Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Just do part I)

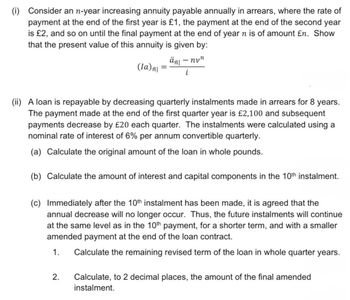

Transcribed Image Text:(i) Consider an n-year increasing annuity payable annually in arrears, where the rate of

payment at the end of the first year is £1, the payment at the end of the second year

is £2, and so on until the final payment at the end of year n is of amount £n. Show

that the present value of this annuity is given by:

ἅπι – ηνη

(la) | =

-

i

(ii) A loan is repayable by decreasing quarterly instalments made in arrears for 8 years.

The payment made at the end of the first quarter year is £2,100 and subsequent

payments decrease by £20 each quarter. The instalments were calculated using a

nominal rate of interest of 6% per annum convertible quarterly.

(a) Calculate the original amount of the loan in whole pounds.

(b) Calculate the amount of interest and capital components in the 10th instalment.

(c) Immediately after the 10th instalment has been made, it is agreed that the

annual decrease will no longer occur. Thus, the future instalments will continue

at the same level as in the 10th payment, for a shorter term, and with a smaller

amended payment at the end of the loan contract.

1.

2.

Calculate the remaining revised term of the loan in whole quarter years.

Calculate, to 2 decimal places, the amount of the final amended

instalment.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- USING FORMULAS, NO TABLESarrow_forwardEach payment of an annuity due is compounded for one compounded for one Select- -Select- v period, so the future value of an annuity due is equal to the future value of an ordinary annuity v period. The equation is: FVAdue=FVAordinary (1 + I) The present value of an ordinary annuity, PVAN, is the value today that would be equivalent to the annuity payments (PMT) received at fixed intervals over the annuity period. The equation is: 1- (1+1)N PVAN= PMT Each payment of an annuity due is discounted for one -Select- period, so the present value of an annuity due is equal to the present value of an ordinary annuity multiplied by (1 + I). The equation is: DVA זדתarrow_forwardCalculate the future value of the following annuities, assuming each annuity payment is made at the end of each compounding period. (FV of $1, PV of $1, FVA of $1, and PVA of $1) (Use appropriate factor(s) from the tables provided. Round your answers to 2 decimal places.) 1. 2. 3. Annuity Annual Payment Rate $4,700 6.0 % 8.0 % 7,700 6,700 10.0 % Show Transcribed Text 1. 2. 3. Annuity Annual Payment Rate Interest Compounded Quarterly Annually Semiannually $ 5,700 Interest Compounded 8.0 % Quarterly 10,700 11.0% Annually 4,700 10.0 % Semiannually Period Invested 5 years 6 years 9 years Calculate the present value of the following annuities, assuming each annuity payment is made at the end of each compounding period. (FV of $1, PV of $1, FVA of $1, and PVA of $1) (Use appropriate factor(s) from the tables provided. Round your answers to 2 decimal places.) $ Period Invested 2 years 5 years 3 years Future Value of Annuity 172,892.28 Present Value of Annuityarrow_forward

- Question 3 (25 points): If the present value of a perpetuity is given by: where C is the periodic payments and r is the discount rate. Show that the present value of an annuity of n years is given by: 1 C - (1 + r)]arrow_forwardThe ___________ of an annuity is the amount that must be invested now at interest rate i per time period to provide n payments each of amount R.arrow_forwardCalculate the future value of the following annuities, assuming each annuity payment is made at the end of each compounding period. (FV of $1, PV of $1, FVA of $1, and PVA of $1) (Use appropriate factor(s) from the tables provided. Round your answers to 2 decimal places.) Annuity Payment Annual Rate Interest Compounded Period Invested Future Value of Annuity 1. $3,100 8.0 % Semiannually 9 years $79,500.77 2. 6,100 10.0 % Quarterly 5 years 3. 5,100 12.0 % Annually 6 yearsarrow_forward

- For each of the following situations involving annuities, solve for the unknown. Assume that interest is compounded annually and that all annuity amounts are received at the end of each period. (i = interest rate, and n = number of years) (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) Present Value Annuity Amount i = n = $3,000 75,000 20,000 80,518 1 2 3 4 5 242,980 161,214 500,000 250,000 8% 9% 10% 5 4 8 4arrow_forwardFor each of the following situations involving annuities, solve for the unknown. Assume that interest is compounded annually and that all annuity amounts are received at the end of each period. (i=interest rate, and n=number of years)(FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of 1$ and PVAD of $1) (Use appropriate factor (s) from the tables provided. Round your final answers to nearest whole dollar amount.) Present Value Annuity Amount i= n= ______________ $ 2,600 8% 5 507,866 135,000 _____ 4 661,241 170,000 9% ____ 540,000 78,557 _____ 8 230,000 _____________ 10% 4arrow_forward15.arrow_forward

- An annuity is payable continuously for n years. The rate of payment is constant through each year and is as follows: 1 unit per annum during the first year; 2 units per annum during the second year; 3 units per annum during the third year; and so on until the final year n. Show that the present value of the annuity is given by: ἅπι (la) n = -ηνη δ Hint: You have to show your full workings from basic principles of valuing a constant payment stream.arrow_forwardThe present value of an ordinary annuity, PAN, is the value today that would be equivalent to the annuity payments (PMT) received at fixed intervals over the annuity period. The equation is: Each payment of an annuity due is discounted for one less (1 + I). The equation is: PVAN= PMT 1- (1+1)N I period, so the present value of an annuity due is equal to the present value of an ordinary annuity multiplied by PVA due PVA ordinary (1+1) One can solve for payments (PMT), periods (N), and interest rates (I) for annuities. The easiest way to solve for these variables is with a financial calculator or a spreadsheet. Quantitative Problem 1: You plan to deposit $1,700 per year for 5 years into a money market account with an annual return of 2%. You plan to make your first deposit one year from today. a. What amount will be in your account at the end of 5 years? Do not round intermediate calculations. Round your answer to the nearest cent. $ b. Assume that your deposits will begin today. What…arrow_forwardPLEASE, WRITE THE SOLUTION ON PAPER, EXPLAINING THE ENTIRE PROCESS, STEP BY STEParrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education