FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

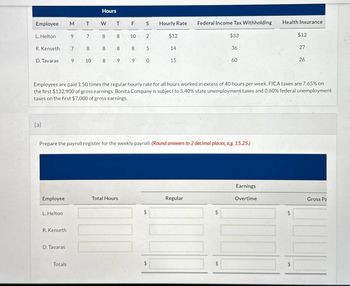

Transcribed Image Text:Hours

Employee

M

T

W

T

F

S

Hourly Rate

Federal Income Tax Withholding

Health Insurance

L. Helton

9

7

8

8

10

2

$12

$33

$12

R. Kenseth

7

8

8

8

8

5

14

36

27

D. Tavaras

9

10

8 9

9 0

15

60

26

Employees are paid 1.50 times the regular hourly rate for all hours worked in excess of 40 hours per week. FICA taxes are 7.65% on

the first $132,900 of gross earnings. Bonita Company is subject to 5.40% state unemployment taxes and 0.60% federal unemployment

taxes on the first $7,000 of gross earnings.

(a)

Prepare the payroll register for the weekly payroll. (Round answers to 2 decimal places, e.g. 15.25.)

Employee

Total Hours

L. Helton

R. Kenseth

D. Tavaras

Totals

Earnings

Regular

Overtime

Gross Pa

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Employee Earnings Record Mary’s Luxury Travel uses a weekly federal income tax withholding table. Refer to Figure 8-4 in the text. The payroll data for each employee for the week ended March 22, 20—, are given. Employees are paid 1½ times the regular rate for working over 40 hours a week. Name No. ofAllowances MaritalStatus Total HoursWorked Mar. 16–22 Rate Total EarningsJan. 1–Mar. 15 Bacon, Andrea 4 M 44 $14.00 $6,300.00 Cole, Andrew 1 S 40 15.00 6,150.00 Hicks, Melvin 3 M 44 13.50 5,805.00 Leung, Cara 1 S 36 14.00 5,600.00 Melling, Melissa 2 M 40 14.50 5,945.00 Social Security tax is withheld from the first $128,400 of earnings at the rate of 6.2%. Medicare tax is withheld at the rate of 1.45%, and city earnings tax at the rate of 1%, both applied to gross pay. Bacon and Leung have $15 withheld and Cole and Hicks have $10 withheld for health insurance. Bacon and Leung have $20 withheld to be invested in the travel agency’s credit union. Cole has $38.75…arrow_forwardjlp.2arrow_forwardBMX Company has one employee. FICA Social Security taxes are 6.2% of the first $137,700 paid to its employee, and FICA Medicare taxes are 1.45% of gross pay. For BMX, its FUTA taxes are 0.6% and SUTA taxes are 5.4% of the first $7,000 paid to its employee. Gross Pay through August 31 Gross Pay for September a. $ 6,700 $ 400 b. 2,300 2,400 c. 131,700 8,300 Prepare the employer's September 30 journal entry to record accrued salary expense and its related payroll liabilities for this employee.arrow_forward

- BMX Company has one employee. FICA Social Security taxes are 6.2% of the first $118,500 paid to its employee, and FICA Medicare taxes are 1.45% of gross pay. For BMX, its FUTA taxes are 0.6% and SUTA taxes are 2.9% of the first $7,000 paid to its employee. Gross Pay through August Gross Pay for September a. $ 6,400 $ 800 b. 18,200 2,100 c. 112,200 8,000 Prepare the employer's September 30 journal entry to record accrued salary expense and its related payroll liabilities for this employee.arrow_forwardBMX Company has one employee. FICA Social Security taxes are 6.2% of the first $137,700 paid to its employee, and FICA Medicare taxes are 1.45% of gross pay. For BMX, its FUTA taxes are 0.6% and SUTA taxes are 5.4% of the first $7,000 paid to its employee. b. C. Gross Pay through August 31 $ 6,700 2,300 131,700 Exercise 9-8 (Algo) Payroll-related journal entries LO P2 Assuming situation (a), prepare the employer's September 30 journal entry to record salary expense and its related payroll liabilities this employee. The employee's federal income taxes withheld by the employer are $90 for this pay period. Complete this question by entering your answers in the tabs below. Taxes to be Withheld From Gross Pay Gross Pay for September $ 400 2,400 8,300 General Journal The employee's federal income taxes withheld by the employer are $90 for this pay period. Assuming situation (a), compute the taxes to be withheld from gross pay for this employee. (Round your answers to 2 decimal places.)…arrow_forwardA-5arrow_forward

- Mary’s Luxury Travel uses a weekly federal income tax withholding table. Refer to Figure 8-4 in the text. The payroll data for each employee for the week ended March 22, 20—, are given. Employees are paid 1½ times the regular rate for working over 40 hours a week. Name No. ofAllowances Marital Status Total Hours Worked Mar. 16–22 Rate Total EarningsJan. 1–Mar. 15 Bacon, Andrea 4 M 44 $12.00 $5,500.00 Cole, Andrew 1 S 40 12.00 5,860.00 Hicks, Melvin 3 M 43 10.50 4,820.00 Leung, Cara 1 S 35 11.00 5,056.50 Melling, Melissa 2 M 40 13.00 4,727.00 Social Security tax is withheld from the first $128,400 of earnings at the rate of 6.2%. Medicare tax is withheld at the rate of 1.45%, and city earnings tax at the rate of 1%, both applied to gross pay. Bacon and Leung have $13 withheld and Cole and Hicks have $4 withheld for health insurance. Bacon and Leung have $22 withheld to be invested in the travel agency’s credit union. Cole has $38.00 withheld and Hicks has…arrow_forwardEmployee Earnings Record Mary’s Luxury Travel uses a weekly federal income tax withholding table. Refer to Figure 8-4 in the text. The payroll data for each employee for the week ended March 22, 20—, are given. Employees are paid 1½ times the regular rate for working over 40 hours a week. Name No. ofAllowances MaritalStatus Total HoursWorked Mar. 16–22 Rate Total EarningsJan. 1–Mar. 15 Bacon, Andrea 4 M 44 $14.00 $6,300.00 Cole, Andrew 1 S 40 15.00 6,150.00 Hicks, Melvin 3 M 44 13.50 5,805.00 Leung, Cara 1 S 36 14.00 5,600.00 Melling, Melissa 2 M 40 14.50 5,945.00 Social Security tax is withheld from the first $128,400 of earnings at the rate of 6.2%. Medicare tax is withheld at the rate of 1.45%, and city earnings tax at the rate of 1%, both applied to gross pay. Bacon and Leung have $15 withheld and Cole and Hicks have $10 withheld for health insurance. Bacon and Leung have $20 withheld to be invested in the travel agency’s credit union. Cole has $38.75…arrow_forwardEmployee Net Pay Kenneth Inverness's weekly gross earnings for the week ended April 22 were $1,000, and his federal income tax withholding was $180. Assuming the social security rate is 6% and Medicare is 1.5%, what is Kenneth's net pay? Note: If required, round your answer to two decimal places. All work saved.arrow_forward

- BMX Company has one employee. FICA Social Security taxes are 6.2% of the first $137,700 paid to its employee, and FICA Medicare taxes are 1.45% of gross pay. For BMX, its FUTA taxes are 0.6% and SUTA taxes are 5.4% of the first $7,000 paid to its employee. a. b. c. Gross Pay through August 31 $ 6,400 2,700 133,300 Gross Pay for September $1,700 2,800 9,900 Assuming situation (a), prepare the employer's September 30 journal entry to record the employer's payroll taxes expense and its related liabilities. Complete this question by entering your answer in the tabs below. Employer Payroll taxes Payroll Taxes General Journal Expense Assuming situation (a), compute the payroll taxes expense. (Round your answers to 2 decimal places.) September earnings subject to tax Tax Ratearrow_forwardPayroll Review ProblemCalculate payroll for Uno company’s one employee for the first week of March. Their only employee worked 50 hours and makes $12/hour. The employee has not exceeded any of the wage or tax limits. Use the tax rates as follows: TAX RATE LIMITS FICA – Soc Sec 6.20% $118,500 FICA – Medicare 1.45% None Fed Inc Tax 8.00% None FUTA 0.60% $7,000 SUTA 5.40% $12,000 Required: Calculate gross pay, deductions, and net pay. Prepare the journal entry to record wages expense and its related payroll liabilities for the employee’s payroll. Prepare the journal entry to record the payroll tax expense and related liabilities for Uno Company’s payroll.arrow_forwardUramilabenarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education