FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

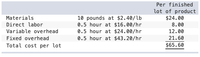

Humphrey Manufacturing has the following standards for its production department:

Transcribed Image Text:Per finished

lot of product

Materials

10 pounds at $2.40/lb

0.5 hour at $16.00/hr

$24.00

Direct labor

8.00

Variable overhead

0.5 hour at $24.00/hr

12.00

Fixed overhead

0.5 hour at $43.20/hr

21.60

Total cost per lot

$65.60

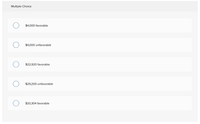

Transcribed Image Text:Multiple Choice

$4,000 favorable

$4,000 unfavorable

$22,920 favorable

$29,200 unfavorable

$33,304 favorable

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- SouthHaven Corporation applies overhead based on direct labor hours. According to standard cost card, the variable overhead standard is 11.5 hours at $20.5 per hour. During July, SouthHaven produced 4,600 units using 52,380 labor hours and spent $1,091,700 for variable overhead. What is the variable overhead efficiency variance? Multiple Choice $17,910 unfavorable $979,490 favorable $17,910 favorable $10,660 favorablearrow_forwardWhich one is the correct answer?arrow_forwardAmazing Corporation gathered the following information for Job #928: Standard Total Cost Actual Total Cost Direct labor: Standard: 900 hours at $6.50/hr. $5,850 Actual: 200 hours at $4.75/hr. $950 What is the direct labor efficiency variance?arrow_forward

- The following data are given for Stringer Company: Budgeted production Actual production Materials: Standard price per ounce Standard ounces per completed unit Actual ounces purchased and used in production Actual price paid for materials Labor: Standard hourly labor rate Standard hours allowed per completed unit Actual labor hours worked Actual total labor costs Overhead: Actual and budgeted fixed overhead Standard variable overhead ate Actual variable overhead costs Overhead is applied on standard labor hours. The direct materials quantity variance is 965 units 1,067 units $1.95 11 12,089 $24,782 $14.56 per hour 4.1 5,495.05 $83,800 $1,138,000 $24.00 per standard labor hour $153,861arrow_forwardPrivack Corporation has a standard cost system in which it applies overhead to products based on the standard direct labor-hours allowed for the actual output of the period. Data concerning the most recent year appear below: Budgeted variable overhead cost per direct labor-hour $ 4.00 Total budgeted fixed overhead cost per year $ 528,180 Budgeted direct labor-hours (denominator level of activity) 75,455 Actual direct labor-hours 84,000 Standard direct labor-hours allowed for the actual output 81,000 Required: 1. Compute the predetermined overhead rate for the year. Be sure to include the total budgeted fixed overhead and the total budgeted variable overhead in the numerator of your rate. (Round your intermediate calculations and final answer to the nearest whole dollar amount.) 2. Compute the amount of overhead that would be applied to the output of the period. (Round your intermediate calculations and final answer to the nearest whole dollar amount.)arrow_forwardThe following information was gathered for Larsen Corp. for the year ending 20xx. Budgeted direct labor hours 15,500 Actual direct labor hours 16,200 Budgeted factory overhead cost $73,625 Actual factory overhead cost $74,990 -Assume direct labor hours is the cost driver Required: What is the amount of over/underapplied overhead ? Is the variance over or under estimated ?arrow_forward

- The records of Heritage Home Supplies show the following for July: Standard direct labor-hours allowed per unit of output 4 Standard variable overhead rate per standard direct labor-hour $ 44 Good units produced 3,800 Actual direct labor-hours worked 14,675 Actual total direct labor cost $ 537,200 Direct labor efficiency variance $ 19,530 F Actual variable overhead $ 645,700 Required: Compute the direct labor and variable overhead price and efficiency variances. Note: Do not round intermediate calculations. Indicate the effect of each variance by selecting "F" for favorable, or "U" for unfavorable. If there is no effect, do not select either option. Direct labor: Price variance Efficiency variance Variable overhead: Price variance Efficiency variance need helparrow_forwardYou Did It! (YDI) has the following standards for direct labor: o Estimated quantity 8,900 direct labor hours o Estimated unit variable $48 per hour o Estimated fixed costs $18,000 YDI actually used 8,300 direct labor hours during production at an average hourly wage rate of $49.20, and actually incurred total fixed costs of $17,600. Using this information, answer the following questions. Please circle to identify the variance as favorable or unfavorable. What is the direct labor volume variance? Favorable or unfavorable?arrow_forwardThingOne Company has the following information available for the past year. They use machine hours to allocate overhead. Actual total overhead $69,270 Actual fixed overhead $33,000 Actual machine hours 9,000 Standard hours for the units produced 8,300 Standard variable overhead rate $4.40 What is the variable overhead efficiency variance? Enter the amount as positive number. Variable overhead efficiency variance $fill in the blank 1arrow_forward

- The measure of activity in the standard costing system used at Esta GmbH is machining hours. The company's flexible manufacturing overhead budget and then data regarding the most recent period's operations are given below: Flexible Budget: Budgeted Level of Activity: 6,600 machining hours Overhead costs at the Budgeted activity level: Variable Overhead Cost: $17,226 Fixed Overhead Cost: $13,992 Most Recent period's operations: Actual level of activity: 7,200 machining hours Standard level of activity for output: 7,140 machining hours Actual total variable overhead cost: $17,856 Actual total fixed overhead cost: $14,256 PART A What is the variable overhead rate variance? (936 favorable, 481 unfavorable, 630 unfavorable, 779 favorable, OR 2,267 favorable) PART B What is the variable overhead efficiency variance? (157 unfavorable, 1409 unfavorable, 1566 unfavorable, 1488 unfavorable, OR 149 unfavorable) PART C What is the fixed overhead budget variance? (264 unfavorable, 1272…arrow_forwardSince, the predetermined overhead rate and the budgeted factory overhead is given. We need to calculate the amount of the allocation base in order to know how Mystic Inc. computed its predetermined overhead rate for 2010. Equation to compute the Predetermined Overhead rate: Given: Predetermined Overhead rate = Predetermined rate: $4.25 per direct labor dollar Budgeted Factory Overhead: $1,275,000 Solution: $4.25 = ? = $300,000 = = $300,000 is the budgeted direct labor cost.arrow_forwardA) i)Calculate the standard quantity of materials needed to make 21,000 monitors ii)Calculate the standard quantity of labour-hours needed to make 21,000 monitors iii)Calculate the Direct Materials Price Variance iv)Calculate the Direct Materials Quantity Variance v)Calculate the Direct Labour Efficiency Variance b)Calculate the Variable Overhead Spending Variancearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education