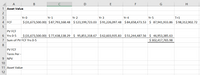

I need to solve for the asset value, but I'm not sure what rate needs to be used in order to solve for

Asset Beta= 1.096303

Discount Rate= 0.13372

Working capital to support sales is estimated to be 15.65% of yearly sales for the first 5 years and then is projected to slow to a 4.59% annual growth rate thereafter. The marginal corporate income tax rate is expected to average 23.67% barring any changes to the corporate tax code and the projected annual growth rate of

Historically, the debt-equity ratio has averaged roughly 116% for which Ljutic A/I Inc.’s current debt level is $39,889,950 with an average maturity of 6 years and an interest rate on this debt averaging 8.175%. Upon a regression analysis, the historical equity Beta was calculated to be 2.067, while the risk-free rate of return is given as 2.876% and the market rate of return is assumed to be 12.45%. Currently there are 3,231,443 shares of common stock outstanding.

Step by stepSolved in 7 steps with 6 images

- Use the information below to answer Question#40: GIVEN: The XYZ Company is considering the following project with its corresponding financial data. The Company requires a 9% return from its investments. $ 500,000 $ 200,000 $ 225,000 $ 245,000 Initial investment: Expected Cash in-flow Year 1: Expected Cash in-flow Year 2: Expected Cash in-flow Year 3: Present Value Factor of 1 at 9%: n=1: 0.91743 n=2: 0.84168 n=3: 0.77218 40) Choose from one of the following that accurately depicts this decision: A) This investment should not be considered because NPV is a negative $62,048 B) This învestment should be considered because NPV equals positive $62,048 C) This investment should be considered because the IRR for this investment is obviously less than its Required Rate of Return D) B and Care both correctarrow_forwardPlease answer the following questions using the information below: NPV. Using a 10% required rate of return, calculate the NPV for this project. Should it be accepted or rejected? PI. Calculate the Profitability Index (PI) for this project. Should it be accepted or rejected? Consider the following cash flows: Year 0 1 2 3 4 5 6 Cash Flow -$8,000 $3,000 $3,600 $2,700 $2,500 $2,100 $1,600 Payback. The company requires all projects to payback within 3 years. Calculate the payback period. Should it be accepted or rejected? Discounted Payback. Calculate the discounted payback using a discount rate of 10%. Should it be accepted or rejected? IRR. Calculate the IRR for this project. The company’s required rate of return is 10%. Should it be accepted or rejected? NPV. Using a 10% required rate of return, calculate the NPV for this project. Should it be accepted or rejected? PI. Calculate the Profitability Index (PI) for this project. Should it be accepted or rejected?…arrow_forwardAn investment that costs $22,500 will produce annual cash flows of $4,500 for a period of 6 years. Further, the investment has an expected salvage value of $2,750. Given a desired rate of return of 9%, what will the investment generate? (PV of $1 and PVA of $1) Note: Use appropriate factor(s) from the tables provided. Do not round your intermediate calculations. Round your answer to the nearest whole dollar.arrow_forward

- Molin Inc. is considering to a project that will have the following series of cash flow from assets (in $ million): Year Cash flow 0 -1,580.92 1 453 2 749 3 935 The required return for the project is 6%. Year Cash flow 0 -1,580.92 1 453 2 749 3 935 1. The required return for the project is 6%. 2. What is the project's profitability index? 3. What is the internal rate of return (IRR) for this project?arrow_forwardNovak Company is contemplating an investment costing $168,810. The investment will have a life of 8 years with no salvage value and will produce annual cash flows of $30,500. Click here to view PV tables. What is the approximate internal rate of return associated with this investment? (Use the above table.) (Round answer to O decimal places, e.g. 15%) Internal rate of return. %6arrow_forwardPlease provide a step-by-step solution with an explanation.arrow_forward

- Heedy Inc. is considering a capital investment proposal that costs $460,000 and has an estimated life of four years, and no residual value. The estimated net cash flows are as follows: Net Cash Flow $195,000 160,000 120,000 80,000 Year 1 2 3 4 The minimum desired rate of return for net present value analysis is 10%. The present value of $1 at compound interest rates of 10% for 1, 2, 3, and 4 years is 0.909, 0.826, 0.751, and 0.683, respectively. Determine the net present value. Enter negative values as negative numbers. 5,825 Xarrow_forwardan investment under consideration has a payback of six years and a cost of 885000. Assume the cash flows are conventional. If the required return is 12% what is the worst case NPV. Please use excel when showing how you got therarrow_forwardProblem 2 please.arrow_forward

- Help pleasearrow_forwardEmerald Enterprises is developing a new product at the cost of $ 50,000. The new product is expected to increase the cash flow for the next five years as follows: $ 10000, $ 15000, $ 15000, $ 20000 and $ 20000. If the discounting rate is 12%, what is the IRR of the project? Note: Use EXCEL function “=IRR(Cash Flow Range)” 18.54% 15.96% 12.43% - 2.48%arrow_forwardYou invest $5000 at time t=0 and an additional $2000 at time t=1/2. At time t=1/2 you have $5300 in your account and at time t=1 you have $7300 in your account. Find the dollar-weighted rate of return rd and the time-weighted rate of return rt on this investment.A. rd= 2.86 %, rt=3.43 %B. rd= 2 %, rt=2.4 %C. rd= 6.26 %, rt=7.5 %D. rd= 2.51 %, rt=3 %E. rd= 5.01 %, rt= 6 % Please answer it only correct without using Excelarrow_forward

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education