FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

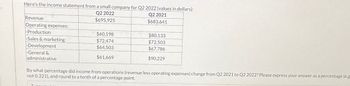

Transcribed Image Text:Here's the income statement from a small company for Q2 2022 (values in dollars):

Q2 2022

Q2 2021

$695,925

$683,641

Revenue

Operating expenses:

-Production

-Sales & marketing

-Development

-General &

administrative

$60,198

$72,474

$64,503

$61,669

$80,133

$72,503

$67,786

$90,229

By what percentage did income from operations (revenue less operating expenses) change from Q2 2021 to Q2 2022? Please express your answer as a percentage (e.g

not 0.321), and round to a tenth of a percentage point.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Cochran corporation, Inc. has the following income statement: Cochran corporation, Inc. Income statement For the year ended December 31, 2021 net sales $240 Cost of goods sold $150 gross profit $90 Operating expenses $65 Net income $25 Using vertical analysis, what percentage is assigned to operating expenses? a. 27,1% b. 43.3% c. 72.2% d. 260.0%arrow_forwardQuestion: Vertical Analysis of the Income statement Company A Company B Net sales 2,300,000 300,000 Cost of goods sold 1,100,000 200,000 Gross profit 1,200,000 100,000 Operating Expenses: Administrative expenses 120,000 20,000 Marketing expenses 220,000 30,000 Research and Development 500,000 10,000 Total Operating expenses 840,000 60,000 Interest expense 200,000 10,000 Net income 160,000 30,000 Required: Prepare a vertical analysis of these two companies. Compare and contrast the financial situation of these two companies assuming that they are in the same industry. Discuss fully.arrow_forwardanswer the questionsarrow_forward

- Return on Total Assets A company reports the following income statement and balance sheet information for the current year: Net income $157,080 Interest expense 27,720 Average total assets 2,800,000 Determine the return on total assets? If required, round the answer to one decimal place.arrow_forwardSheffield Enterprises reports the following information for 2026: Net sales Cost of goods sold Average common stockholders' equity Average total assets Total assets Retained Earnings Net income Sheffield's gross profit margin is $2325000 1585650 1219000 679000 783000 596000 433000arrow_forwardfarrow_forward

- Blossom Manufacturing Ltd.'s sales for the year ended December 31, 2022 are $1.00 million. The expenses for 2022 are as follows: Cost of goods sold Selling expenses Administrative expenses Variable $320,000 56,000 27,920 Fixed $180,000 26,400 36,000 Prepare a detailed CVP income statement for the year ended December 31, 2022. Blossom Manufacturing Ltd. CVP Income Statement $ $arrow_forwardSelected current year company information follows: Net income Net sales Total liabilities, beginning-year Total liabilities, end-of-year $ 16,553 718,855 89,932 109,201 Total stockholders' equity, beginning-year 204,935 Total stockholders' equity, end-of-year 130,851 What is the return on total assets? (Do not round intermediate calculations.).arrow_forwardSelected income statement data for Abbott Laboratories, Bristol-Myers Squibb Company, Johnson & Johnson, GlaxoSmithKline plc, and Pfizer, Inc. is presented in the following table: Bristol- Johnson Glaxo Abbott Мyers & Smith ($ millions) Laboratories Squibb Johnson Kline plc Pfizer Sales revenue $38,851 $21,244 $65,030 £27,387 $67,425 Cost of sales 15,541 5,598 20,360 7,332 15,085 SG&A expense 12,757 5,160 20,969 8,826 19,468 R&D expense 4,129 3,839 7,548 4,009 9,112 Interest expense 530 145 571 799 1,681 Net income 4,728 5,260 9,672 5,458 10,051 Required a. Compute the profit margin (PM) and gross profit margin (GPM) ratios for each company. (As a British company, GlaxoSmithKline plc has a statutory tax rate of 26.5% in 2014; assume a statutory rate of 35% for all other companies.) (Round your answers to one decimal place.) Bristol- Johnson Glaxo Abbott Myers & Smith Laboratories Squibb Johnson Kline plc Pfizer PM % GPM % b. Compute the research and development (R&D) expense to sales…arrow_forward

- Crane Manufacturing Ltd's sales for the year ended December 31, 2022 are $1.24 million. The expenses for 2022 are as follows: Cost of goods sold Selling expenses Variable Fixed $416,000 $234.000 34,320 46,800 72,800 Administrative expenses 36,320 Prepare a detailed CVP income statement for the year ended December 31, 2022. Crane Manufacturing Ltd. CVP Income Statementarrow_forwardProvide correct solutionarrow_forwardWhat is the impact on retained earnings each year?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education