FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

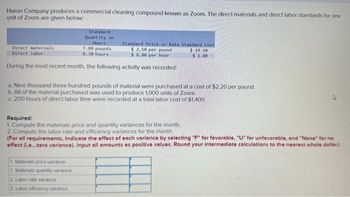

Transcribed Image Text:Huron Company produces a commercial cleaning compound known as Zoom. The direct materials and direct labor standards for one

unit of Zoom are given below:

Direct materials

Direct labor

Standard

Quantity or

Hours

7.80 pounds

0.30 hours

During the most recent month, the following activity was recorded:

Standard Price or Rate Standard Cost

$ 2.50 per pound

$6.00 per hour

a. Nine thousand three hundred pounds of material were purchased at a cost of $2.20 per pound.

b. All of the material purchased was used to produce 1,000 units of Zoom.

c. 200 hours of direct labor time were recorded at a total labor cost of $1,400.

Required:

1. Compute the materials price and quantity variances for the month.

2. Compute the labor rate and efficiency variances for the month.

1 Materials price variance

1. Materials quantity variance

2 Labor rate variance

2 Labor efficiency variance

$19.50

$ 1.80

(For all requirements, Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no

effect (i.e.. zero variance). Input all amounts as positive values. Round your intermediate calculations to the nearest whole dollar)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 6 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Equivalent Units of Production and Related Costs The charges to Work in Process-Assembly Department for a period, together with information concerning production, are as follows. All direct materials are placed in process at the beginning of production. Work in Process-Assembly Department Bal., 6,000 units, 25% completed Direct materials, 141,000 units @ $2.1 Direct labor 15,300 To Finished Goods, 138,000 units 296,100 194,700 75,765 ? Factory overhead Bal. 2 units, 65% completed Determine the following: a. The number of units in work in process inventory at the end of the period. units b. Equivalent units of production for direct materials and conversion. If an amount box does not require an entry, leave it blank. Work in Process-Assembly Department Equivalent Units of Production for Direct Materials and Conversion Costs Fquivalentarrow_forwardNn. 126.arrow_forward! Required information [The following information applies to the questions displayed below.] Cane Company manufactures two products called Alpha and Beta that sell for $135 and $95, respectively. Each product uses only one type of raw material that costs $6 per pound. The company has the capacity to annually produce 105,000 units of each product. Its unit costs for each product at this level of activity are given below: Direct materials Direct labour Variable manufacturing overhead Traceable fixed manufacturing overhead Variable selling expenses Common fixed expenses Cost per unit Alpha $30 23 10 19 15 18 $115 Beta $18 16 8 21 11 13 $87 The company considers its traceable fixed manufacturing overhead to be avoidable, whereas its common fixed expenses are deemed unavoidable and have been allocated to products based on sales dollars.arrow_forward

- Saved Required information Data Beginning work in process inventory: 5. Units in process 200 6. Completion with respect to materials 50 % 7 Completion with respect to conversion Costs in the beginning work in process inventory: 40 % 8. 6. Materials cost 2,590 10 Conversion cost 6,184 11 Units started into production during the period 16.500 12 Costs added to production during the period: 13 Materials cost $ 415,325 Conversion cost $ 1,266.500 15 Ending work in process inventory: 16 Units in process 100 17 Completion with respect to materials 50 % 18 Completion with respect to conversion 80 % %24 %24 2. 4. 1.arrow_forwardPlease do not give solution in image format thankuarrow_forwardSelect each of the items with the best description of its purpose. Description Items 1. Holds indirect cost until assigned to production. 2. Used when materials move continuously through a manufacturing process. 3. Hold production costs until products are transferred from production to finished goods (or another department). 4. Computes equivalent units only on production activity in the current period. 5. Standardizes partially completed units into equivalent completed units. 6. Combined costs of direct labor and overhead per equivalent unit. 7. Holds costs of finished products until sold to customers.arrow_forward

- When units are produced over multiple periods (i.e. incomplete at the end of one period) production cost are assigned to individual units based on : -Equal units, -Equal costs -Equivalent cost -Equivalent units, arrow_forward(Do not provide solution in imge format. and also do not provide plagarised content otherwise i dislike.)arrow_forwardplease asnzwer as soon as possiblearrow_forward

- Which of the following activity bases would be appropriate to use for materials handling? A. Number of machine hours B. Number of material moves C. Number of production orders D. Kilowatt-hours usedarrow_forwardThe equivalent units for the FIFO unit cost represent: a. work done during the current period. b. work done during the current period and the previous period. c. work done on units completed during the current period. d. work done during the previous period. e. the same thing as the equivalent units for the weighted average unit cost.arrow_forwardDengo Company makes a trail mix in two departments: Roasting and Blending. Direct materials are added at the beginning of each process, and conversion costs are added evenly throughout each process. The company uses the FIFO method of process costing. October data for the Roasting department follow. Beginning work in process inventory Units started and completed Units completed and transferred out Ending work in process inventory Beginning work in process inventory Costs added this period Direct materials. Conversion Total costs to account for Units 4,400 20, 600 25,000 3,800 $314, 760 1,374,948 Direct Materials Conversion Percent Percent Complete Complete 100% 30% 100% $ 124,790 1,689, 708 $ 1,814, 498 70%arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education