Cornerstones of Financial Accounting

4th Edition

ISBN: 9781337690881

Author: Jay Rich, Jeff Jones

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

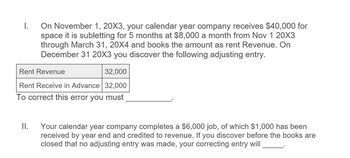

Transcribed Image Text:I.

On November 1, 20X3, your calendar year company receives $40,000 for

space it is subletting for 5 months at $8,000 a month from Nov 1 20X3

through March 31, 20X4 and books the amount as rent Revenue. On

December 31 20X3 you discover the following adjusting entry.

Rent Revenue

32,000

Rent Receive in Advance 32,000

To correct this error you must

II.

Your calendar year company completes a $6,000 job, of which $1,000 has been

received by year end and credited to revenue. If you discover before the books are

closed that no adjusting entry was made, your correcting entry will

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- On November 19, Nicholson Company receives a $24,000, 60-day, 6% note from a customer as payment on account. What adjusting entry should be made on the December 31 year-end? (Use 360 days a year.) Multiple Choice Debit Interest Revenue $240; credit Interest Receivable $240. Debit Notes Receivable $168; credit Interest Receivable $168. Debit Notes Receivable $72; credit Interest Revenue $72. Debit Interest Receivable $168; credit Interest Revenue $168. Debit Interest Receivable $240; credit Interest Revenue $240.arrow_forwardHurd Inc. prepays rent every 3 months on March 1, June 1, September 1, and December 1. Rent for the 3 months totals S3,600. On December 31, 2019, Hurd will report Prepaid Rent of: a. $0 b. $1,200 c. $2,400 d. $3,600arrow_forwardScrimiger Paints wants to upgrade its machinery and on September 20 takes out a loan from the bank in the amount of $500,000. The terms of the loan are 2.9% annual interest rate and payable in 8 months. Interest is due in equal payments each month. Compute the interest expense due each month. Show the journal entry to recognize the interest payment on October 20, and the entry for payment of the short-term note and final interest payment on May 20. Round to the nearest cent if required.arrow_forward

- SALES RETURNS AND ALLOWANCES ADJUSTMENT At the end of year 1, JCs estimates that 2,000 of the current years sales will be returned in year 2. Prepare the adjusting entry at the end of year 1 to record the estimated sales returns and allowances and customer refunds payable for this 2,000. Use accounts as illustrated in the chapter.arrow_forwardOn November 19, Nicholson Company receives a $21,600, 60-day, 5% note from a customer as payment on account. What adjusting entry should be made on the December 31 year-end? (Use 360 days a year.) Multiple Choice Debit Notes Receivable $54; credit Interest Revenue $54. Debit Notes Receivable $126; credit Interest Receivable $126. Debit Interest Receivable $126; credit Interest Revenue $126. Debit Interest Receivable $180; credit Interest Revenue $180. Debit Interest Revenue $180; credit Interest Receivable $180.arrow_forward8) Rent Income account has a credit balance of 240,000 composed of the following: Rental for three months ending March 31, 2020, 45000 A credit of 195,000 representing advance rental payment for one year beginning April 1 The December 31 adjusting entry will require a debit to rent income and a credit to Unearned Rent of? A 45000 B 191250 C 48750 D 195000arrow_forward

- 10.4 Jelly Co has sublet part of its offices and in the year ended 30 November 20X3 the rent receivable was: Until 30 June 20X3 $8,400 per year $12,000 per year From 1 July 20X3 Rent was paid quarterly in advance on 1 January, April, July, and October each year. What amounts should appear in Jelly Co's financial statements for the vear ended 30 November 20X3? Rent receivable Statement of financial position $2,000 in sundry payables $1,000 in sundry payables $1,000 in sundry payables $2,000 in sundry receivables A $9,900 $9,900 B $10,200 $9,900 Carrow_forwardOn September 1, Kennedy Company loaned $126,000, at 11% annual interest, to a customer. Interest and principal will be collected when the loan matures one year from the issue date. Assuming adjustments are only made at year-end, what is the adjusting entry for accruing interest that Kennedy would need to make on December 31, the calendar year-end? Multiple Choice Debit Cash, $4,620; credit Interest Revenue, $4,620. Debit Interest Expense, $4,620; credit Interest Payable, $4,620 Debit Interest Receivable, 4,620; credit Interest Revenue, $4620. Debit Interest Expense, $13,860; credit Interest Payable, $13,860 Debit Interest Receivable, $13,860; credit Cash, $13,860 Graw 7:26 PM W 100% 3 Type here to search 2/21/2022arrow_forwardMutiple choice: A hospitality company is the maker of an $18,000 note to be paid in quarterlyinstallments of $3,000 each. The first payment is to be made on June 30. How willthe note be represented on the balance sheet for May 31? A. $18,000 long-term liabilityB. $3,000 expense, $15,000 long-term liabilityC. $3,000 expense, $9,000 current liability, $6,000 long-term liabilityD. $12,000 current liability, $6,000 long-term liabilityarrow_forward

- 10.4 Jelly Co has sublet part of its offices and in the year ended 30 November 20X3 the rent receivable was. Until 30 June 20X3 From 1 July 2OX3 $8,400 per year $12,000 per year Rent was paid quarterly in advance on 1 January, April, July, and October each year. What amounts should appear in Jelly Co's financial statements for the year ended 30 November 20X3 Rent receivable Statement of financial position A $9,900 $9,900 $10,200 $9,900 $2,000 in sundry payables $1,000 in sundry payables $1,000 in sundry payables $2,000 in sundry receivables C Darrow_forwardOn December 1, Daw Company accepts a $46,000, 45-day, 9% note from a customer. (1) Prepare the year-end adjusting entry to record accrued interest revenue on December 31. (2) Prepare the entry required on the note's maturity date assuming it is honored. (Use 360 days a year.) View transaction list Journal entry worksheet Record the year-end adjustment related to this note, if any. Note: Enter debits before credits. Date General Journal Debit December 31 Clear entry Record entry Credit View general journalarrow_forward7arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,