FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Please do not give solution in image format thanku

Transcribed Image Text:Hruska Corporation's production budget for next year contained the following estimates:

Units to be produced

1st Quarter 2nd Quarter 3rd Quarter. 4th Quarter

10,400

9,400

11,400

12,400

Each unit requires 0.25 direct labor-hour and direct laborers are paid $12.00 per hour.

In addition, the variable manufacturing overhead rate is $1.70 per direct labor-hour. The fixed manufacturing overhead is $84,000 per

quarter. The only noncash element of manufacturing overhead is depreciation of $24,000 per quarter.

Required:

1. Calculate the company's total estimated direct labor cost for each quarter and for the year as a whole.

2. and 3. Calculate the company's total estimated manufacturing overhead cost and the cash disbursements for manufacturing

overhead for each quarter and for the year as a whole.

Complete this question by entering your answers in the tabs below.

Required 2

and 3

Required 1

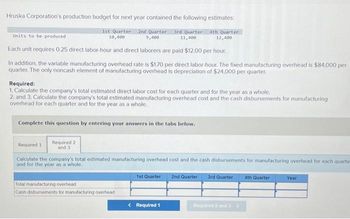

Calculate the company's total estimated manufacturing overhead cost and the cash disbursements for manufacturing overhead for each quarte

and for the year as a whole.

2nd Quarter

Total manufacturing overhead

Cash disbursements for manufacturing overhead

1st Quarter

< Required 1

3rd Quarter 4th Quarter

Required 2 and 3>

Year

Transcribed Image Text:Hruska Corporation's production budget for next year contained the following estimates:

1st Quarter 2nd Quarter 3rd Quarter

10,400

11,400

9,400

Units to be produced.

Each unit requires 0.25 direct labor-hour and direct laborers are paid $12.00 per hour.

In addition, the variable manufacturing overhead rate is $1.70 per direct labor-hour. The fixed manufacturing overhead is $84,00-

quarter. The only noncash element of manufacturing overhead is depreciation of $24,000 per quarter.

Required:

1. Calculate the company's total estimated direct labor cost for each quarter and for the year as a whole.

2. and 3. Calculate the company's total estimated manufacturing overhead cost and the cash disbursements for manufacturing

overhead for each quarter and for the year as a whole.

Complete this question by entering your answers in the tabs below.

4th Quarter

12,400

Required 2

and 3

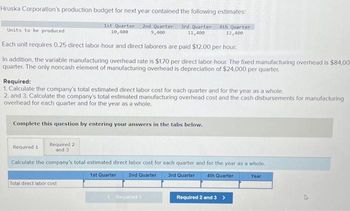

Calculate the company's total estimated direct labor cost for each quarter and for the year as a whole.

1st Quarter

2nd Quarter

3rd Quarter 4th Quarter

Required 1

Total direct labor cost

Required 1

Required 2 and 3>

Year

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Zarrow_forwardO PowerPoint O from Towards a O Mail - Edjouline X E Content - ACG: X * CengageNOWv. x D (58) YouTube v2 cengagenow.com/ilm/takeAssignment/takeAssignmentMain.do?invoker=assignments&takeAssignmentSessionLocator=assignment-take&inpro. Q < * * C WouTube O Maps ANKSHEET Entries for Notes Receivable Spring Designs & Decorators issued a 120-day, 4% note for $60,000, dated April 13 to Jaffe Furniture Company on account. Assume a 360-day year when calculating LANKSHEET interest. LGO a. Determine the due date of the note. LGO b. Determine the maturity value of the note. cl. Journalize the entry to record the receipt of the note by Jaffe Furniture. c2. Journalize the entry to record the receipt of payment of the note at maturity. If an amount box does not require an entry, leave it blank. 24 068 s: 912 items Previous Next 回习 9 O 11:49arrow_forwardPlease avoid answers in image format thank youarrow_forward

- help please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forwardPlease answer G part with explanationarrow_forwardCan you explain what I might be missing throughly please? I have it correct but it claims that it's not complete. What am I missing?arrow_forward

- help please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forwardI need this in text not imagesarrow_forwardNote:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forward

- How is the access control list approach different from RBAC?arrow_forwardPlease answer questions correctlyarrow_forwardhelp please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education