FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

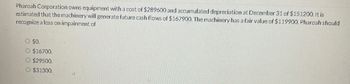

Transcribed Image Text:Pharoah Corporation owns equipment with a cost of $289600 and accumulated depreciation at December 31 of $151200. It is

estimated that the machinery will generate future cash flows of $167900. The machinery has a fair value of $119900. Pharoah should

recognize a loss on impairment of

$0.

O $16700.

○ $29500.

○ $31300.

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Crane Company owns machinery with a book value of $750000. It is estimated that the machinery will generate future cash flows of $690000. The machinery has a fair value of $550000. Crane should recognize a loss on impairment of $200000. a. $ -0-. b. $140000. c. $60000.arrow_forwardGodoarrow_forwardT2.arrow_forward

- Flanagan Concrete owns equipment with a book value of $3,500,000. The equipment is estimated to generate future cash flows of $2,975,000. The equipment has a fair value of $2,890,000. The journal entry to record the impairment loss will a.) increase the asset’s Accumulated Depreciation account by $610,000. b.) include a $610,000 credit to the Equipment account. c.) record a loss of $85,000. d.) reduce income from continuing operations by $525,000.arrow_forwardToro Co. has equipment with a carrying amount of$700,000. The expected future net cash flows from theequipment are $705,000, and its fair value is $590,000.The equipment is expected to be used in operations inthe future. What amount (if any) should Toro report asan impairment to its equipment?arrow_forwardDomesticarrow_forward

- Splish Brothers Inc. owns equipment that cost $627,000 and has accumulated depreciation of $162,000. The expected future net cash flows from the use of the asset are expected to be $414,000. The fair value of the equipment is $358,000.Prepare the journal entry, if any, to record the impairment loss. (If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Account Titles and Explanation Debit Credit enter an account title enter a debit amount enter a credit amount enter an account title enter a debit amount enter a credit amountarrow_forwardShamrock Inc. owns equipment that cost $605,000 and has accumulated depreciation of $157,000. The expected future net cash flows from the use of the asset are expected to be $400,000. The fair value of the equipment is $346,000. Prepare the journal entry, if any, to record the impairment loss. (If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Account Titles and Explanation Debit Creditarrow_forwardGadubhaiarrow_forward

- Martinez Company owns equipment that cost $1,053,000 and has accumulated depreciation of $444,600. The expected future net cash flows from the use of the asset are expected to be $585,000. The fair value of the equipment is $468,000.Prepare the journal entry, if any, to record the impairment loss. (If no entry is required, select "No entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Account Titles and Explanation Debit Creditarrow_forward* Your answer is incorrect. Bramble Company owns equipment that cost $1,026,000 and has accumulated depreciation of $433,200. The expected future net cash flows from the use of the asset are expected to be $620,000. The fair value of the equipment is $456,000. Prepare the journal entry, if any, to record the impairment loss. (If no entry is required, select "No entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually. List debit entry before credit entry.) Account Titles and Explanation Accumulated Depreciation - Equipment Loss on Impairment eTextbook and Media List of Accounts Debit 592800 0 Credit 0 592800arrow_forwardSage Hill Inc. owns equipment that cost $594,000 and has accumulated depreciation of $154,000. The expected future net cash flows from the use of the asset are expected to be $392,000. The fair value of the equipment is $339,000. Prepare the journal entry, if any, to record the impairment loss. (If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Account Titles and Explanation Debit Creditarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education