Concept explainers

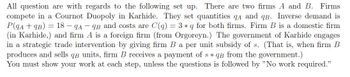

(3) Assume that s = 3.

(a) Find firm B’s profit function under the subsidy. (No work required.)

(b) Find firm B’s best response function.(You may do this directly or by setting s to zero in your

expressions from (1b).

(c) Why don’t I need to ask you to solve for A’s best response?

(d) Solve for the equilibrium outputs (q*A, q*b ).

(e) Solve for the

(f) Solve for firm B profits.

Step by stepSolved in 4 steps

Can you please answer the next few parts to this question?

(c) Why don’t I need to ask you to solve for A’s best response?

(d) Solve for the equilibrium outputs (q*A, q*b ).

(e) Solve for the

(f) Solve for firm B profits.

Please answer the questions properly with handwritten working out

Can you please answer the next few parts to this question?

(c) Why don’t I need to ask you to solve for A’s best response?

(d) Solve for the equilibrium outputs (q*A, q*b ).

(e) Solve for the

(f) Solve for firm B profits.

Please answer the questions properly with handwritten working out

- 2. You are the Southeastern Michigan regional manager at Coca-Cola, responsible forproduction and pricing in the Metro Detroit area. Your primary competitor is Pepsi. The marketresearch team at Coca-Cola is thinking about launching a new product, Orange Vanilla Coke, toboost the brand. The cost function to produce a 12-pack of 12 fl. oz. cans of Orange VanillaCoke is C(qcoke) = 0.25qcoke and the market research team has estimated inverse market demandfor a 12-pack of this new “pop” in Southeastern Michigan to be P = 10.25 – 0.00025Q. a. Assuming Pepsi decides not to produce a similar product, allowing Coca-Cola to maintainmonopoly power in the market for orange vanilla cola, what price and quantity will youchoose to maximize profit? How much profit does Coca-Cola earn?b. What price and quantity you would choose to maximize profit if Pepsi spies discover yourproduct before launch, allowing Pepsi to produce and launch an identical product at the sametime. For your answer, assume the cost…arrow_forwardPlease solve all parts will upvote please. Hand written solution is not allowed.arrow_forward1. A company has estimated that its total cost (TC) function is: TC = 12,000 + 60Q Where Q refers to quantity. The marketing department of this company is unable to estimate the demand function for the company but believes the price elasticity for the company's products is (-)4. Given this information, calculate the profit maximising pricearrow_forward

- Consider the market for good x for which there is one firm controlling the market.D(q)=165-10qMC(q)=5q+15MR(q)=165-20qC(q)=2.5q^2+15q+8 (a) Find the point of equilibrium. (b) How many units must the firm produce and sell to maximize its profits? (c) What will be the price the firm will charge to consumers?arrow_forwardOnly part (b) please, thank you!arrow_forwardPlease solve this problem? THANK YOUarrow_forward

- (A) Suppose that the two firms merge. Write down the profit function of the merged firm. Calculate the profit maximizing level of output, the amount of pollution for the merged firm, and its profit. Is the merger Pareto improvement? Why or why not? (B) Suppose that the merger is forbidden by the government. Instead, now the fishery has the property right to water. In other words, anybody who wants to pollute the water needs to buy a pollution right from the fishery. Let the price of the pollution right be Px. Write down the steel mill’s new profit function and the fishery’s new profit function. (C) Calculate the profit maximizing level of output for each firm, the amount of pollution, and the price of pollution right. please, please answer the three questions together..arrow_forwardParts B and Carrow_forwardonly typed solutionarrow_forward

- ammm. 11arrow_forwardA7 You are the manager of a bakery that produces and packages gourmet muffins, and you currently sell muffins in packages of 3. A consultant’s report has estimated the (inverse) demand of a typical consumer to: P = 3 − 0.5Q If your cost of producing bran muffins is C(Q) = Q: (a) What is the marginal cost of muffins? (b) Draw the demand and marginal cost on a diagram. (c) Determine the optimal number of muffins to sell in a single package. (d) What price should the firm charge for each park?arrow_forwardQuestion 1 Sal's Streaming Company streams TV shows to subscribers in the US and Canada. Demand is Qus 50 (1/3)Pus - QCA 80 (2/3)P CA = - where Q's are in thousands of subscriptions per year and P's are the subscription prices per year. The cost of providing Q units of service is given by TC = 1000 + 30Q, where Q = Qus+ QCA (a) What are the profit-maximizing prices and quantities for the US and Canadian markets? (b) As a consequence of a new VPN service that Facebook has developed, subscribers in Canada are now able to get the US streams and vice versa, so Sal can charge only a single price. What is the profit-maximizing single price that he should charge? (c) In which situation is Sal better off? In terms of consumers' surplus which situation do people in Canada prefer and which do people in the US prefer? Why?arrow_forward

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education