Understanding Business

12th Edition

ISBN: 9781259929434

Author: William Nickels

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Question

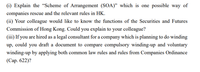

Transcribed Image Text:(i) Explain the “Scheme of Arrangement (SOA)" which is one possible way of

companies rescue and the relevant rules in HK.

(ii) Your colleague would like to know the functions of the Securities and Futures

Commission of Hong Kong. Could you explain to your colleague?

(iii) If you are hired as a legal consultant for a company which is planning to do winding

up, could you draft a document to compare compulsory winding-up and voluntary

winding-up by applying both common law rules and rules from Companies Ordinance

(Сар. 622)?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, management and related others by exploring similar questions and additional content below.Similar questions

- Which of the following correctly identify the requirements for both legal and personal competence for a fiduciary? Must be a U.S. citizen Must meet a minimum age requirement as specified by state law Must be capable of analyzing a situation and making decisions Must be mentally competent as required by state law A) I and II B) II and III C) I, II, III, and IV D) III and IVarrow_forwardJosue is part of a business entity in which the parties are protected against personal liability for business debts. What type of business entity is this? Is it able to be registered as a brokerage? It is an LLC. It may be registered as a brokerage. It is an LLC. It may NOT be registered as a brokerage. It is a corporation. It may be registered as a brokerage. It is a corporation. It may NOT be registered as a brokerage.arrow_forwardI have a new client wanting to purchase a franchise retail operation. What would be 8-10 questions you would ask the client that would help your legal team in structuring the business, forming their entity documents, and advising them on employee operations.arrow_forward

- 24. what is an example of controlled business a. Insurance contracts covering an agent's family members b. Insurance contract covering an agent's friends a neighbor c. noncontributory group insurance plans d. self-insured group insurance plansarrow_forwardSECTION D Read the following extract and then answer the question belowA client is interested in setting up a business and does not know which form of business to use. He has been told that he can form a sole proprietorship, or partnership, or a limited liability company. He comes seeking for business advises on the advantages and disadvantages of a registered company. Make a comparison between a sole proprietorship, partnership, and a limited liability company.arrow_forwardWhat are the steps an accountant might go through in making the decision of whether and how to be a 'whistleblower' regarding a perceived unethical practice of his or her employer, which is a reputable accounting firm.arrow_forward

- Solve this question with steps please. The subject is legal environment of business (BUS 156).arrow_forwardNeed a long and detailed self-explanatory analysis of the following case after hearing the oral argument of the case in Oyez Bank of America Corp. v. City of Miamiarrow_forwardpls help ASAParrow_forward

- 11arrow_forwardA sales associate prepares a BPO but they can't remember if they can charge the client for this service. You inform the sales associate that in Florida: "You can't charge for the BPO, that's illegal." "You can charge for the BPO as long as you only do so under the supervision of your employing broker." "You can't charge for the BPO unless you run it by a certified appraiser." "You can charge for the BPO, but refer to it as an appraisal toarrow_forwardQ1. To prevail in an action brought under common law, the plaintiff must show all of the following except: (in your response, explain the burdens of proof for a third-party plaintiff under common law). Q2. Kerry CPA is the auditor for Sammy Corp. During the audit, Kerry discovers a material misstatement in Sammy's financial statements. Sammy's management tells Kerry that if the misstatement is corrected or if Kerry issues an opinion that indicates there is a material misstatement, Sammy Corp. will likely have to declare bankruptcy and thousands of employees will lose their jobs. Which of the following statements is true if the misstatement is not corrected and Kerry issues an unqualified opinion on Sammy's financial statements? (in your response, identify the court case that makes Kerry liable to any person who suffered a loss as a result of the fraud).arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Understanding BusinessManagementISBN:9781259929434Author:William NickelsPublisher:McGraw-Hill Education

Understanding BusinessManagementISBN:9781259929434Author:William NickelsPublisher:McGraw-Hill Education Management (14th Edition)ManagementISBN:9780134527604Author:Stephen P. Robbins, Mary A. CoulterPublisher:PEARSON

Management (14th Edition)ManagementISBN:9780134527604Author:Stephen P. Robbins, Mary A. CoulterPublisher:PEARSON Spreadsheet Modeling & Decision Analysis: A Pract...ManagementISBN:9781305947412Author:Cliff RagsdalePublisher:Cengage Learning

Spreadsheet Modeling & Decision Analysis: A Pract...ManagementISBN:9781305947412Author:Cliff RagsdalePublisher:Cengage Learning Management Information Systems: Managing The Digi...ManagementISBN:9780135191798Author:Kenneth C. Laudon, Jane P. LaudonPublisher:PEARSON

Management Information Systems: Managing The Digi...ManagementISBN:9780135191798Author:Kenneth C. Laudon, Jane P. LaudonPublisher:PEARSON Business Essentials (12th Edition) (What's New in...ManagementISBN:9780134728391Author:Ronald J. Ebert, Ricky W. GriffinPublisher:PEARSON

Business Essentials (12th Edition) (What's New in...ManagementISBN:9780134728391Author:Ronald J. Ebert, Ricky W. GriffinPublisher:PEARSON Fundamentals of Management (10th Edition)ManagementISBN:9780134237473Author:Stephen P. Robbins, Mary A. Coulter, David A. De CenzoPublisher:PEARSON

Fundamentals of Management (10th Edition)ManagementISBN:9780134237473Author:Stephen P. Robbins, Mary A. Coulter, David A. De CenzoPublisher:PEARSON

Understanding Business

Management

ISBN:9781259929434

Author:William Nickels

Publisher:McGraw-Hill Education

Management (14th Edition)

Management

ISBN:9780134527604

Author:Stephen P. Robbins, Mary A. Coulter

Publisher:PEARSON

Spreadsheet Modeling & Decision Analysis: A Pract...

Management

ISBN:9781305947412

Author:Cliff Ragsdale

Publisher:Cengage Learning

Management Information Systems: Managing The Digi...

Management

ISBN:9780135191798

Author:Kenneth C. Laudon, Jane P. Laudon

Publisher:PEARSON

Business Essentials (12th Edition) (What's New in...

Management

ISBN:9780134728391

Author:Ronald J. Ebert, Ricky W. Griffin

Publisher:PEARSON

Fundamentals of Management (10th Edition)

Management

ISBN:9780134237473

Author:Stephen P. Robbins, Mary A. Coulter, David A. De Cenzo

Publisher:PEARSON