Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Transcribed Image Text:Help

df

#

E

Q Û 2. Ö

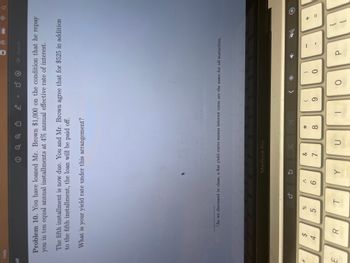

Problem 10. You have loaned Mr. Brown $1,000 on the condition that he repay

you in ten equal annual installments at 4% annual effective rate of interest.

The fifth installment is now due. You and Mr. Brown agree that for $525 in addition

to the fifth installment, the loan will be paid off.

What is your yield rate under this arrangement?

$

%

488

5

4

R

As we discussed in class, a flat yield curve means interest rates are the same for all maturities.

T

MacBook Pro

6

Y

&

7

14

U

14

* CO

8

(

9

0

<

O

Q Search

0

P

-

{

+ 11

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

how was the rate calculated, without excel

Solution

by Bartleby Expert

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

how was the rate calculated, without excel

Solution

by Bartleby Expert

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- 3. A loan of $50,000 due in one year is to be repaid by three equal payments due today, six months from now, and one year from now. What is the amount of the equal payments if interest is 6.5% (simple interest) and the focal date is today?arrow_forwardThe bank offers you the following three options to pay back the loan from the previous question: I: To pay the interest of 6.00% annually II: To pay an interest of 0.49% monthly III: To pay an interest of 1.46% quarterly Which of these three options would be most beneficial for you? O All three options would be equally beneficial Option II ○ Option III Option I O Option II and Option III would be equally beneficialarrow_forwardAssume you plan to borrow $400,000 from your bank to buy a home. The bank offers: a 5-year fixed rate of 6.05 %, compounded monthly. a 3-year fixed rate of 5.75 %, compounded monthly. If you choose to repay the borrowing in equal installments monthly over a 20 years, what would be the difference between your monthly payments at the two different APRs? a. $68.94 b. $154.58 c. $26.98 d. $89.32arrow_forward

- Q11 To borrow $1,900, you are offered an add-on interest loan at 6 percent. Three loan payments are to be made, one at four months, another at eight months, and the last one at the end of the year. Compute the three equal payments. (Round your answer to 2 decimal places.) THREE EQUAL PAYMENTS?arrow_forwardYour brother-in-law asks you to lend him $225000.00 as a second mortgage on his vacation home. He promises to make level monthly payments for 10 years, 120 payments in all. You decide that a fair interest rate is 4.50% compounded annually. What should the monthly payment be on the $225000.00 loan? O $2369.60 $2331.86 $1875.00 O $2272.31 O $1959.37arrow_forward9arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education