026 LA What portion of the total contract price would be recognized as revenue in 2025? In 2026? (Do not round intermediate calculations.) $ 2025 $616,740 1,006,260 414,000 1,717,000 352,000 2026 $1,441,000 850060 1386940 -0- 1,508,000arrow_forwardNeed help with #2.arrow_forwardAlpesharrow_forward

- E12.1B (L0 1,2) (Classification Issues—Intangibles) Presented below is a list of items that could be included in the intan- gibleassets section of the balance sheet. 1. Cost of purchasing a patent from an inventor. 2. Unrecovered costs of a successful legal suit to protect the patent. 3. Cost of purchasing a copyright. 4. Long-term receivables. 5. Cost of purchasing a trademark. 6. Cost of developing a trademark. 7. Research and development costs. 8. Cost of conceptual formulation of possible product alternatives. 9. Legal costs incurred in securing a patent. 10. Cost of developing a patent. 11. Timberland. 12. Lease prepayment (6 months’ rent paid in advance). 13. Cost of searching for applications of new research findings. 14. Operating losses incurred in the start-up of a business. 15. Purchase cost of a franchise. 16. Goodwill generated internally. 17. Goodwill acquired in the purchase of a business. 18. Cost of testing in search for product alternatives. 19. Training costs…arrow_forwardDuring the 2021/2022 financial year, the company had following events. On 1 April 2022, ABC Industry purchased additional 30,000 allowances on the market as the initially granted emission allowances seemed insufficient to settle their obligations (emission liabilities). On this date, the fair value of an allowance was $60. 1) How to recognise the Purchased emission allowances? As an intangible asset, inventory, debtor? Your team need to explain why the emission allowances should be recognised as such.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education