FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

16. What is the adjusted cash balance on November 30, 2020?

17. What is the adjusted cash balance on December 31, 2020?

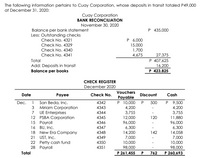

Transcribed Image Text:The following information pertains to Cuay Corporation, whose deposits in transit totaled P49,000

at December 31, 2020:

Cuay Corporation

BANK RECONCILIATION

November 30, 2020

P 435,000

Balance per bank statement

Less: Outstanding checks

Check No. 4321

P 6,000

15,000

Check No. 4329

Check No. 4340

1,700

Check No. 4341

4,675

27,375

P 407,625

16,200

P 423,825

Total

Add: Deposits in transit

Balance per books

CHECK REGISTER

December 2020

Vouchers

Date

Рayee

Check No.

Discount

Cash

Pаyable

P 10,000 P

4,200

3,755

12,000

96,000

6,300

14,200

7,000

10,000

98,000

P 9,500

4,200

3,755

11,880

96,000

6,300

14,058

7,000

10,000

98,000

Dec.

1

San Beda, Inc.

4342

500

3 Miriam Corporation

7

4343

4344

UE Enterprises

12 PSBA Corporation

15 Pаyroll

16 BU, Inc.

18 New Era Company

21 UST, Inc.

4345

120

4346

4347

4348

142

4349

22 Petty cash fund

28 Payroll

4350

4351

Total

P 261,455

762

P 260,693

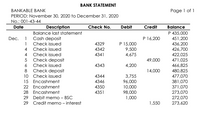

Transcribed Image Text:BANK STATEMENT

Page 1 of 1

BANKABLE BANK

PERIOD: November 30, 2020 to December 31, 2020

No.: 001-43-44

Description

Balance last statement

Check No.

Date

Debit

Credit

Balance

P 435,000

451,200

436,200

426,700

422,025

471,025

466,825

480,825

477,070

381,070

371,070

273,070

272,070

273,620

Dec. 1 Cash deposit

P 16,200

1 Check issued

4 Check issued

P 15,000

9,500

4,675

4329

4342

4 Check issued

4341

5 Check deposit

6 Check issued

8 Check deposit

49,000

4343

4,200

14,000

3,755

96,000

10,000

98,000

1,000

10 Check issued

4344

15 Encashment

4346

22 Encashment

4350

28 Encashment

4351

29 Debit memo - BSC

29 Credit memo - interest

1,550

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Which of the following is an appropriate method of computing free cash fl ow to the fi rm? A . Add operating cash fl ows to capital expenditures and deduct after-tax interest payments.arrow_forwardQw.02. Compute trend percents for the following accounts using 2020 as the base year. For each of the three accounts, state whether the situation as revealed by the trend percents appears to be favourable or unfavourable Sales Cost of goods sold Accounts receivable Numerator: 2024: 2023: Numerator: 2024 $ 463,414 234,107 22,522 2024: 2023: 2022: 2021: 2020: Is the trend percent for Net Sales favourable or unfavourable? Numerator: I 1 1 1 Trend Percent for Net Sales: 2023 $ 306,897 155,099 17,861 1 1 1 I 1 2022 2021 $ 249,510 $ 175,095 128,255 89,348 10,226 17,042 Trend Percent for Cost of Goods Sold: Denominator: 2024: 2023: 2022: 2021: 2020: Is the trend percent for Cost of Goods Sold favourable or unfavourable? 7 Denominator: 7 1 Trend Percent for Accounts Receivable: Denominator: 2022: 2021: 2020: Is the trend percent for Accounts Receivable favourable or unfavourable? = E # = S U = E = = 2020 $ 129,700 64,850 8,871 Trend percent Trend percent Trend percent 1% %6 % % % % 196 196 56…arrow_forwardIn an inflationary period, what is the difference between (a) inflated dollars and “then-current” future dollars, and (b) “then-current” future dollars and constant-value future dollars?arrow_forward

- What are the Conditions for Accrual of Paid Future Absences?arrow_forwardWhat are three reasons that cash is worth more today than cash to be received in the future?arrow_forwardWhat is the estimated worth today of an amount of cash to be received (or paid) in the future called? contract value discount value premium value present valuearrow_forward

- Listen The future value of $100 deposited today (assuming positive interest rates and a time difference between the present and the future): 1) will always be less than $100. 2) will always be equal to $100. 3) will always be greater than $100. depending on the exact interest rate and on the precise amount of time difference between the present and the future, can be less than $100, greater than $100, or equal to $100. 5) None of the statements above are correct. 4)arrow_forward1) Find the PW, AW and FW of the following cashflow if the interest rate compound semiannually. P-7 i-10% --14%- Year $100 $100 S100 $100 $100 S160 S160 SIGDarrow_forwardIn 2018, the yen went from $0.00887619 to $0.00906626. • By how much did the yen appreciate against the dollar? • By how much has the dollar depreciated against the yen?arrow_forward

- What is George's monthly cash flow? (include negative sign if needed)arrow_forward82. In addition to the three basic financial statements, which of the following is also a required financial statement? A) the Statement of Cash Flows B) the "Cash Budget C) the Cash Reconciliation" D) the Statement of Cash Inflows and Outflowsarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education