ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

Hi I need help on a) b) & e). Thanks!

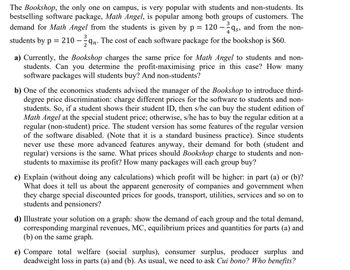

Transcribed Image Text:The Bookshop, the only one on campus, is very popular with students and non-students. Its

bestselling software package, Math Angel, is popular among both groups of customers. The

demand for Math Angel from the students is given by p = 120-qs, and from the non-

students by p = 210 - In. The cost of each software package for the bookshop is $60.

3

a) Currently, the Bookshop charges the same price for Math Angel to students and non-

students. Can you determine the profit-maximising price in this case? How many

software packages will students buy? And non-students?

b) One of the economics students advised the manager of the Bookshop to introduce third-

degree price discrimination: charge different prices for the software to students and non-

students. So, if a student shows their student ID, then s/he can buy the student edition of

Math Angel at the special student price; otherwise, s/he has to buy the regular edition at a

regular (non-student) price. The student version has some features of the regular version

of the software disabled. (Note that it is a standard business practice). Since students

never use these more advanced features anyway, their demand for both (student and

regular) versions is the same. What prices should Bookshop charge to students and non-

students to maximise its profit? How many packages will each group buy?

c) Explain (without doing any calculations) which profit will be higher: in part (a) or (b)?

What does it tell us about the apparent generosity of companies and government when

they charge special discounted prices for goods, transport, utilities, services and so on to

students and pensioners?

d) Illustrate your solution on a graph: show the demand of each group and the total demand,

corresponding marginal revenues, MC, equilibrium prices and quantities for parts (a) and

(b) on the same graph.

e) Compare total welfare (social surplus), consumer surplus, producer surplus and

deadweight loss in parts (a) and (b). As usual, we need to ask Cui bono? Who benefits?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 6 steps with 27 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- E1 After watching the Frontline video and reviewing several articles about college athletes, what is your opinion regarding NCAA college athletes being paid for: the use of their likeness playing a college sport endorsement deals while playing college athletics. Be sure to include if the pay includes or goes beyond "Cost of Attending" scholarships.arrow_forward10.27 onlyarrow_forwardMany people believe that businesses that commit fraud cannot last long because (a) the government will shut them down (b)their competition will sue them (c)word will spread and they will lose their customers (d) they will be apprehended and put in jail.arrow_forward

- What percentage of consumers believe consumer-generated content (CGC) is the most authentic form of all content?A. 20%B. 40%C. 60%D. 80%E. 90%arrow_forwardThe first step to take when you consider making a major purchase is to decide (a) whether you need the product (b) whether you have enough money to buy the product (c) what make and model of the product you should buy (d) where the best place is to purchase the product.arrow_forwardAutoSave W- q5 micro OFF Home Insert Draw Design Layout References Mailings Review View Share O Comments Calibri (Bod... v 11 A^ A Аa v AaBbCcDdE AaBbCcDdEe AaBb( AaBbCcDc AaBbCcDdE€ AqBbCcDdEe > Paste A A No Spacing Subtle Emph... Styles Pane Sensitivity v ab X, Subtitle U Normal Heading 1 Heading 2 Title * Office Update To keep up-to-date with security updates, fixes, and improvements, choose Check for Updates. Check for Updates Consider a monopolist that produces coal for energy, with demand curve defined by P = 190 – 20 and marginal cost given by MC = 10 + 2Q. Also, the firm's average total cost is ATC = 100/Q + Q+ 10. (Price and costs are in dollars per tonne of coal, while quantity is in thousands of tonnes.) Calculate the monopolisť's profit-maximizing quantity, price, and profit. For a monopoly, profit maximization occurs where the marginal revenue equals the marginal cost. a. b. What would be the competitive output and price if this monopolist operated as a competitive firm?…arrow_forward

- plz solve both parts within 30-40 mins I'll give upvotearrow_forwardTeresa works mowing lawns and babysitting. She earns 8.40 an hour for mowing and 6.90 an hour for babysitting. How much will she earn for 5 hours of mowing and 1 hour of babysitting?arrow_forwardWhich of the following involve a trade-off? a. Buying a new car b. Going to college O c. Watching a football game on Saturday afternoon O d. Taking a nap Oe. All of the answer choices involve trade-offs. Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education