Cornerstones of Financial Accounting

4th Edition

ISBN: 9781337690881

Author: Jay Rich, Jeff Jones

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

4

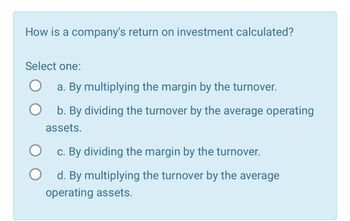

Transcribed Image Text:How is a company's return on investment calculated?

Select one:

a. By multiplying the margin by the turnover.

b. By dividing the turnover by the average operating

assets.

c. By dividing the margin by the turnover.

О

О

d. By multiplying the turnover by the average

operating assets.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- In a DuPont analysis, what are the components of return on assets?a. Net Profit Margin Ratio and Debt Ratiob. Net Profit Margin Ratio and Leverage Ratioc. Net Profit Margin Ratio and Asset Turnover Ratiod. Asset Turnover Ratio and Leverage Ratioarrow_forwardWhy is the operating return on assets ratio also referred to as the operating returnon investment?arrow_forwardA. Which of the following is most closely associated with the cost of using assets? a. Asset utilization b. Sales revenue c. Proportion of debt and equity d. Average price B. Which of the following is most closely associated with the return on management’s use of assets? a. Cost of capital b. Mix of equity types c. Prime lending rate d. # of products soldarrow_forward

- The following are investment criteria: net present value, payback, profitability index, average accounting return, and the internal rate of return. Question: Which one of these is the most valuable from a financial point of view, and why? (Answer the question correctly and in-depth.)arrow_forwardWhich of the following is NOT a profitability ratio? Select one:a. Return on Equityb. Net Profit Marginc. Return on Assetsd. Average Collection Periodarrow_forwardIn the DuPont system, the return on total assets (asset) is equal to (return on equity) × (financial leverage multiplier). (net profit margin) × (fixed asset turnover). (return on equity) × (total asset turnover). (net profit margin) × (total asset turnover).arrow_forward

- Which of the following correctly orders the investment rules of average accounting return (AR), internal rate of return (IRR), and net present value (NPV) from the most desirable to the least desirable? a. IRR, AR, NPV. b. AR, IRR, NPV. c. NPV, AR, IRR. d. AR, NPV, IRR. e. NPV, IRR, AR.arrow_forwardQuick assets divided by current liabilities is the: Select one: a.Current ratio. b.Working capital ratio. c.Quick asset turnover ratio. d.Acid-test ratio.arrow_forwardWhich of the following measures the profitability of a division relative to the size of its investment in capital assets? A. residual Income (RI) B. sales margin C. return on investment (ROI) D. economic value added (EVA)arrow_forward

- Which approach to investment analysis is "best" in terms of accounting for both the timing and amount of revenue streams from a potential investment? A. the payback period B. the simple rate of return C. the net present value D. the internal rate of returnarrow_forwardDiscuss the impact of the following ratios and usefulness to users of financial statements. Gross profit Margin Return on capital employed Operating profit (PBIT) percentage Asset turnover Gearing ratioarrow_forwardThe higher the anticipated return on net operating assets (RNOA) relative to the anticipated growth in net operating assets, the higher will be the unlevered price-to-book ratio. Is this correct? Kindly answer the question with introduction and conclusion based on the concept of the question. Explain the answer properly considering the accounting aspect of it.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L...

Accounting

ISBN:9781337619455

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:Cengage Learning