ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

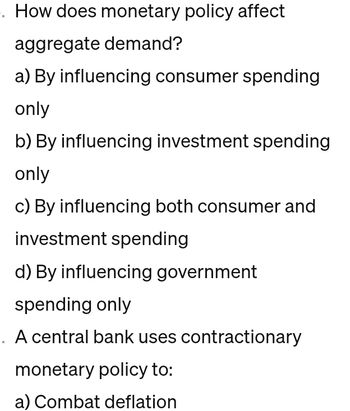

Transcribed Image Text:. How does monetary policy affect

aggregate demand?

a) By influencing consumer spending

only

b) By influencing investment spending

only

c) By influencing both consumer and

investment spending

d) By influencing government

spending only

-. A central bank uses contractionary

monetary policy to:

a) Combat deflation

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Considering how monetary policy affects the market, which of the following statements is most accurate? There is an indirect impact on aggregate demand by monetary policies. O There is more of an impact on consumption than investments by monetary policies. There is a direct impact on aggregate demand by monetary policies.arrow_forwardIn the AS/AD model, higher interest rates are produced by: Multiple Choice O O O O a steady-as-you-go monetary policy. a contractionary monetary policy. an expansionary monetary policy. an activist monetary policy.arrow_forwardStart with a brief introduction that explains use of Government policy to control the economy. When is it appropriate to use monetary and fiscal policy to stimulate or stabilize the economy? Look at both. When is it inappropriate to use monetary and fiscal policy to stimulate or stabilize the economy? Look at both. What specific fiscal policy tools would you use to stimulate aggregate demand and how? What specific monetary policy tools would you use to stimulate aggregate demand and how? What is your conclusion, should policymakers use the monetary and or fiscal policy, or a combination of both, to stimulate aggregate demand? Explain your reasoning.arrow_forward

- Which of the following supports the argument for hands-off policy? A. Monetary policy does not impact the economy. B. Fiscal policy does not impact the economy. C. Fine-tuning is not compatible with our design capabilities. D. The economy has been fairly stable since World War II.arrow_forwardA policy that results in slow and steady growth of the money supply is an example of A-an “easy” monetary policy. B-a “passive” monetary policy. C-a “practical” monetary policy. D-an “active” monetary policy.arrow_forwardFiscal and Monetary Policies are different in that a)Only fiscal policy tools may include taxation and stimulus checks for a country residents b)Only monetary policy tools may include targeting the Fed Funds rate c)Only Congress is authorized to approve spending associated with fiscal policy d)All of the abovearrow_forward

- If the U.S. government's budget deficits are increasing aggregate demand, and the economy is producing at a level that is substantially less than potential GDP, then: a) government borrowing is likely to crowd out private investment. b) an inflationary increase in the price level is in real danger. c) the central bank might react with an expansionary monetary policy. d) higher interest rates will crowd out private investment.arrow_forwardShould Monetary and Fiscal Policymakers Try to Stabilize the Economy? Explain.arrow_forwardUsing the aggregate demand and supply model shows how a government can manage aggregate demand. Faced with the possibility of recession explain how monetary policy may be used to rectify the position. How effective is such a policy likely to be?arrow_forward

- Boblandia produces no oil. It starts at potential GDP with inflation equal to the Central Bank's inflation target. Boblandia then sees a significant increase in the price of oil. Which of the following is true (according to our models) if the Central Bank engages in inflation targeting? The Central Bank will enact expansionary monetary policy. This action will put upward pressure on read GDP. The Central Bank will enact expansionary monetary policy. This action will put downward pressure on read GDP. The Central Bank will enact contractionary monetary policy. This action will put upward pressure on read GDP. The Central Bank will enact contractionary monetary policy. This action will put downward pressure on read GDP.arrow_forward2) When would the Federal Reserve want to carry out a monetary policy to decrease aggregate demand?arrow_forwardcan you answer this for mearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education