FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

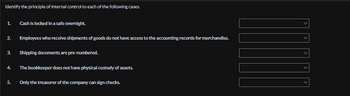

Transcribed Image Text:Identify the principle of internal control to each of the following cases.

1.

Cash is locked in a safe overnight.

2.

Employees who receive shipments of goods do not have access to the accounting records for merchandise.

3.

Shipping documents are pre-numbered.

4.

The bookkeeper does not have physical custody of assets.

5.

Only the treasurer of the company can sign checks.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 1 steps

Knowledge Booster

Similar questions

- 3 Nolan Company has the following internal control procedures over cash receipts. Identify the internal control principle that is applicable to each procedure. (a) All over-the-counter receipts are entered in cash registers. (b) The duties of receiving cash, recording cash, and having custody of cash are assigned to different individuals. (c) Daily cash counts are made by cashier department supervisors. (d) All cashiers are bonded. (e) Only cashiers may operate cash registers.arrow_forwardDetermine whether each procedure described below is an internal control strength or weakness; then identify the internal control violated or followed for each procedure. 1. The owner does not use ID scanners to limit access to expensive merchandise. Instead, the owner argues they hire honest employees. 2. Several salesclerks share the same cash drawer. 3. The company devotes resources towards keeping accurate accounting records for machinery. 4. The company does not allow employees with access to cash to modify accounting records. 5. Employees that handle easily transferable assets such as cash are bonded. Weakness or Strength 1. Weakness 2. Weakness 3. Strength 4. Strength 5. Strength Internal Control Principlearrow_forwardWant answerarrow_forward

- Indicate whether the following statements are true or false. A guideline for safeguarding cash is to separate the duties of those who have custody of cash from this who keep cash records. Choose... + A guideline for safeguarding cash is that all cash receipts be deposited monthly or yearly. Choose... Separation of duties eliminates the possibility of collusion to steal an asset and hide the theft from the records. Choose... + A voucher system of control is a control system exclusively for cash receipts Choose...arrow_forwardProvide an example of an internal control and how it can prevent breakdown or fraud. In a company, what internal controls do one encounter on a regular basis? Are those controls appreciated or viewed as a nuisance that must be worked around? Explain. What are the major components of an internal control system? Are these components always necessary? On March 1, the actual cash received from cash sales was $53,649 and the amount indicated by the cash register total was $53,542. Journalize the entry to record the cash receipts and cash sales.arrow_forwardWhole Fruits Market took the following actions to improve internal controls. For each of the following actions, identify the internal control principle the company followed. a. Prohibit the recordkeeper from having control over cash. b. Purchased an insurance (bonding) policy against losses from theft by a cashier. c. Each cashier is designated a specific cash drawer and is solely responsible for cash in that drawer. d. Detailed records of inventory are kept to ensure items lost or stolen do not go unnoticed. e. Digital time clocks are used to register which employees are at work at what times. f. External auditors are regularly hired to evaluate internal controls.arrow_forward

- Rolling Hills Ltd. has the following internal controls over cash payments. Identify the control activity that is applicable to each procedure. 1. 2. 3. 4. 5. 6. Company cheques are prenumbered. The bank statement is reconciled monthly by the assistant controller. Blank cheques are stored in a safe in the controller's office. Both the controller and the assistant controller are required to sign cheques or authorize electronic payments. Cheque signers are not allowed to record cash payments. All payments are made by cheque or electronic transfer. Assignment of responsibility Review and reconciliation Segregation of duties Physical controls Documentationarrow_forwardThe following are deficiencies in internal controls over cash. a. When the cashier isn't available, Amy prepares both the deposit and opens the mail. b. The mail clerk may not prepare remittance advice for the A/R department if a customer does not submit a one with payment. c. Sometimes, the treasurer's department does not stop the supporting documents for cash disbursements. d. John handles both the customer correspondence concerning monthly statements and making the bank deposits. e. Mike handles incoming mail and also prepares bank reconciliations; however, the bank reconciliations are not done in a timely manner. For each deficiency: Determine what applicable audit procedure(s) should be conducted to identify whether any material misstatements exist Explain why you think this procedure is best for this situation. Consider each deficiency independently of the others. While each deficiency presents potential issues, identify two that stand out as the worse with your professional…arrow_forwardWhich internal control activity is being violated when the cashier in a retail store also records the daily receipts in a journal? adequate documents and records safeguards over assets and records independent checks on recorded amounts segregation of dutiesarrow_forward

- Which of the following reflects a weak internal control system? Please explain with full explanation. a. All employees are well supervised. b. A single employee is responsible for comparing a receiving report to an invoice. c. All employees must take their vacations. d. A single employee is responsible for collecting and recording cash.arrow_forwardWhich of the following is not a reason why paying by check is an important internal control? A. The check must be signed by an authorized official. B. The check provides a record of the payment. ○ C. Before signing the check, the purchasing agent reviews the invoice or other evidence supporting the payment. OD. All of the above statements are correct.arrow_forwardAn accounting manager, who has full access to a Company’s accounting system also has access to the bank account and is able to send cash payments without supervision. What is an internal control that should be implemented to reduce the risk of theft or fraud in this company?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education