ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

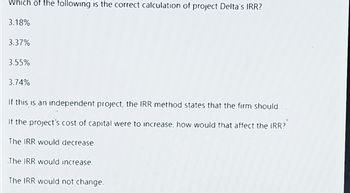

Transcribed Image Text:Which of the following is the correct calculation of project Delta's IRR?

3.18%

3.37%

3.55%

3.74%

If this is an independent project, the IRR method states that the firm should

If the project's cost of capital were to increase, how would that affect the IRR?

The IRR would decrease.

The IRR would increase.

The IRR would not change.

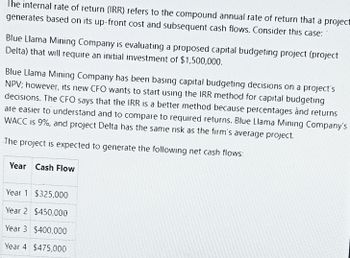

Transcribed Image Text:The internal rate of return (IRR) refers to the compound annual rate of return that a project

generates based on its up-front cost and subsequent cash flows. Consider this case:

Blue Llama Mining Company is evaluating a proposed capital budgeting project (project

Delta) that will require an initial investment of $1,500,000.

Blue Llama Mining Company has been basing capital budgeting decisions on a project's

NPV; however, its new CFO wants to start using the IRR method for capital budgeting

decisions. The CFO says that the IRR is a better method because percentages and returns

are easier to understand and to compare to required returns. Blue Llama Mining Company's

WACC is 9%, and project Delta has the same risk as the firm's average project.

The project is expected to generate the following net cash flows:

Year Cash Flow

Year 1 $325,000

Year 2 $450,000

Year 3 $400,000

Year 4 $475,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- If mutually exclusive projects with normal cash flows are being analyzed, the net present value (NPV) and internal rate of return (IRR) methods always agree. Projects Y and Z are mutually exclusive projects. Their cash flows and NPV profiles are shown as follows. Year Project Y Project Z 0 -$1,500 -$1,500 1 $200 $900 2 $400 $600 3 $600 $300 4 $1,000 $200 NPV (Dollars) 800 600 Project Y 400 Project Z 200 -200 0246 8 10 12 14 16 18 20 COST OF CAPITAL (Percent) If the weighted average cost of capital (WACC) for each project is 14%, do the NPV and IRR methods agree or conflict? O The methods agree. O The methods conflict.arrow_forwardE1arrow_forward7.11 Determine the rate of return for the following cash flow series. 4000 2 3 i=? 300 300 300 300 6 7 12,000 8 100 100 100 Instruction: Use both the trial and error method and MS. Excel. Hint: You may solve first by MS Excel to find the initial trial and error starting point. Yeararrow_forward

- The fixed cost at Harley Motors are $ 1 Million annually. The min. product has revenue of $8.90 per unit and $4.50 variable cost. Determine the Break even quantity per year (A) 227,273 B 22,723 112,360 (D) 111,273arrow_forwardOne of the concerns of economists and policy makers is the share of the labor factor in the total income of the economy. Differently, what part of the GDP goes to the workers and what part of the GDP goes to the owners of the companies. A growth in income inequalities should translate into a ** drop * in the labor factor. GDP data in terms of income allows us to see what is happening in the case of Canada. kt = i + (1 – 8)k;-1 %3D Yt = At · k1 Ct = (1 – s) · Yt Yt = C + i %3D R = a A¿'• k 1 (a-1) wi = (1 – a) · Yt %3D where kt is the stock of productive capital per worker at the end of period t, yt ,ct and it represent GDP, consumption, and investment in productive capital, Rt is the interest rate in the economy and wt is the salary. At is the level of productivity in the economy and is considered exogenous, as is the share of capital in production a and the household s savings rate. A) Given the information provided, what are the endogenous variables of the model? B) Now assume that…arrow_forwardYou have an opportunity to invest $49,300 now in return for 500,500 in one year. If your cost of capital is 7 8%, what is the NPV of this investment? The NPV will be $(Round to the nearest cent) CODEDarrow_forward

- i will 10 upvote no chatgptarrow_forwardA project has an investment of $150,000 in year 0 and an additional investment of $20,000 at the end of year Project starts producing net cash inflows of $50,000 end of years years 2-7 (years 2 to years 7? What is the internal rate of return (IRR) of this Project? A 12.00% 13.77% 14.51% 15.00% 21.13%arrow_forwardAnalyze a CSR capital investment proposal for Ganon Inc. Ganon Inc. is evaluating a proposal to replace its HID (high intensity discharge) lighting with LED (light emitting diode) lighting throughout its warehouse. LED lighting consumes less power and lasts longer than HID lighting for similar performance. The following information was developed: Line Item Description Value HID watt hour consumption per fixture 500 watts per hr. LED watt hour consumption per fixture 300 watts per hr. Number of fixtures 800 Lifetime investment cost (in present value terms) to replace each HID fixture with LED $300 Operating hours per day 10 Operating days per year 300 Metered utility rate per kilowatt-hour (kwh)* $0.12 *Note: A kilowatt-hour is equal to 1,000 watts per hour. a. Determine the investment cost for replacing the 800 fixtures.fill in the blank 1 of 1$ b. Determine the annual utility cost savings from employing the new energy solution.fill in the blank 1 of 1$ c. Should…arrow_forward

- Describe the process of determining the equivalent annual worth of the project and the unit profit per production?arrow_forwardA project has an initial cost of $65,000, expected net cash inflows of $11,000 per year for 12 years, and a cost of capital of 11%. What is the project's MIRR? (Hint: Begin by constructing a time line.) Do not round intermediate calculations. Round your answer to two decimal places.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education