EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

Accounting problem with correct solution

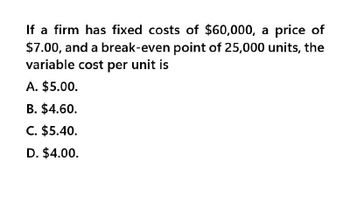

Transcribed Image Text:If a firm has fixed costs of $60,000, a price of

$7.00, and a break-even point of 25,000 units, the

variable cost per unit is

A. $5.00.

B. $4.60.

C. $5.40.

D. $4.00.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- 1. Calculate the contribution margin rate, the sales dollar breakeven point, and the unit sales breakeven point. 2. Use the following information to perform your calculations. a. Net Sales: $50,000.00 b. Contribution Margin: $20,000.00 c. Total Fixed Costs: $15,500.00 d. Unit Sales Price: $25.00 3. Provide the formula and write out the equation that you use for each calculation. a. Contribution Margin Rate: b. Sales Dollar Breakeven Point: C. Unit Sales Breakeven Point:arrow_forwardWhat is the correct choice? How many total dollars of sales must BAC Company sell to break even if the selling price per unit is $8.50, variable costs are $4.00 per unit, and fixed costs are $9,000? a. $4,000 b. $8,500 c. $9,000 d. $17,000arrow_forwardWhat is the break-even price? Assume: Fixed Costs = $30,000, Break Even Units = 12,000, Variable costs/unit = $2.50arrow_forward

- 8. Assume that Current Sales are $100,000; and Break even in sales dollars is $75,000. What is the Margin of Safety ratio? a. 25% b. 50% c. 75% d. 100% 9. Assume Fixed costs are $10,000; Selling price is $30 and variable costs are $10. What is the break even in units? Give answer to the nearest unit. Group of answer choices a. 500 units b. 1,000 units c. 250 units d 334 units 10. If Direct Labor is 1 hour per unit at a rate of $25 per hour, what would be the budgeted amount for Direct Labor costs for the year if we expect to use 500 hours in the first six months and 600 hours in the second six months? a. $55,000 b. $27,500 c. $2,200 f $25,000 11. If Variable MOH is $2 per direct labor hour and the fixed MOH (all cash) is $2,500 per month, what is the amount of MOH budgeted for the month if 1,000 Direct Labor hours are budgeted? a. $2,500 b. $2,000 c. $4,500 d. $5,000 12. Assume Fixed costs are $10,000; Selling price is $30 and…arrow_forward1. Consider the following: Variable cost as a percentage of sales = 60% Unit variable cost = $30 Fixed costs = $200,000 What is the break-even point in units? If required, rarrow_forwardAssume the following cost information for Standard Corporation: Selling price per unit Variable costs per unit $45.00 $25.00 $100,000.00 Total fixed costs If Standard's fixed costs increased by 10% and management wanted to maintain the original breakeven point, then the selling price per unit would have to be increased to: O a. $49.50 O b. $47.00 Ос. O c. $65.00 O d. $48.50arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT