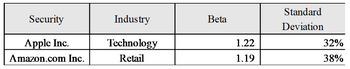

Sally, your secondary classmate who recently joined the asset management industry, shared the following information with you: The yield to maturity on the treasury bonds and the market risk premium is 3% and 5% respectively. Appraise which security (i.e. Apple or Amazon) is more risky, and examine which security(ies) you will include in your investment portfolio. No computations are require, the answer should be in paragraphs and not exceed 400 words.

Step by stepSolved in 3 steps

How to construct a portfolio comprising three assets (i.e. Apple, Amazon and treasury bonds) which produces an expected return of 6% and a beta of 0.6, based on the above information.

Construct a portfolio comprising three assets (i.e. Apple, Amazon and treasury bonds)

which produces an expected return of 6% and a beta of 0.6, based on the above

information.

How to construct a portfolio comprising three assets (i.e. Apple, Amazon and treasury bonds) which produces an expected return of 6% and a beta of 0.6, based on the above information.

Construct a portfolio comprising three assets (i.e. Apple, Amazon and treasury bonds)

which produces an expected return of 6% and a beta of 0.6, based on the above

information.

- An investor receives an investment newsletter that recommends that she invest in a stock that has doubled the return of the S&P 500 in the last two months. It also claims that this stock is a "safe bet" for the future. Which of the following statements is correct regarding this information? The investment newsletter contains contrary information since the stock must be a high risk and therefore cannot also be a "safe bet." This investment newsletter is most likely correct because they most likely have some special knowledge about the stock. It is common for individual stocks to double the return of the S&P 500 and still be a "safe bet."arrow_forwardFrank Meyers, CFA, is a fixed-income portfolio manager for a large pension fund. A member of the Investment Committee, Fred Spice, is very interested in learning about the management of fixed-income portfolios. Spice has approached Meyers with several questions.Meyers decides to illustrate fixed-income trading strategies to Spice using a fixed-rate bond and note. Both bonds have semiannual coupon periods. Unless otherwise stated, all interest rate changes are parallel. The characteristics of these securities are shown in the following table. He also considers a 9-year floating-rate bond (floater) that pays a floating rate semiannually and is currently yielding 5%. Characteristics of Fixed-Rate Bond and Fixed-Rate Note Fixed-Rate Bond Fixed-Rate Note Price 107.18 100.00 Yield to maturity 5.00% 5.00% Time to maturity (years) 18 8 Modified duration (years) 6.9848 3.5851 Spice asks Meyers to quantify price changes from changes in interest rates. To illustrate, Meyers…arrow_forwardAdam Smith is a portfolio manager with Point72 Investments, a U.S.-based asset management firm. Smith is considering using options to enhance portfolio returns and control risk. He asks his junior analyst, Tommy Lee, to help him. Lee collected and summarize the relationship between a European call option and various factors that might impact the call option value in Table 1. Which of the relationships shown in Table 1 below is incorrect? (Choose the best answer) Table 1 Impact of Increasing the Variables on put option value Variables Impact on put option value Stock price Decrease Strike Price Decrease Maturity Increase Volatility Increase Interest rate Decrease Dividend Increase Volatility and Stock Price Risk-free rate and Volatility Dividend and stock price Maturity and Strike Price Stock Price and Interest Ratearrow_forward

- As a junior investment manager, your boss instructs you to help a client to invest $100,000for the next year. Particularly, you are asked to form an investment portfolio for the clientby investing in risk-free assets like 90-day bank bill and two stocks: A and B. Stock A hasa beta value of 0.8, an expected return of 7% and a standard deviation of 10%; and stockB has a beta value of 1.2, an expected return of 12% and a standard deviation of 15%.The correlation coefficient between the returns for the two stocks is 0. The risk-free rate is2%.(a) What is the expected return of the risky portfolio with the two stocks that has theleast amount of risk?(b) Suppose that the optimal risky portfolio with the two stocks has a weight of 53% inA and 47% in B, and has the expected return of 9.4% and standard deviation of8.8%. If this client is willing to take a risk measured by standard deviation of 5% forhis overall investment portfolio, how much would you recommend to the client toinvest in the…arrow_forwardAssume that markets are efficient. Give 2 reasons why you cannot retire all portfolio managers / financial analysts and simply rely on a random choice via computer to select securities for your portfolio.arrow_forwardYour client, Sandra is considering three assets: a bond mutual fund, a cryptocurrency ETF, and US Treasury bills. The annualized T-bill rate is 2%. The information below refers to the two risky assets. Expected return Standard deviation Bond mutual fund Cryptocurrency ETF 3% 10% Correlation coefficient 0 14% 20% (a) What are the proportions of each asset, in Sandra's optimal risky portfolio? (b) Suppose the return for each risky asset follows a normal distribution. What is the 1% value-at-risk for Sandra's optimal risky portfolio? Hint: P(Z<-2.326) = 0.01 where Z~N(0, 1).arrow_forward

- Formulate a system of equations for the situation below and solve. A private investment club has $600,000 earmarked for investment in stocks. To arrive at an acceptable overall level of risk, the stocks that management is considering have been classified into three categories: high-risk, medium-risk, and low-risk. Management estimates that high-risk stocks will have a rate of return of 15% / year; medium-risk stocks, 10%/year; and low-risk stocks, 7%/year. The members have decided that the investment in low-risk stocks should be equal to the sum of the investments in the stocks of the other two categories. Determine how much the club should invest in each type of stock if the investment goal is to have a return of $60,000/year on the total investment. (Assume that all the money available for investment is invested.) high-risk stocks $ 24000 X medium-risk stocks low-risk stocks LA LAarrow_forward1. What are some comparative advantages of investing in the following? a) Unit investment trusts. b) Open-end mutual funds. c) Individual stocks and bonds that you choose for yourself. 2. You are considering two alternative two-year investments: You can invest in a risky asset with a positive risk premium and returns in each of the two years that will be identically distributed and uncorrelated, or you can invest in the risky asset for only one year and then invest the proceeds in a risk-free asset. Which of the following statements about the first investment alternative (compared with the second) are true? a) Its two-year risk premium is the same as the second alternative. b) c) d) e) The standard deviation of its two-year return is the same.Its annualized standard deviation is lower.Its Sharpe ratio is higher.It is relatively more attractive to investors who have lower degrees of risk aversion. 3. Tabulate and draw the investment opportunity set of the two…arrow_forwardPlease correct answer and don't use hand ratingarrow_forward

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education