Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

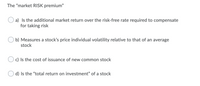

The “market RISK premium”

Transcribed Image Text:**Understanding the "Market RISK Premium"**

The "market RISK premium" is a crucial concept in finance, particularly in the fields of investing and portfolio management. It represents the compensation investors expect for taking on the additional risk associated with investing in the stock market over risk-free securities, such as government bonds.

### Multiple-Choice Question:

What is the "market RISK premium"?

**a) Is the additional market return over the risk-free rate required to compensate for taking risk**

**b) Measures a stock’s price individual volatility relative to that of an average stock**

c) Is the cost of issuance of new common stock

d) Is the “total return on investment” of a stock

### Explanation of the Choices:

- **Option a):** This is the correct definition of the market risk premium. It quantitatively expresses how much more return an investor demands to invest in the market as a whole rather than in risk-free assets.

- **Option b):** This option describes the concept of beta, which measures a stock’s individual volatility compared to the overall market. While related to risk, beta is not the same as the market risk premium.

- **Option c):** This option is related to the cost of equity, which is the return a company needs to offer investors to compensate for the risk of investing in its new common stock. This is not the same as the market risk premium.

- **Option d):** This option defines the "total return on investment" which includes both capital gains and dividends received from a stock. While important, it is not synonymous with the market risk premium.

This question aims to clarify the specific meaning and implication of the market risk premium within the context of financial theory and investment practice. Understanding these distinctions is essential for making informed financial decisions and effectively managing investment risk.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- The no-arbitrage price of Security C?arrow_forwardDetermine how the appropriate yield to be offered on a security is affected by a higher risk-free rate. Explain the logic of this relationship. . Determine how the appropriate yield to be offered on a security is affected by a higher default risk premium. Explain the logic of this relationship.arrow_forwardExplain Comparing Risk Premiums?arrow_forward

- Define each of the following terms: d. Stand-alone risk; corporate (within-firm) risk; market (beta) riskarrow_forwardDefine the terms, or give short explanations. -risk-free rate -risk management -risk neutrality risk preference -risk premium -risk-return trade-offarrow_forwardWhat is counterparty risk?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education