FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

![!

Required information

[The following information applies to the questions displayed below.]

Felix & Company reports the following information.

Period Units Produced

0

560

960

123456789

10

1,360

1,760

2,160

2,560

2,960

3,360

3,760

Total Costs

$ 4,660

3,960

4,360

4,960

4,060

4,260

8,760

16,160

4,960

11,992

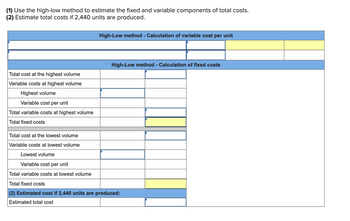

(1) Use the high-low method to estimate the fixed and variable components of total costs.

(2) Estimate total costs if 2,440 units are produced.](https://content.bartleby.com/qna-images/question/cba5c243-d3c4-478f-8b27-e10a19198737/cf836677-f329-43a3-8253-be66cbd8cbd0/hk81qpj_thumbnail.png)

Transcribed Image Text:!

Required information

[The following information applies to the questions displayed below.]

Felix & Company reports the following information.

Period Units Produced

0

560

960

123456789

10

1,360

1,760

2,160

2,560

2,960

3,360

3,760

Total Costs

$ 4,660

3,960

4,360

4,960

4,060

4,260

8,760

16,160

4,960

11,992

(1) Use the high-low method to estimate the fixed and variable components of total costs.

(2) Estimate total costs if 2,440 units are produced.

Transcribed Image Text:(1) Use the high-low method to estimate the fixed and variable components of total costs.

(2) Estimate total costs if 2,440 units are produced.

Total cost at the highest volume

Variable costs at highest volume

Highest volume

Variable cost per unit

Total variable costs at highest volume

Total fixed costs

High-Low method - Calculation of variable cost per unit

High-Low method - Calculation of fixed costs

Total cost at the lowest volume

Variable costs at lowest volume

Lowest volume

Variable cost per unit

Total variable costs at lowest volume

Total fixed costs

(2) Estimated cost if 2,440 units are produced:

Estimated total cost

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- send to expert Required information Cost Classifications (Algo) Skip to question [The following information applies to the questions displayed below.] Kubin Company's relevant range of production is 15,000 to 19,000 units. When it produces and sells 17,000 units, its average costs per unit are as follows: Average Cost per Unit Direct materials $ 7.60 Direct labor $ 4.60 Variable manufacturing overhead $ 2.10 Fixed manufacturing overhead $ 5.60 Fixed selling expense $ 4.10 Fixed administrative expense $ 3.10 Sales commissions $ 1.60 Variable administrative expense $ 1.10 Exercise 1 - 10 (Algo) Differential Costs and Sunk Costs [LO1 - 5] Required: What is the incremental manufacturing cost incurred if the company increases production from 17,000 to 17,001 units? What is the incremental cost incurred if the company increases production and sales from 17,000 to 17,001 units? Assume Kubin Company produced 17,000 units and expects to sell 16,740 of them. If a new customer unexpectedly…arrow_forwardPlease answer completearrow_forward! Required information Use the following information for the Quick Study below. (Algo) [The following information applies to the questions displayed below.] Ramort Company reports the following for its single product. Ramort produced and sold 20,600 units this year. Direct materials Direct labor Variable overhead Fixed overhead Variable selling and administrative expenses Fixed selling and administrative expenses Sales price Compute gross profit under absorption costing. $ 13 per unit $ 15 per unit $6 per unit $ 41,200 per year $2 per unit QS 19-9 (Algo) Computing gross profit under absorption costing LO P2 RAMORT COMPANY Gross Profit (Absorption Costing) $ 65,800 per year $ 69 per unitarrow_forward

- ! Required information [The following information applies to the questions displayed below.] Felix & Company reports the following information. Period 1 Units Produced Total Costs 0 $ 2,820 123456789 200 3,660 400 4,500 600 5,340 800 6,180 1,000 7,020 1,200 7,860 1,400 8,700 1,600 9,540 10 1,800 10,380 (1) Use the high-low method to estimate the fixed and variable components of total costs. (2) Estimate total costs if 2,820 units are produced.arrow_forwardPlease do not give solution in image format thankuarrow_forwardplease answer within the format by providing formula the detailed workingPlease provide answer in text (Without image)Please provide answer in text (Without image)Please provide answer in text (Without image)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education