FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

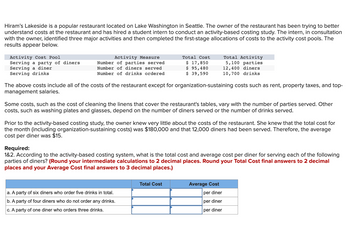

Transcribed Image Text:Hiram's Lakeside is a popular restaurant located on Lake Washington in Seattle. The owner of the restaurant has been trying to better

understand costs at the restaurant and has hired a student intern to conduct an activity-based costing study. The intern, in consultation

with the owner, identified three major activities and then completed the first-stage allocations of costs to the activity cost pools. The

results appear below.

Activity Cost Pool

Serving a party of diners

Serving a diner

Serving drinks

Activity Measure

Number of parties served

Number of diners served

Number of drinks ordered

Total Cost

$ 17,850

$ 95,480

$ 39,590

The above costs include all of the costs of the restaurant except for organization-sustaining costs such as rent, property taxes, and top-

management salaries.

Some costs, such as the cost of cleaning the linens that cover the restaurant's tables, vary with the number of parties served. Other

costs, such as washing plates and glasses, depend on the number of diners served or the number of drinks served.

Total Activity

5,100 parties

12,400 diners

10,700 drinks

Prior to the activity-based costing study, the owner knew very little about the costs of the restaurant. She knew that the total cost for

the month (including organization-sustaining costs) was $180,000 and that 12,000 diners had been served. Therefore, the average

cost per diner was $15.

a. A party of six diners who order five drinks in total.

b. A party of four diners who do not order any drinks.

c. A party of one diner who orders three drinks.

Required:

1&2. According to the activity-based costing system, what is the total cost and average cost per diner for serving each of the following

parties of diners? (Round your intermediate calculations to 2 decimal places. Round your Total Cost final answers to 2 decimal

places and your Average Cost final answers to 3 decimal places.)

Total Cost

Average Cost

per diner

per diner

per diner

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Alvarez Manufacturing Inc. is a job shop. The management of Alvarez Manufacturing Inc. uses the cost information from the job sheets to assess cost performance. Information on the total cost, product type, and quantity of items produced is as follows: See Attachment a. Develop a graph for each product (three graphs) with Job Number (in date order) on the horizontal axis and Unit Cost on the vertical axis. Use this information to determine Alvarez Manufacturing Inc.’s cost performance over time for the three products.b. What additional information would you require in order to investigate Alvarez Manufacturing Inc.’s cost performance more precisely?arrow_forwardPixel Studio, Inc., is a small company that creates computer-generated animations for films and television. Much of the company’s work consists of short commercials for television, but the company also does realistic computer animations for special effects in movies. The young founders of the company have become increasingly concerned with the economics of the business—particularly since many competitors have sprung up recently in the local area. To help understand the company’s cost structure, an activity-based costing system has been designed. Three major activities are carried out in the company: animation concept, animation production, and contract administration. The animation concept activity is carried out at the contract proposal stage when the company bids on projects. This is an intensive activity that involves individuals from all parts of the company in creating story boards and prototype stills to be shown to the prospective client. Once a project is accepted by the…arrow_forwardDanielle Hastings was recently hired as a cost analyst by CareNet Medical Supplies Inc. One of Danielle’s first assignments was to perform a net present value analysis for a new warehouse. Danielle performed the analysis and calculated a present value index of 0.75. The plant manager, Jerrod Moore, is very intent on purchasing the warehouse because be believes that more storage space is needed. Jerrod asks Danielle into his office and the following conversation takes place: Jerrod: Danielle, you’re new here, aren’t you? Danielle: Yes, I am. Jerrod: Well, Danielle, I’m not at all pleased with capital investment analysis that you performed on this new warehouse. I need that warehouse for my production. If I don’t get it, where am I going to place out output? Danielle: Well, we need to get product into our customer’s hands. Jerrod: I agree, and we need a warehouse to do that. Danielle: My analysis does not support constructing a new warehouse. The numbers don’t lie; the warehouse does not…arrow_forward

- Pacific Decor, Inc., designs, manufactures, and sells contemporary wood furniture. Ling Li is a furniture designer for Pacific. Li has spent much of the past month working on the design of a high-end dining room table. The design has been well-received by Jose Alvarez, the product development manager. However, Alvarez wants to make sure that the table can be priced competitively. Amy Hoover, Pacific's cost accountant, presents Alvarez with the following cost data for the expected production of 200 tables: Design cost $ 5,000 Direct materials 120,000 Direct manufacturing labor Variable manufacturing overhead Fixed manufacturing overhead 142,000 64,000 46,500 Marketing 15,000 1. Alvarez thinks that Pacific can successfully market the table for $2,000. The company's target operating income is 10% of revenue. Calculate the target full cost of producing the 200 tables. Does the cost estimate developed by Hoover meet Pacific's requirements? Is value engineering needed? 2. Alvarez discovers…arrow_forwardAn activity based costing system is being considered at Evelia, nv to assign products overhead costs; these overhead costs are currently assigned strictly by number of units produced. First, the two overhead costs of Rent expense and Insurance expense would be allocated to three activity cost pools - Finishing, Sanding, and Other - based on resource consumption. The information used to perform these allocations is below: Overhead Costs: Rent expense: $2,000,000 Insurance expense: $1,650,000 Distribution of Resource Consumption across Activity Cost Pools: Overhead Cost Activity Cost Pools Finishing Sanding Other Rent expense 0.45 0.25 0.30 Insurance expense 0.20 0.35 0.45 In the second stage, Finishing costs would be assigned to products using direct labor hours and Sanding costs would be assigned to products using the number of machine hours. The costs in the Other activity pool would not be assigned to products. Activity data for the company's two products is as…arrow_forwardRichard's Events provides catering services, among other services. The company has adopted activity-based costing (ABC) for the catering services. The ABC system classifies activities into two groups based on the cost driver used: Diners and Events. Each event is limited to 25 guests and requires four people to serve and clean up. Richard's Events offers two types of catered events—an informal, outside party and a formal, seated meal. The cost accountant at Richard's Events has developed the following cost-driver rates for the individual activities: Activities (and cost drivers) Informal Party Formal Dinner Advertising (events) $ 124 per event $ 124 per event Planning (events) 94 per event 154 per event Renting equipment (events, diners) 64 per event plus 14 per diner 94 per event plus 26 per diner Obtaining insurance (events) 244 per event 484 per event Serving (events) 244 per event 364 per event Preparing food (diners) 26 per diner 38 per diner…arrow_forward

- Hiram's Lakeside is a popular restaurant located on Lake Washington in Seattle. The owner of the restaurant has been trying to better understand costs at the restaurant and has hired a student intern to conduct an activity-based costing study. The intern, in consultation with the owner, identified three major activities and then completed the first-stage allocations of costs to the activity cost pools. The results appear below. Activity Cost Pool Serving a party of diners Serving a diner Serving drinks Activity Measure Number of parties served Number of diners served Number of drinks ordered Total Cost $ 12,240 $ 118,680 $ 27,040 The above costs include all of the costs of the restaurant except for organization-sustaining costs such as rent, property taxes, and top- management salaries. Some costs, such as the cost of cleaning the linens that cover the restaurant's tables, vary with the number of parties served. Other costs, such as washing plates and glasses, depend on the number of…arrow_forwardVikarmbhaiarrow_forwardThe following situations describe decision scenarios that could use managerial accounting information: The manager of High Times Restaurant wishes to determine the price to charge for various lunch plates. By evaluating the cost of leftover materials, the plant manager of a precision tool facility wishes to determine how effectively the plant is being run. The division controller of West Coast Supplies needs to determine the cost of products left in inventory. The manager of the Maintenance Department of a large manufacturing company wishes to plan next year’s anticipated expenditures. For each situation, discuss how managerial accounting information could be used. b) What are the major differences between managerial accounting and financial accounting?arrow_forward

- Cathy, the manager of Cathy’s Catering, Inc., uses activity-based costing to compute the costs of her catered parties. Each party is limited to 20 guests and requires 5 people to serve and clean up. Cathy offers two types of parties—an afternoon picnic and an evening formal dinner. The breakdown of the costs follows. Activities (and cost drivers) Afternoon Picnic Formal Dinner Advertising (parties) $ 81 per party $ 81 per party Planning (parties) $ 54 per party $ 124 per party Renting equipment (parties, guests) $ 49 per party plus $12 per guest $ 71 per party plus $23 per guest Obtaining insurance (parties) $ 220 per party $ 355 per party Serving (parties, servers) $ 58 per server per party $ 70 per server per party Preparing food (guests) $ 18 per guest $ 31 per guest Per party costs do not vary with the number of guests. Required: a. Compute the cost of a 20-guest afternoon picnic. b. Compute the cost of a 20-guest evening formal dinner. c. How much…arrow_forwardJohnson Gardening Company provides lawn and garden services to its clients. The company uses an activity-based costing system for its overhead costs. The company has provided the following data from its activity-based costing system. Activity Cost Pool Total Cost Total Activity Mowing/trimming $150,750 12,250 hours Job support 25,725 1,800 jobs Client support 7,250 250 clients Other 100,000 Not applicable Total $283,725 The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs. One particular client, the Guzman family, requested 26 jobs during the year that required a total of 150 hours of gardening. For these services, the client was charged $5,000.Required:a.…arrow_forwardNorth Street Corporation manufactures two models of motorized go - carts, a standard and a deluxe model. The following activity and cost information has been compiled: Number of Number of Number of Product Setups Components Direct Labor Hours Standard 16 7 730 Deluxe 34 19 490 Overhead costs $16,000 $24,960 Number of setups and number of components are identified as activity - cost drivers for overhead. Assuming an activity - based costing system is used, what is the total amount of overhead cost assigned to the standard model? (Do not round interim calculations. Round the final answer to the nearest whole dollar.) O A. $17,600 O B. $11,840 OC. $29,120 O D. $20,480arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education