ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

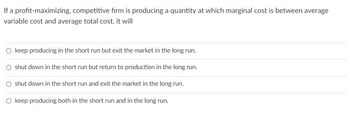

Transcribed Image Text:If a profit-maximizing, competitive firm is producing a quantity at which marginal cost is between average

variable cost and average total cost, it will

O keep producing in the short run but exit the market in the long run.

O shut down in the short run but return to production in the long run.

O shut down in the short run and exit the market in the long run.

O keep producing both in the short run and in the long run.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- With perfect competition, productive efficiency is generally attained in * the short run but not the long run. the long run but not the short run. O both the short run and the long run. O neither the short run nor the long run. O specific firms only.arrow_forwardThe company XYZ produces chairs and its costs are given in the table below. Variable Quantity Total Costs Variable Costs Fixed Costs Value 30 $3,600 $2,400 $1,200 In the short run, should this company shut down if the price of the chair is $95/unit? a. Yes, because the average total cost is higher than the price. b. Yes, because the average variable cost is higher than the price. O c. No, because the average total cost is higher than the price. d. No, because the average variable cost is lower than the price.arrow_forwardIn the long run, a perfectly competitive firm makes O A) either a positive economic profit or a normal profit. B) zero accounting profit. C) zero economic profit. D) negative economic profit, that is, an economic loss. E) a positive economic profit.arrow_forward

- No chatgpt answer pls i will give 10 upvotesarrow_forwardAssume you look at the graph of a perfectly competitive firm and its average total cost curve is entirely above the horizontal price line. In this case the firm is breaking even. O True O Falsearrow_forwardBrody's firm produces trumpets in a perfectly competitive market. The table below shows Brody's total variable cost. He has a fixed cost of $240, and the price per trumpet is $60.-Calculate the average total cost of producing 6 trumpets. Show your work. -Calculate the marginal cost of producing the 11th trumpet. -What is Brody's profit-maximizing quantity? Use marginal analysis to explain your answer. -At the profit-maximizing quantity you determined in part (c), calculate Brody's profit or loss. Show your work. -Brody also produces saxophones at a loss in a perfectly competitive market. Draw a correctly labeled graph for Brody's firm showing the following at a market price of $200. -Brody's profit-maximizing quantity of saxophones -Brody's loss, completely shaded Quantity Total Variable cost 6 $120 7 $145 8 $165 9 $220 10 $290 11 $390arrow_forward

- In the short run, profits when a competitive firm shuts down are-$8200, and they are -$350 when the firm continues to produce. This firm will minimize losses in the short run by Choose one: A. either shutting down or continuing to produce. O B. continuing to produce. O C. shutting down.arrow_forwardIn a perfectly competitive market there is a donut shop that sells 1,200 donuts daily. Each donut sells for the market price of $0.75 and they sell out every day. Assume that this company has labor costs of $275 and materials costs of $400. a. At what price would this donut shop shutdown in the short run? b. Using only variable costs, what is the donut shop’s daily profit? - Now assume that the owner is thinking of adding a second location downtown. The capital investment required is $4,000. The normal rate of return is 5%. c. If the new shop could operate under the same conditions as the original location is it a good business decision to expand?arrow_forwardWhich of the following is an expression of profit for a perfectly competitive firm? Profit for a perfectly competitive firm can be expressed as ⒸA. Profit=(PxQ)-(TCxQ), where P is price, Q is output, and TC is total cost. OB. Profit=P-MC, where P is price and MC is marginal cost. OC. Profit=PxQ, where is price and Q is output. O D. Profit=P-ATC, where P is price and ATC is average total cost. O E. Profit= (P-ATC) XQ, where P is price, Q is output, and ATC is average total cost.arrow_forward

- Refer to the diagram to the right. In the long run, why will the firm produce Q, units and not Q units, which has a lower its average cost of production? OA. Although its average cost of production is lower when the firm produces Qg units, to be able to sell its output the firm will have to charge a price below average cost, resulting in a loss. B. The firm's goal is to charge a high price and make a small profit rather than a low price and no profit. O C. At Qg. average cost exceeds marginal cost so the firm will actually make a loss. Op. At Qg, marginal revenue t is less than average revenue cost which will result in a loss for the firm. Price and cost per unit ($) MR Q₁ QgQnQj Quantity MC ATCarrow_forwardThe owner of Tie-Dyed T-shirts, a perfectly competitive firm, hires you to give him economic advice. He tells you that the market price for his shirts is $15 and that he is currently producing 200 shirts at an AVC of $10 and an ATC of $20. What would you recommend that he do? O a. Tell him that you cannot make any recommendations until you know what his fixed costs are. O b. Continue producing in the short run, as his loss from production is less than his fixed costs, but exit the industry in the long run if there are no changes in economic conditions. Oc Shut down in the short run, as he is incurring a loss, and leave the industry in the long run, if there are no changes in economic conditions. O d. Continue to produce in the short run, even though he is earning a loss, and expand production in the future hoping to increase market share and total revenue.arrow_forwardIs my answer correct? i think you need information about the AVC to answer this question. I know the firm is productive at a loss, but in order to decide whether or not the firm should shut down, you have to know whether or not price is above or below AVC, right?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education