Cornerstones of Financial Accounting

4th Edition

ISBN: 9781337690881

Author: Jay Rich, Jeff Jones

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Answer

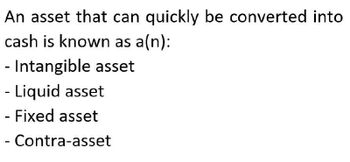

Transcribed Image Text:An asset that can quickly be converted into

cash is known as a(n):

- Intangible asset

- Liquid asset

- Fixed asset

- Contra-asset

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Distinguish between current assets and non-current assets, giving TWO examples of each type of asset.arrow_forwardDiscuss and explain the tension between “Asset Transformation” and “Asset Conversion”arrow_forwardA right of use asset is initially measured at costs and subsequently measured using the A. Cost model B. Fair value model C. Revaluation model D. Any of thesearrow_forward

- These include both tangible assets such as (b) and intangible assets such as (c). To pay for these assets, they sell (d) assets such as (e). The decision about ...arrow_forwardFind the "Asset turnover"!arrow_forwardAssets are often classified into current assets, long-term investments, plant assets, and intangible assets. Group of answer choices True Falsearrow_forward

- the amortization of intangible assets with finite useful lives is justified by the : a- economic entity assumption b- going concern assumption c- monetary unit assumption d- historical cost assumptionarrow_forwardThe term "Fixed Assets" means the same thing as: Multiple Choice Intangible Assets. Current Assets. Natural Resources. Merchandise Inventory. Plant Assets.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Auditing: A Risk Based-Approach to Conducting a Q...AccountingISBN:9781305080577Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:South-Western College Pub

Auditing: A Risk Based-Approach to Conducting a Q...AccountingISBN:9781305080577Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:South-Western College Pub

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Auditing: A Risk Based-Approach to Conducting a Q...

Accounting

ISBN:9781305080577

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:South-Western College Pub