ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

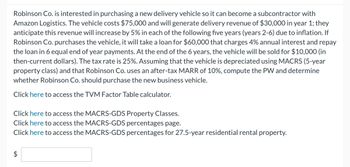

Transcribed Image Text:Robinson Co. is interested in purchasing a new delivery vehicle so it can become a subcontractor with

Amazon Logistics. The vehicle costs $75,000 and will generate delivery revenue of $30,000 in year 1; they

anticipate this revenue will increase by 5% in each of the following five years (years 2-6) due to inflation. If

Robinson Co. purchases the vehicle, it will take a loan for $60,000 that charges 4% annual interest and repay

the loan in 6 equal end of year payments. At the end of the 6 years, the vehicle will be sold for $10,000 (in

then-current dollars). The tax rate is 25%. Assuming that the vehicle is depreciated using MACRS (5-year

property class) and that Robinson Co. uses an after-tax MARR of 10%, compute the PW and determine

whether Robinson Co. should purchase the new business vehicle.

Click here to access the TVM Factor Table calculator.

Click here to access the MACRS-GDS Property Classes.

Click here to access the MACRS-GDS percentages page.

Click here to access the MACRS-GDS percentages for 27.5-year residential rental property.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Suppose you have an opportunity to invest in a fund that pays 11% interest compounded annually. Today, you invest $5,000 into this fund. Three years later (EOY 3), you borrow $2,500 from a local bank at 6% annual interest and invest it in the fund. Two years later (EOY 5), you withdraw enough money from the fund to repay the bank loan and all interest due on it. Three years from this withdrawal (EOY 8) you start taking $1,000 per year out of the fund. After five withdrawals of $1,000, you have withdrawn your original $5,000. The amount remaining in the fund is earned interest. How much remains? Click the icon to view the interest and annuity table for discrete compounding when i = 6% per year. Click the icon to view the interest and annuity table for discrete compounding when i= 11% per year. wwwarrow_forwardIf a nominal interest rate of 8% is compounded continuously, determine the unknown quantity in each of the following situations: a. What uniform EOY amount for 11 years is equivalent to $9,000 at EOY 11? b. What is the present equivalent value of $950 per year for 13 years? c. What is the future equivalent at the end of the sixth year of $232 payments made every six months during the six years? The first payment occurs six months from the present and the last occurs at the end of the sixth year. d. Find the equivalent lump-sum amount at EOY nine when P = $900. Click the icon to view the interest and annuity table for continuous compounding when i = 8% per year. a. The uniform EOY amount is $ (Round to the nearest dollar.) b. The present equivalent value $950 per year for 13 years is $ c. The future equivalent is $ (Round to the nearest dollar.) d. The equivalent lump-sum amount is (Round to the nearest dollar.) (Round to the nearest dollar.)arrow_forwardRosa, age 35, is starting her savings plan this year by putting away $2,900.00 at the end of every year until she reaches age 65. She will deposit this money at her local savings and loan at an interest rate of 6%. The future value annuity interest factor is 79.0582. Based on the information provided, by the time Rosa turns 65, she will have . Nick started his investment program five years earlier and set aside more than Rosa. By the time Nick turns 65, he will have accumulated more than Rosa.arrow_forward

- The nominal interest rate is 14% compounded semiannually. What amount will need to be deposited every six months to be able to have enough money to pay three annuity payments of $20,000 for three years beginning at the end of year seven? The deposits begin now and continue every six months until six deposits have been made. The amount to be deposited every six months is $ (Round to the nearest dollar.)arrow_forwardBefore last year, Ellie (Luke's wife) taught music and earned $30,400. She also earned $9,600 by renting out their basement as a studio apartment. Ellie saves every month. At the end of a typical year she would have saved a total of 10% from her wages and the income earned from the basement for the entire year, and earned a total of 0.5% in interest (for the entire year). At the beginning of last year, Ellie stopped teaching music. She also stopped renting out their basement, and began to use it as the office for her new web design business. The balance on her savings account was $150,000, and she took $5,000 from this account to buy a new laptop computer and a new printer (which also functions as a scanner and a facsimile). She also borrowed $12,000 from the local bank to purchase additional machinery and equipment (a graphics tablet, desktop computer, studio camera and an external hard drive). Her loan payment is $250 per month. During last year, she paid $3,000 for the lease of a…arrow_forward4) (28 points) An employee has decided to make annual contributions over a 15-year period into a retirement fund. She wants to make her first contribution of $5,000 one year from now (t=1). She then plans to increase her annual contribution by $500 each year for the remaining years. The fund is expected to earn 15% per year compounded annually. She decides to retire in 15 years (from now). a) (20 points) Assuming that the fund will be depleted when the last withdrawal is made, what equal amount can she withdraw annually for a period of 10 years starting one year after retirement? b) (8 points) If she wants the fund to have a balance at the time of the 10th withdrawal exactly equal to the balance it had when she retired, what equal amount can she withdraw annually for a period of 10 years starting one year after retirement?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education