FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

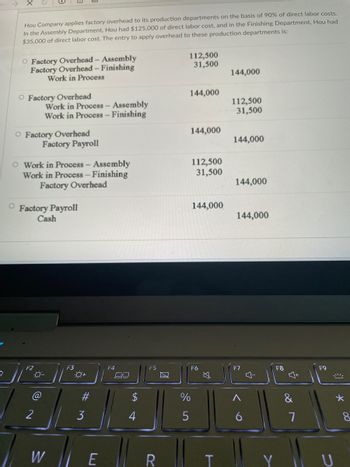

Transcribed Image Text:Hou Company applies factory overhead to its production departments on the basis of 90% of direct labor costs.

In the Assembly Department, Hou had $125,000 of direct labor cost, and in the Finishing Department, Hou had

$35,000 of direct labor cost. The entry to apply overhead to these production departments is:

O Factory Overhead - Assembly

Factory Overhead - Finishing

Work in Process

112,500

31,500

144,000

O Factory Overhead

144,000

112,500

Work in Process - Assembly

Work in Process - Finishing

31,500

O Factory Overhead

144,000

Factory Payroll

144,000

112,500

O Work in Process - Assembly

Work in Process - Finishing

Factory Overhead

31,500

144,000

O

Factory Payroll

Cash

144,000

144,000

F3

F2

0-

@

2

W

0+

3

E

F4

CO

4

F5

R

%

5

F6

T

F7

6

다

F8

Y

80

7

F9

U

*

8

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Calculating Activity-Based Costing Overhead Rates Assume that manufacturing overhead for Glassman Company consisted of the following activities and costs: Setup (1,000 setup hours) $148,000 Production scheduling (400 batches) 64,000 Production engineering (60 change orders) 120,000 Supervision (2,000 direct labor hours) 56,000 Machine maintenance (12,000 machine hours) 84,000 Total activity costs $472,000 The following additional data were provided for Job 845 Direct materials costs $8,000 Direct labor cost (5 Milling direct labor hours; 35 Finishing direct labor hours) $2,000 Setup hours 5 hours Production scheduling 1 batch Machine hours used (25 Milling machine hours; 5 Finishing machine hours) 30 hours Production engineering 3 change orders a. Calculate the cost per unit of activity driver for each activity cost category. Setup Production scheduling cost Production engineering cost Supervision cost Machine…arrow_forwardWaterway Manufacturing assigns overhead based on machine hours. Department R records 608 machine hours, while Department W records 392 machine hours for the period. The overhead rate is $6 per machine hour. What will the entry to assign overhead include? Select answer from the options below A debit to Manufacturing Overhead for $6000. A credit to Manufacturing Overhead for $6000. A debit to Work in Process Inventory-Department W for $2352. A credit to Work in Process Inventory-Department R for $3648.arrow_forwardBraverman Company has two manufacturing departments-Finishing and Fabrication. The predetermined overhead rates in Finishing and Fabrication are $15.00 per direct labor-hour and 120% of direct materials cost, respectively. The company's direct labor wage rat is $22.00 per hour. The following information pertains to Job 700: Direct materials Direct labor Required: Finishing $ 440 Fabrication $ 65 $ 242 $ 154 1. What is the total manufacturing cost assigned to Job 700? 2. If Job 700 consists of 30 units, what is the unit product cost for this job? (Round your answer to 2 decimal places.)arrow_forward

- Fickel Company has two manufacturing departments-Assembly and Testing & Packaging. The predetermined overhead rates in Assembly and Testing & Packaging are $26.00 per direct labor-hour and $22.00 per direct labor-hour, respectively. The company's direct labor wage rate is $28.00 per hour. The following information pertains to Job N-60: Direct materials Direct labor Assembly $ 410 $ 322 1. Total manufacturing cost 2. Unit product cost Testing & Packaging $ 53 $70 Required: 1. What is the total manufacturing cost assigned to Job N-60? (Do not round intermediate calculations.) 2. If Job N-60 consists of 10 units, what is the unit product cost for this job? (Do not round intermediate calculations. Round your answer to 2 decimal places.) per unitarrow_forwardThe following is taken from Clausen Company’s internal records of its factory with two operating departments. The cost driver for indirect labor is direct labor hours, and the cost driver for the remaining items is number of hours of machine use. Compute the total amount of indirect labor allocated to Dept. 2 using activity-based costing. Direct Labor Hours Machine Hours Operating Dept. 1 1,020 9,600 Operating Dept. 2 2,380 6,400 Totals 3,400 16,000 Factory overhead costs Rent and utilities $ 22,900 Indirect labor 18,500 Depreciation - Equipment 15,600 Total factory overhead $ 57,000arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education