ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:!

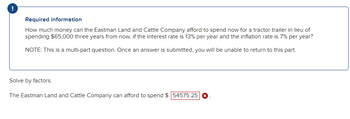

Required information

How much money can the Eastman Land and Cattle Company afford to spend now for a tractor trailer in lieu of

spending $65,000 three years from now, if the interest rate is 13% per year and the inflation rate is 7% per year?

NOTE: This is a multi-part question. Once an answer is submitted, you will be unable to return to this part.

Solve by factors.

The Eastman Land and Cattle Company can afford to spend $ 54575.25

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- help please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forwardA diamond ring will be worth P35,000 in 2023. How much was it when it was bought in 2019 if the annual inflation and interest rates for the period are 7% and 9%, respectively?arrow_forwardIf the inflation rate is 4.8% per year and themarket interest rate is known to be 10.2% per year,what is the implied real interest (inflation-free) ratein this inflationary economy?arrow_forward

- Maria, who is now 51 years old, is employed by a firm that guarantees her a pension of $35,000/year at age 65. What is the present value of her first year's pension if the inflation over the next 14 years is 3%/year compounded continuously? 4%/year compounded continuously? 6%/year compounded continuously? (Round your answers to the nearest cent.)arrow_forwardToday you borrowed $90,000 from a bank at an interest rate of 10.25%, compounded monthly. You are supposed to repay the loan and its interest charges in equal monthly payments over a 15-year period, with the first payment in a month from now. The estimated annual inflation rate is 6%, compounded monthly.(a) What is the amount of your monthly payments?(b) What is the bank's real effective annual rate of return on this deal after taking inflation into account?arrow_forwardA machine currently under consideration by Marcus Industries has a cost of $31, 000. When the purchasing manager complained that a similar machine the company purchased 5 years ago was much cheaper, the salesman responded that the cost of the machine has increased solely in accordance with the inflation rate, which has averaged 5% per year. When the purchasing manager checked the invoice for the machine he purchased 5 years ago, he saw that the price was $25,000. Was the salesman telling the truth about the increase in the cost of the machine? What should the machine cost now, provided the price increased by only the inflation rate? Use the formulaarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education