Concept explainers

i just needhelp with the second entry the rest are correct

This information relates to Sarasota Real Estate Agency.

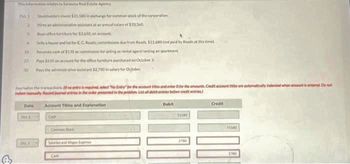

Journalize the transactions. (If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually. Record

Date Oct. 1 Stockholders invest $31,580 in exchange for common stock of the corporation.

Hires an administrative assistant at an annual salary of $33,360.

Buys office furniture for $3,650, on account.

Sells a house and lot for E. C. Roads; commissions due from Roads, $11,680 (not paid by Roads at this time).

Receives cash of $135 as commission for acting as rental agent renting an apartment.

Pays $610 on account for the office furniture purchased on October 3.

Pays the administrative assistant $2,780 in salary for October.

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

- i need the answer quicklyarrow_forwardPlease do not give solution in image format ? And Fast Answering Please ? And Explain Proper Step by Step.arrow_forward6 Metlock, Inc. had the following transactions during the current period. Mar. 2 June 121 July 11 Nov. 28 Journalize the transactions. (Record journal entries in the order presented in the problem. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Account Titles and Explanation Date Mar 2 # Issued 4,200 shares of $5 par value common stock to attorneys in payment of a bill for $25,400 for services performed in helping the company to incorporate Issued 59,200 shares of $5 par value common stock for cash of $373,700. Issued 2,125 shares of $100 par value preferred stock for cash at $130 per share. Purchased 1,930 shares of treasury stock for $79,000 June 12: Debit Credit SUPPORTarrow_forward

- (a) Describe the detail of the transaction being performed in the following screen. (b) Give the journal entry that MYOB made as a result of the transaction in part (a) (Note: account numbers are not required, just use account names.)arrow_forwardNatalie and her friend Curtis Lesperance decide that they can benefit from joining Cookie Creations and Curtis's coffee shop. In this part of the problem, they want your help in preparing financial information following the first year of operations of their new business, Cookie & Coffee Creations. After establishing their company's fiscal year-end to be October 31, Natalie and Curtis begin operating Cookie & Coffee Creations Inc. on November 1, 2020. On that date, after the issuance of shares, the paid-in capital section of the company's balance sheet is as follows. Paid-in capital Preferred stock, $0.50 noncumulative, no par value, 10,000 shares authorized, 2,000 shares issued Common stock, no par value, 100,000 shares authorized, 25,930 shares issued $10,000 25,930 Cookie & Coffee Creations then has the following selected transactions during its first year of operations. Dec. 1 Issues an additional 800 preferred shares to Natalie's brother for $4,000. Apr. 30 June 30 Oct. 31 31 31…arrow_forwardOn December 31, 2023, Carla Vista Corporation, a public company, had the following shareholders' equity accounts: CARLA VISTA CORPORATION Balance Sheet (partial) December 31, 2023 Shareholders' equity Common shares (unlimited number of shares authorized, 95,000 issued) Retained earnings Total shareholders' equity During the year, the following transactions occurred: Jan. 15 Declared a $1 per share cash dividend to shareholders of record on January 31, payable February 15. Announced a 2-for-1 stock split. The market price per share on the date of the announcement was $18. Declared a 15% stock dividend to shareholders of record on December 30, distributable on January 15. On December 15, the market price of each share was $9: on December 30, $10, and on January 15, $9. July Dec. 15 Determined that profit before income tax for the year was $413,000. The company has a 30% income tax rate. 1 $1,145,000 560,000 $1,705,000 31arrow_forward

- Analyze each transaction and match it with the correct journal entry as stated. Be sure to look at each transaction carefully to ensure you make the correct choice. Purchase on account some office equipment Paid for utilities expense Paid the bank back the money previously borrowed on a note Paid the telephone bill received Made a partial payment to a creditor on account Took cash out of the business to pay for a personal bill Record revenues earned, but not collected yet Record internet expenses incurred, but not paid yet Received cash for the return of some equipment that was defective Received Payment from customer on an accounts receivable Made payment to an accounts payable Paid salary for office administrator Dr. Office Equipment; Cr. Acc Dr. Utilities Expense; Cr. Casl Dr. Accounts Payable; Cr. Cas Dr. Telephone Expense; Cr. C✓ Dr. Cash; Cr. Account Receivi Dr. Accounts Payable; Cr. Ca: ✓ Dr. Internet Expense; Cr. Acc Dr. Internet Expense; Cr. Acc Dr. Cash; Cr. Account Receiv:…arrow_forward.arrow_forward.arrow_forward

- Requirements: 1. Journalize each transaction including explanations. 2. The accounts listed in the trial balance, together with their balances as of March 31,2024, have been opened for you in T-account form. Post the journal entries to the ledger (use T-account format). 3. Prepare the trial balance of Harper Service Center as of April 30, 2024. More info Apr. 2 Borrowed $45,000 from the bank and signed a note payable in the name of the business. Apr. 4 Paid cash of $40,000 to acquire land. Apr. 9 Performed services for a customer and received cash of $5,000. Apr. 13 Purchased office supplies on account, $300. Apr. 15 Performed services for a customer on account, $2,600. Apr. 18 Paid $1,200 on account. Apr. 21 Paid the following cash expenses: salaries, $3,000; rent, $1,500; and interest, $400. Apr. 25 Received $3,100 from a customer on account. Apr. 27 Received a $200 utility bill that will be paid next month. Apr. 29 Received $1,500 for services to be…arrow_forwardCan you help me create a trial balance and balance sheet please for the following informationarrow_forwardPlease answer within the format with detailed working, please answer in text form (without image)arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education