FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Please do not give solution in image format thanku

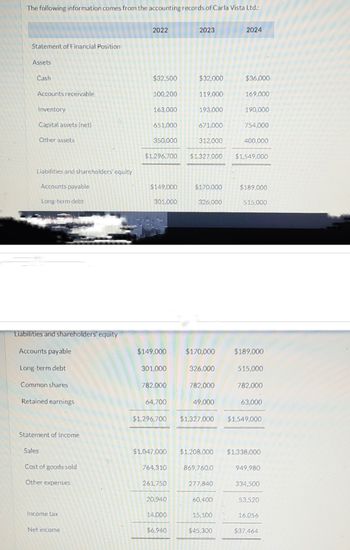

Transcribed Image Text:The following information comes from the accounting records of Carla Vista Ltd.:

Statement of Financial Position

Assets

Cash

Accounts receivable

Inventory

Capital assets (net)

Other assets

Liabilities and shareholders' equity

Accounts payable

Long-term debt

Liabilities and shareholders' equity

Accounts payable

Long-term debt

Common shares

Retained earnings

Statement of Income

Sales

Cost of goods sold

Other expenses

Income tax

Net income

2022

$32,500

100,200

163,000

651,000

350,000

$1.296,700

$149,000

301.000

$149,000

301,000

782,000

64,700

$1,296,700

$1,047,000

764,310

261,750

20,940

14,000

$6,940

2023

$32,000

119,000

193,000

671,000

312,000

$170,000

326,000

$170,000

326,000

782,000

$1,327,000 $1,549,000

49,000

869,760.0

277,840

2024

60,400

$36,000

15,100

169,000

$45,300

190,000

754,000

400,000

$189,000

515,000

$1,327,000 $1,549,000

$189,000

$1,208,000 $1,338,000

515,000

782,000

63,000

949,980

334,500

53,520

16,056

$37,464

Transcribed Image Text:O

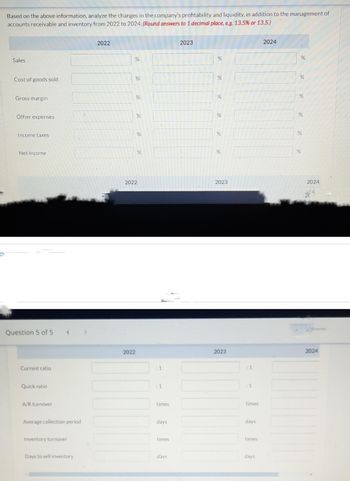

Based on the above information, analyze the changes in the company's profitability and liquidity, in addition to the management of

accounts receivable and inventory from 2022 to 2024. (Round answers to 1 decimal place, e.g. 13.5% or 13.5.)

Sales

Cost of goods sold

Gross margin

Other expenses

Income taxes

Net income

Question 5 of 5

Current ratio

Quick ratio

A/R turnover

<

Average collection period

Inventory turnover

Days to sell inventory

2022

20

%

%

%

2022

%

%

%

2022

:1

times

days

times

days

2023

%

%

%

%

%

%

2023

2023

:1

:1

times

days

times

days

2024

%

%

%

%

%

%

2024

2024

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please don't use chat gpt and other ai other wise I give multiplie downvote Which of the following is sometimes called a currently attainable standard? O a. par b. normal standard O c. theoretical standard d. ideal standardarrow_forwardDoes a user view always require multiple tables to support it? Explain.arrow_forwardHow do you access the Power Query interface?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education