Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

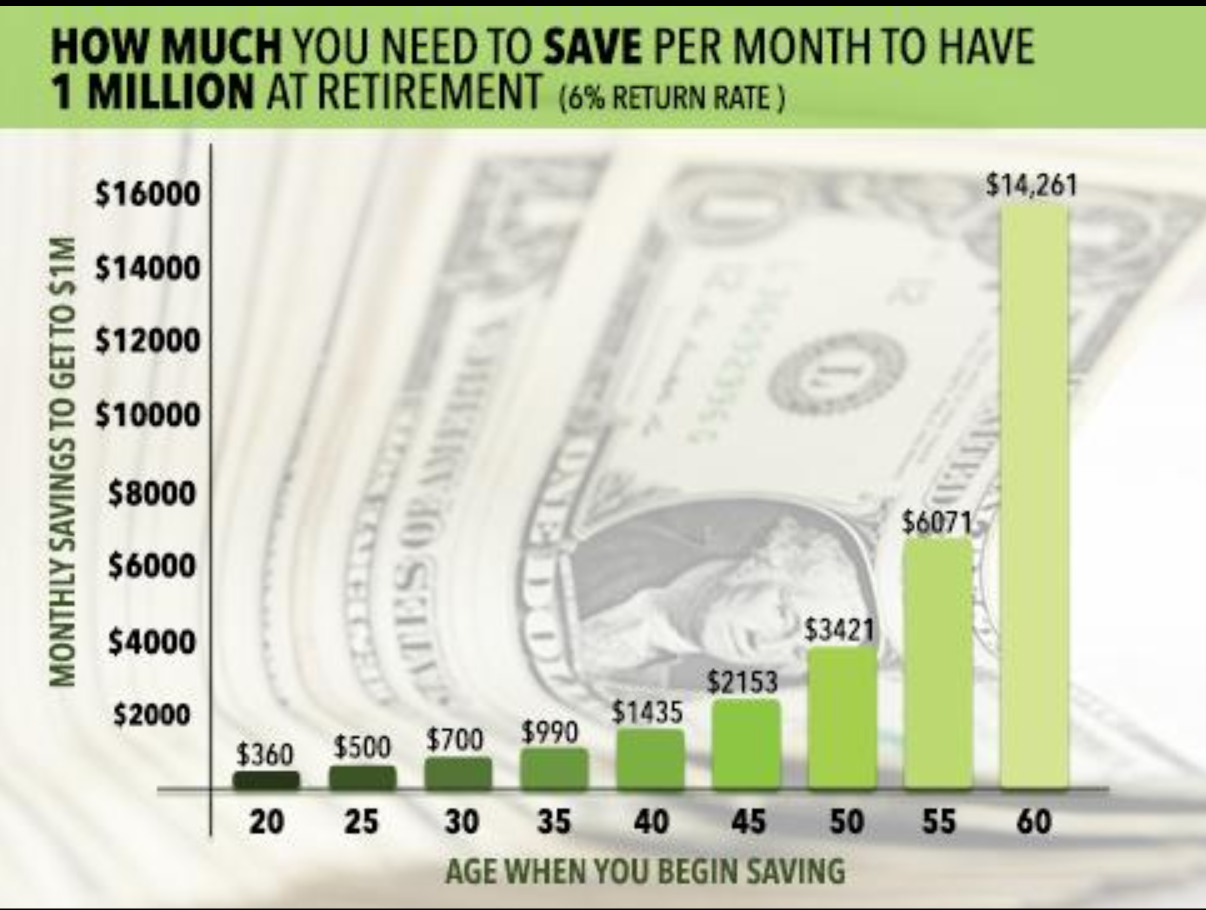

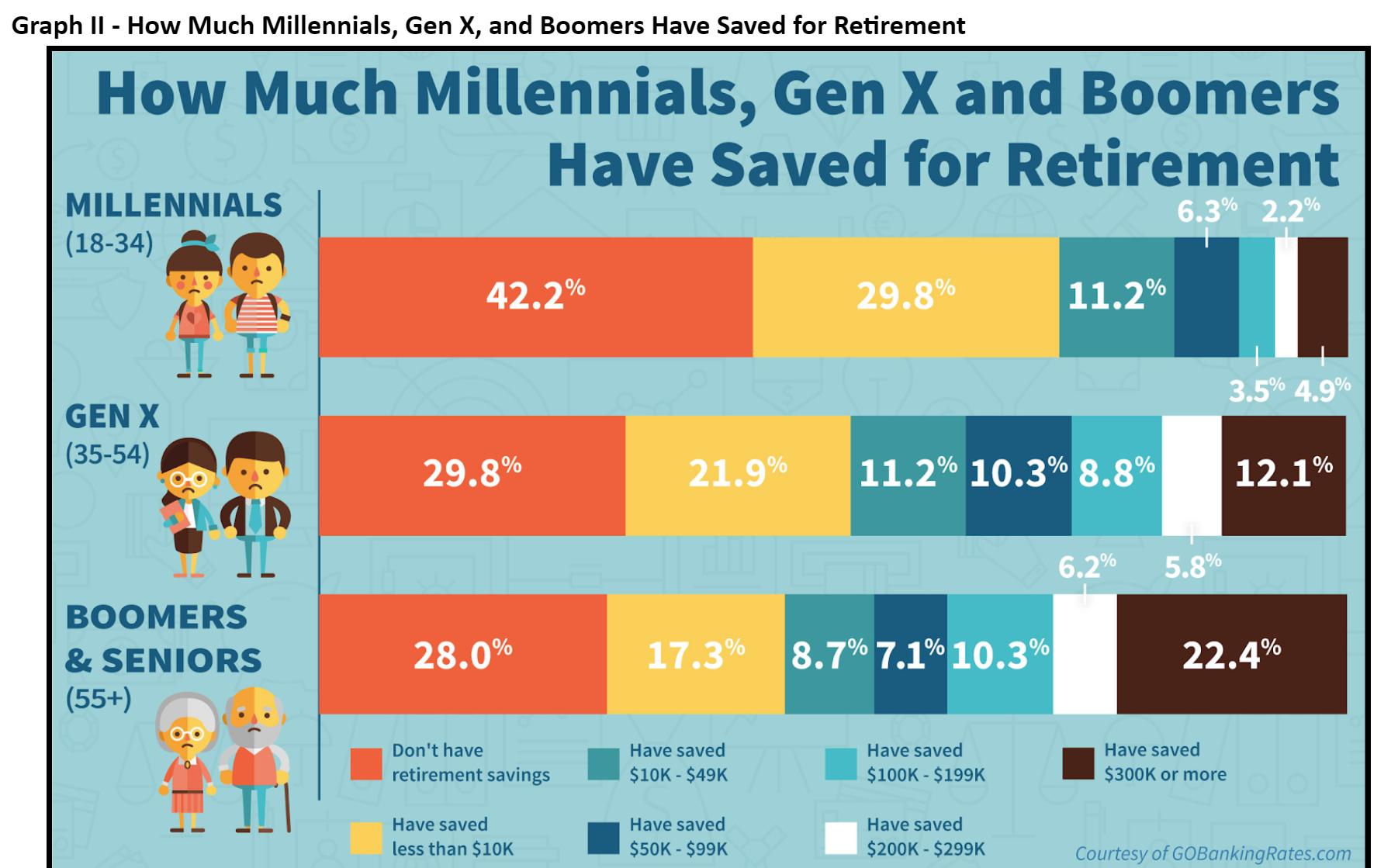

Using the data in graphs II and III, how much will most millennials need to begin investing, per month, in order to have $1M in retirement? Please, explain.

Transcribed Image Text:HOW MUCH YOU NEED TO SAVE PER MONTH TO HAVE

1 MILLION AT RETIREMENT (6% RETURN RATE )

$16000

$14,261

$14000

$12000

$10000

$8000

$6071

$6000

$4000

$3421

$2153

$1435

$990

$2000

$360 $500 $700

20

25

30

35 40

45

50

55

60

AGE WHEN YOU BEGIN SAVING

MONTHLY SAVINGS TO GET TO $1M

TECN

NTES OF AMEMWA

ITED

Transcribed Image Text:Graph II - How Much Millennials, Gen X, and Boomers Have Saved for Retirement

How Much Millennials, Gen X and Boomers

Have Saved for Retirement

MILLENNIALS

6.3% 2.2%

(18-34)

42.2%

29.8%

11.2%

3.5% 4.9%

GEN X

(35-54)

29.8%

21.9%

11.2% 10.3% 8.8%

12.1%

6.2%

5.8%

BOOMERS

& SENIORS

28.0%

17.3%

8.7% 7.1% 10.3%

22.4%

(55+)

Don't have

retirement savings

Have saved

Have saved

Have saved

$10K - $49K

$100K - $199K

$300K or more

Have saved

Have saved

Have saved

less than $10K

$50K - $99K

$200K - $299K

Courtesy of GOBankingRates.com

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- 1. You want to have an income of $50,000 per year in retirement, and you think you will be alive for 30 years in retirement. How much do you need to have invested the day you retire, in real dollars, assuming a 3% real rate of return?arrow_forwardSuppose a husband wants to take his wife on a trip three years from now to Europe to celebrate their 40th anniversary. He has just received a $20,000 inheritance from an uncle and intends to invest it for the trip. The husband estimates the trip will cost $26,600. What interest rate, compounded annually, must be earned to accumulate enough to pay for the trip? Note: Use tables, Excel, or a financial calculatorarrow_forwardPeter and Blair recently reviewed their future retirement income and expense projections. They hope to retire in 29 years and anticipate they will need funding for an additional 20 years. They determined that they would have a retirement income of $62,000.00 in today's dollars but that they would actually need $86,142.00 in retirement income (in today's dollars) to meet all of their objectives. a. What is their annual shortfall at retirement assuming inflation of 3 percent per year? Click on the table icon to view the FVIF table: b. At the time that they retire, how much additional amount must they have accumulated to fund their retirement needs, assuming 3 percent inflation and a rate of return of 9 percent? Click on the table icon to view the PVIFA table: c. Calculate the additional amount that Peter and Blair must save each year for the next 29 years if they wish to completely fund their income shortfall. Click on the table icon to view the FVIFA table:arrow_forward

- Sarah Wiggum would like to make a single investment and have $1.2 million at the time of her retirement in 30 years. She has found a mutual fund that will earn 4 percent annually. How much will Sarah have to invest today? If Sarah invests that amount and could earn a 14 percent annual return, how soon could she retire, assuming she is still going to retire when she has $1.2 million? Click on the table icon to view the PVIF table To have $1.2 million at retirement, the amount Sarah must invest today is $ (Round to the nearest cent.)arrow_forwardDont uplode image in answer, USE BAII Plus Financial Calculator to solve the TVM questions. $_____________You would like to start saving for retirement. Assuming you are now 22 years old and you want to retire at age 60, you have 38 years to watch your investment grow. You decide to invest in the stock market, which you expect it to earn about 6% per year into the future. You decide to invest $600 at the end of each month for the next 38 years (456 months). Calculate your accumulated investment at the end of 38 years. (Round to nearest whole dollar)arrow_forwardPlease answer using life-cycle problem. Suppose the interest rate is 5%, the income tax rate 35%, the tax rate on investment income is 20%, and the investment horizon 40 years. (a) What is the final payoff after tax if $100 pre-tax income is invested in a regular savings account? (b) What is the final payoff after tax if $100 pre-tax income is invested in a retirement account? (c) What is the final payoff after tax if $100 pre-tax income is invested in a Roth account?arrow_forward

- Suppose you have estimated that you will need $2,500 per month in your retirement to meet your expenses and live comfortably, and that you have found or chosen a fund (account) which pays monthly interest 4% APR . What principal, or balance, will your account need to maintain in order to be able to pay you this amount each month? Round/take your answer to the nearest cent.arrow_forward1. If you begin investing at age 25 instead of age 20, how much more do you need to invest per month to have $1M at retirement? 2. If you begin investing at age 45 instead of age 40, how much more do you need to invest per month to have $1M at retirement? Why is this amount so much greater than the difference between 20 and 25? 3. If you wait until you’re 45 to begin investing, how much money will you need to invest, just for retirement, per year? Why might this be difficult? 4. Using the data in graphs II and III, how much will most millennials need to begin investing, per month, in order to have $1M in retirement? Please, explain.arrow_forwardUse a financial calculator or computer software program to answer the following questions: a) Melanie is trying to save money for retirement and has a future goal of $750,000 at the end of 20 years. Determine the present value of her goal using a discount rate of 12%. b) How would the present value change if the $750,000 is to be received at the end of 15 years instead? Explain the impact and show your work?arrow_forward

- Calculate the amount of money you would be saving for a month by no longer spending $10. Please show your work. If you were to retire at 65, find the number of years left for you to retire. Show calculations. If you were to invest the monthly savings (every month) in an account that gives you 7% interest compounded monthly, calculate the amount of money you would have in your retirement account (at age 65) by making this one change in your lifestyle. Show all the steps.arrow_forwardUsing the date in these two graphs, answer this question: how much will most millennials need to begin investing, per month, in order to have $1M in retirement? Explain your answer.arrow_forwardYou plan to start your own business and are investing today to grow some seed money. You have $15571 to invest and aim to have $29610 in 7 years. What interest rate must you earn to meet your goal? Include 2 decimal places. Answer:arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education