FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

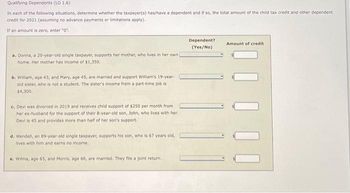

Transcribed Image Text:Qualifying Dependents (LO 1.6)

In each of the following situations, determine whether the taxpayer(s) has/have a dependent and if so, the total amount of the child tax credit and other dependent

credit for 2021 (assuming no advance payments or limitations apply).

If an amount is zero, enter "0"

a. Donna, a 20-year-old single taxpayer, supports her mother, who lives in her own

home. Her mother has income of $1,350.

b. William, age 43, and Mary, age 45, are married and support William's 19-year-

old sister, who is not a student. The sister's income from a part-time job is

$4,300,

c. Devi was divorced in 2019 and receives child support of $250 per month from

her ex-husband for the support of their 8-year-old son, John, who lives with her.

Devi is 45 and provides more than half of her son's support.

d. Wendell, an 89-year-old single taxpayer, supports his son, who is 67 years old,

lives with him and earns no income.

e. Wilma, age 65, and Morris, age 66, are married. They file a joint return.

Dependent?

(Yes/No)

Amount of credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 6 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Charlotte (age 40) is a surviving spouse and provides all of the support of her four minor children who live with her (all are under age 16). She also maintains the household in which her parents live and furnished 60% of their support. Besides interest on City of Miami bonds in the amount of $5,500, Charlotte's father received $2,400 from a part-time job. Charlotte has a salary of $80,000, a short-term capital loss of $2,000, a cash prize of $4,000 from a church raffle, and itemized deductions of $10,500. FILING STATUS 2019 2020 Single 12,200 12,400 Married, Filing Jointly 24,400 24,800 Surviving spoise 24,400 24,800 Head of Household 18,350 18,650 Married, Filing Seperate 12,200 12.400 A. a. Compute Charlotte's taxable income. B b. Using the Tax Rate Schedules (See attached), tax liability (before any allowable credits) for Charlotte is $ *Blank* for 2020. C. c. Compute Charlotte's child and dependent tax credit.Charlotte's child tax credit is $ ________, of which $…arrow_forwardSusan, a single taxpayer, owns and operates a bakery (as a sole proprietorship). The business is not a specified services business. In 2021, the business pays $60,000 in W-2 wages, has $150,000 of qualified property, and $200,000 in net income (all of which is qualified business income). Susan also has a part-time job earning wages of $13,600, receives $3,400 of interest income, and will take the standard deduction. What is Susan’s qualified business income deduction?arrow_forwardKen is a self-employed architect in a small firm with four employees: himself, his office assistant, and two drafters, all of whom have worked for Ken full-time for the last four years. The office assistant earns $33,600 per year and each drafter earns $43,600. Ken's net earnings from self-employment (after deducting all expenses and one-half of self-employment taxes) are $353,600. Ken is considering whether to establish a SEP plan and has a few questions. Assume that all the employees are at least 21 years old d. If the employees are not covered, what is the maximum amount Ken can contribute for himself? A.Lesser of $61,000 or 25% of employee earnings b.Greater of $61,000 or 25% of employee earnings C.Only 25% of employee earnings d.Only $61,000 e. If Ken is required to contribute for his employees and chooses to contribute the maximum amount, what is the maximum amount Ken can contribute for himself? (Hint: Calculate the employee amounts first.) Ignore any changes in Ken's…arrow_forward

- 4. Ned is single and lives alone. He covers all of the household expenses of his mother Barbara who lives down the street. Barbara has gross income of $4,500. Can Ned file as “head of household?”arrow_forwardPeter Marwick, an accountant and accrual basis taxpayer, performed accounting services in Year One for Ellie Vader. Peter gave Ellie a bill for $30,000 in Year One. Ellie paid Peter $5,000 in Year One, but Ellie disputes that she owes the other $25,000 because she thinks his work is shoddy. Ellie agreed to put $25,000 in escrow until she and Peter could resolve their legal dispute over Peter's fees. In Year Three after litigation, the dispute is resolved in Peter's favor and he gets the money out of escrow. How much income does Peter have and when? Question 9 options: Peter has $30,000 income in Year 1 because he is on the accrual method. Peter has no income in Year 1 because there is a contested liability. Ellie has $25,000 in cancellation of indebtedness income in Year 1. Peter has $5,000 income in Year 1 and $25,000 in Year 3 under the Claim of Right Doctrine.arrow_forwardNed is a head of household with a dependent son, Todd, who is a full-time student. This year Ned made the following expenditures related to Todd's support: Auto insurance premiums $ 1,700 Room and board at Todd’s school 2,200 Health insurance premiums (not through an exchange) 600 Travel (to and from school) 350 What amount can Ned include in his itemized deductions?arrow_forward

- Aa.43. Adrienne is a single mother with a six-year-old daughter who lived with her during the entire year. Adrienne paid $2,050 in child care expenses so that she would be able to work. Of this amount, $540 was paid to Adrienne’s mother, whom Adrienne cannot claim as a dependent. Adrienne had net earnings of $1,100 from her jewelry business. In addition, she received child support payments of $20,100 from her ex-husband. Use Child and Dependent Care Credit AGI schedule. Required: What amount, if any, of child and dependent care credit can Adrienne claim?arrow_forwardEkiya, who is single, has been offered a position as a city landscape consultant. The position pays $150,200 in wages. Assume Ekiya has no dependents. Ekiya deducts the standard deduction instead of itemized deductions, and she is not eligible for the qualified business income deduction. What is the amount of Ekiya's after-tax compensation (ignore payroll taxes)? Solve for sub-questions 2, 4, and 6.arrow_forward17. Which of the following expenses, if any, is/are deductible? a.Contribution to an IRA. b.Job-hunting expenses of a fishing guide to become an insurance salesman. c.Costs involved in maintaining an office in the home by a self-employed insurance adjuster. Taxpayer's wife also uses the office as a meeting place for her bridge club. d.Cost of moving to first job location. Taxpayer just graduated from college.arrow_forward

- Adrienne is a single mother with a 6-year-old daughter who lived with her during the entire year. Adrienne paid $2,500 in child care expenses so that she would be able to work. Of this amount, $500 was paid to Adrienne’s mother, whom Adrienne cannot claim as a dependent. Adrienne had net earnings of $2,000 from her jewelry business. In addition, she received child support payments of $21,100 from her ex-husband. Use Child and Dependent Care Credit AGI schedule. Required: What amount, if any, of child and dependent care credit can Adrienne claim?arrow_forwardBonnie is 49 and single. She receives salary income of $35,000, unemployment compensation of $5,400, dividend income of $1,000 and a gift of $7,000 in cash from her aunt. How much is Bonnie's taxable income (Form 1040, Line 15)? Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardsavitaarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education