FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

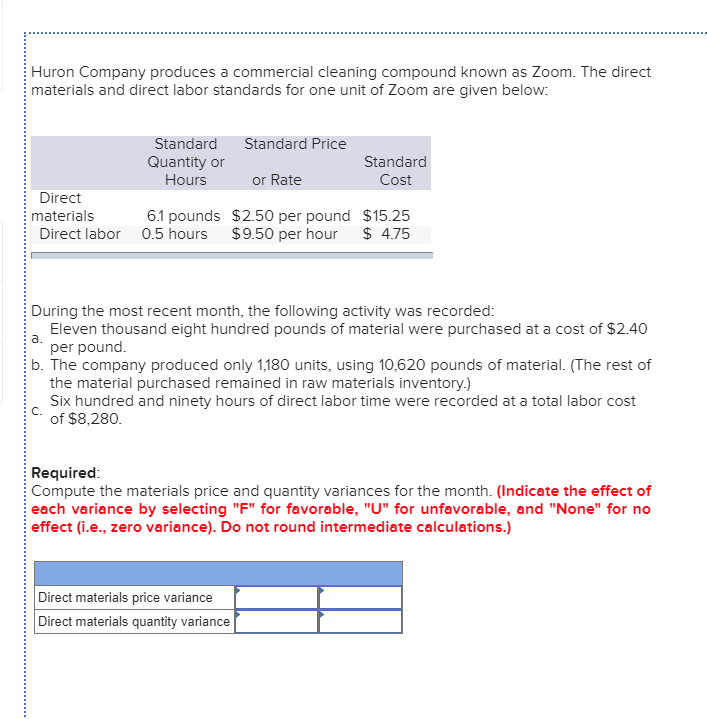

Transcribed Image Text:Huron Company produces a commercial cleaning compound known as Zoom. The direct

materials and direct labor standards for one unit of Zoom are given below:

Standard

Standard Price

Standard

Quantity or

Hours

or Rate

Cost

Direct

6.1 pounds $2.50 per pound $15.25

$9.50 per hour

materials

Direct labor 0.5 hours

$ 4.75

During the most recent month, the following activity was recorded:

Eleven thousand eight hundred pounds of material were purchased at a cost of $2.40

a.

per pound.

b. The company produced only 1,180 units, using 10,620 pounds of material. (The rest of

the material purchased remained in raw materials inventory.)

Six hundred and ninety hours of direct labor time were recorded at a total labor cost

of $8,280.

Required:

Compute the materials price and quantity variances for the month. (Indicate the effect of

each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no

effect (i.e., zero variance). Do not round intermediate calculations.)

Direct materials price variance

Direct materials quantity variance

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The Rodgers Company makes 27,000 units of a certain component each year for use in one of its products. The cost per unit for the component at this level of activity is as follows: Direct materials. $4.20 Direct labor. $12.00 $5.80 Variable manufacturing overhead. Fixed manufacturing overhead $6.50 ****** Rodgers has received an offer from an outside supplier who is willing to provide 27,000 units of this component each year at a price of $25 per component. Assume that direct labor is a variable cost. None of the fixed manufacturing overhead would be avoidable if this component were purchased from the outside supplier. Assume that there is no other use for the capacity now being used to produce the component and the total fixed manufacturing overhead of the company would be unaffected by this decision. If Rodgers Company purchases the components rather than making them internally, what would be the impact on the company's annual net operating income? Select one: a. $94,500 increase b.…arrow_forwardHuron Company produces a commercial cleaning compound known as Zoom. The direct materials and direct labor standards for one unit of Zoom are given below: Direct materials Direct labor Standard Quantity or Hours Standard Price or Rate 6.90 pounds $ 2.60 per pound 0.30 hours $ 7.00 per hour Standard Cost $ 17.94 $ 2.10 During the most recent month, the following activity was recorded: a. Nineteen thousand two hundred and fifity pounds of material were purchased at a cost of $2.40 per pound. b. All of the material purchased was used to produce 2,500 units of Zoom. c. 450 hours of direct labor time were recorded at a total labor cost of $4,500. Required: 1. Compute the materials price and quantity variances for the month. 2. Compute the labor rate and efficiency variances for the month. (For all requirements, Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). Input all amounts as positive values. Round…arrow_forwardRichards Company manufactures small plastic widgets. The standard direct materials quantity required to produce one widget is 1/2 pound at a cost of $9 per pound. Every widget requires 7 direct labor hours at a standard cost of $19 per direct labor hour. During November, 1,500 widgets were produced using 770 pounds of materials costing $3,120. At the end of November, an examination of the labor cost records showed that the company used 10,400 direct labor hours (DLHr) at a cost of $18 per hour. What is the direct labor efficiency variance? $1,900 F B. $1,900 U C. $10,400 F D. $10,400 Uarrow_forward

- Assume Sherwin-Williams Company, a large paint manufacturer, has determined the following activity cost pools and cost driver levels for the latest period: Activity Cost Pool Activity Cost Activity Cost Driver Machine setup $960,000 2,500 setup hours Material handling 830,000 5,000 material moves Machine operation 200,000 20,000 machine hours The following data are for the production of single batches of two products, Mirlite and Subdue: Mirlite Subdue Gallons produced 50,000 30,000 Direct labor hours 400 250 Machine hours 800 250 Direct labor cost $9,500 $7,000 Direct materials cost $360,000 $160,000 Setup hours 15 12 Material moves 60 35 Determine the batch and unit costs per gallon of Mirlite and Subdue using ABC.Round cost per gallon to two decimal places. Product Costs Mirlite Subdue Direct materials Answer Answer Direct labor Answer Answer Manufacturing overhead: Machine setups Answer Answer Material…arrow_forwardSharp Company manufactures a product for which the following standards have been set: Standard Standard Quantity Standard Price or or Hours Rate Cost $15 3 feet hours $5 per foot ? per hour ? ? Direct materials Direct labor During March, the company purchased direct materials at a cost of $54,630, all of which were used in the production of 2,875 units of product. In addition, 4,700 direct labor-hours were worked on the product during the month. The cost of this labor time was $47,000. The following variances have been computed for the month: Materials quantity variance Labor spending variance Labor efficiency variance Required: 1. For direct materials: a. Compute the actual cost per foot of materials for March. b. Compute the price variance and the spending variance. 2. For direct labor: a. Compute the standard direct labor rate per hour. b. Compute the standard hours allowed for the month's production. c. Compute the standard hours allowed per unit of product. $ 2,400 U $ 3,300 U $…arrow_forwardHuron Company produces a cleaning compound known as Zoom. The direct materials and direct labor standards for one unit of Zoom are given below: Standard Quantity or Hours 6.00 pounds 0.50 hours During the most recent month, the following activity was recorded: a. 11,000.00 pounds of material were purchased at a cost of $2.10 per pound b. All of the material purchased was used to produce 1,500 units of Zoom. c. 500 hours of direct labor time were recorded at a total labor cost of $6,500. Required: Direct materials Direct labor 1. Compute the materials price and quantity variances for the month. 2. Compute the labor rate and efficiency variances for the month. 1. Materials price variance 1. Materials quantity variance 2. Labor rate variance 2. Labor efficiency variance Standard Price or Rate Standard Cost $ 2.30 per pound $10.00 per hour Note: For all requirements, Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e.,…arrow_forward

- Monroe Materials processes a purchased material, PM-20, and produces three outputs, Alpha, Beta, and Gamma. In February, the costs to process PM-20 are $524,000 for materials and $196,000 for conversion costs. The results of the processing follow: Alpha Beta Gamma Product Alpha Beta Units Produced 24,000 19, 200 4,800 Required: Assign costs to Alpha, Beta, and Gamma for February using the net realizable value method. Gamma Total Sales Value per Unit $ 9.60 18.00 80.00 Cost Assignedarrow_forwardHardevarrow_forwardHuron Company produces a commercial cleaning compound known as Zoom. The direct materials and direct labor standards for one unit of Zoom are given below: Standard Quantity or Hours Standard Price or Rate Standard Cost 7.40 pounds $ 2.60 per pound $ 19.24 $ 3.60 8.45 hours $ 8.00 per hour During the most recent month, the following activity was recorded: Direct materials Direct labor a. Twelve thousand one hundred pounds of material were purchased at a cost of $2.50 per pound. b. All of the material purchased was used to produce 1,500 units of Zoom. c. 575 hours of direct labor time were recorded at a total labor cost of $5,750. Required: 1. Compute the materials price and quantity varlances for the month. 2. Compute the labor rate and efficiency variances for the month. (For all requirements, Indicate the effect of each varlance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (1.e., zero variance). Input all amounts as positive values. Round your…arrow_forward

- Dawson Toys, Limited, produces a toy called the Maze with the following standards: Direct materials: 7 microns per toy at $0.30 per micron Direct labor: 1.2 hours per toy at $7.30 per hour During July, the company produced 5,100 Maze toys. The toy's production data for the month are as follows: Direct materials. 74,000 microns were purchased at a cost of $0.29 per micron. 29,375 of these microns were still in inventory at the end of the month. Direct labor. 6,720 direct labor-hours were worked at a cost of $53,088. Required: 1. Compute the following variances for July: Note: Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). Input all amounts as positive values. Do not round intermediate calculations. Round final answer to the nearest whole dollar amount. a. The materials price and quantity variances. b. The labor rate and efficiency variances. 1a. Material price variance 1a. Material quantity…arrow_forwardA company incurs $4,050,000 of overhead each year in three departments: Ordering and Receiving, Mixing, and Testing. The company prepares 2,000 purchase orders, works 50,000 mixing hours, and performs 1,500 tests per year in producing 200,000 drums of Glu and 600,000 drums of Sim. The following data are available: Expected use of Driver Department Ordering and Receiving Mixing Testing Cost $1 200 000 1 500 000 2 000 50 000 1 500 1 350 000 Production information for Glu is as follows: Department Ordering and Receiving Mixing Testing Expected use of Driver 400 20 000 500 Required: Calculate the amount of overhead assigned to Glu.arrow_forwardRahularrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education